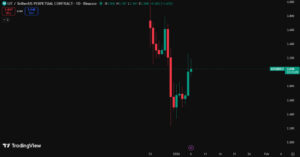

The native token of the Lighter protocol, LIT, rose approximately 14% in the past 24 hours, reaching $3.04. This rapid price increase is driven by growing expectations that the protocol may actively conduct token buybacks, along with transparency measures supported by on-chain treasury data. Market participants have started pricing in the possibility that Lighter could adopt a strategy aligning its revenues more closely with token holders.

Developments Driving the LIT Price Increase

The surge in LIT was fueled by speculation around the protocol’s treasury movements. On-chain data shows a steady increase in the amount of LIT held in Lighter’s treasury, strengthening expectations that these holdings could support a potential token buyback. The timing of these on-chain movements coinciding with the price rise further reinforced positive market sentiment.

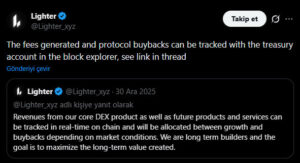

Lighter officially confirmed via its X (formerly Twitter) account that its treasury account can be monitored by anyone through a block explorer, allowing transparent tracking of protocol revenues and potential token buybacks. This step highlights not only short-term price dynamics but also the protocol’s commitment to accountability and long-term value sharing.

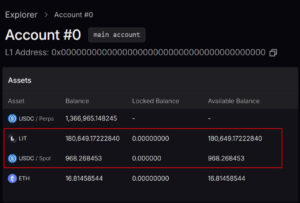

What the Treasury Data Shows

As of Monday night, the Treasury Account (#0) held 180,588 LIT tokens worth approximately $548,987. This steady accumulation demonstrates Lighter’s focus not just on short-term price movements, but on long-term strategic planning. The increase in the treasury indicates the protocol’s commitment to strengthening liquidity management and buyback capacity.

Previous announcements from the Lighter team stated that revenue usage would be carefully planned, balancing ecosystem growth with token buybacks depending on market conditions. The latest treasury movements signal that this policy is now actively being implemented. The on-chain growth is seen by investors as a concrete sign of the protocol’s transparency and accountability.

What Officials Say

The Lighter team emphasizes that its main goal is to ensure that protocol revenues return long-term value to LIT holders. This approach aims to create sustainable value sharing between the protocol and its investors, rather than focusing solely on short-term price gains.

The team stated:

“We aim for the value generated by all Lighter products and services to accumulate for LIT holders through growth initiatives and potential token buybacks.”

This statement shows that the token buyback mechanism is designed as a strategic move for long-term value alignment and ecosystem stability, not merely as a speculative tool. Transparent treasury management and shared on-chain data allow investors to follow the protocol’s strategies with confidence, boosting trust among both institutional and retail participants and supporting Lighter’s sustainable growth goals.

Strong Fundamentals and a Growing Ecosystem

Since launching its mainnet in October, Lighter quickly became one of the most popular perpetual trading platforms. With over $200 billion in monthly trading volume reported in December, Lighter surpassed competitors like Aster and Hyperliquid. Recently, the platform raised $68 million in funding at a $1.5 billion valuation, led by Founders Fund and Ribbit Capital.

Lighter has committed 50% of its total 1 billion token supply to the ecosystem. Under the Token Generation Event (TGE), 25% of the supply was distributed via airdrop, and currently around 250 million LIT tokens are in circulation. Analysts will closely monitor the treasury’s movements, the frequency and scale of buybacks, and other key metrics to assess whether the recent LIT price surge is sustainable.

Buyback Expectations Behind the LIT Surge

The nearly 14% increase in LIT is largely supported by expectations of active token buybacks, transparent treasury data, and strong operational growth. In the highly competitive perpetual trading market, Lighter’s token management strategy could serve as an important reference point not only for LIT but also for other protocols in the DeFi ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.