Cryptocurrency prices are trading under pressure today. Declines in Bitcoin, Ethereum, and XRP have increased investors’ risk-off sentiment, while the total crypto market capitalization has fallen by around 2% to approximately $2.92 trillion. Market participants are adopting a cautious stance amid global economic uncertainty, regulatory developments, and short-term volatility. This reflects investors’ more careful portfolio positioning and preparedness for sudden market shifts.

Volatile Session in Bitcoin and Institutional Pressure

Bitcoin fell to the $86,000 level on December 17 after a volatile session. Following short-lived $3,000 price spikes, a sharp decline occurred within an hour; liquidations of both long and short positions highlight the fragility of market confidence. Analysts note that the decline is not driven by weak fundamentals but rather by institutional selling pressure. Large investors continue to accumulate Bitcoin, but selling from other parts of the market is increasing downside pressure.

The drop also coincided with news that the U.S. Senate Banking Committee postponed its work. A long-anticipated bill expected to address the structure of the crypto market has had any hearings delayed until early 2026. While this delay increases short-term uncertainty, it reinforces the need for investors to closely monitor regulatory developments. Analysts say this has weighed on market sentiment and supported a cautious investor stance.

Additionally, concerns around China’s Bitcoin mining restrictions resurfaced. According to reports, tighter mining conditions led to an approximately 8% drop in the network’s hash rate. This sudden decline triggered fears of miner sell-offs and short-term instability.

Ethereum Falls as Risk Appetite Weakens

Ethereum experienced a sharper decline than Bitcoin, falling around 3% over the past 24 hours and more than 14% over the past week. ETH’s drop is linked less to project-specific news and more to global risk aversion and low liquidity. Profit-taking and a lack of short-term catalysts have left Ethereum vulnerable to deeper pullbacks. As a result, investors are placing greater emphasis on short-term risk management and cautiously reshaping their portfolios.

XRP spot prices declined by about 2% since the start of the day, falling to $1.88. Despite positive developments within the Ripple ecosystem, broad selling pressure across the altcoin market has limited XRP’s resilience. This reflects ongoing risk aversion and caution toward short-term volatility. Analysts say XRP’s movement signals that selling pressure across the altcoin market remains in place.

Japan Interest Rate Decision and Global Pressure

On December 19, the Bank of Japan is expected to announce its interest rate decision. The potential global market impact could increase volatility, particularly for crypto assets. Investors are closely watching how the decision may influence short-term sentiment and price action. Analysts warn that any unexpected surprise could trigger sharp moves in the crypto market.

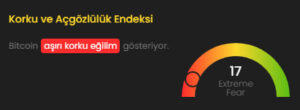

Extreme Fear and Market Sentiment

The Crypto Fear and Greed Index stands around 17, firmly in the “extreme fear” zone. This indicates heightened panic and cautious behavior among investors in the face of short-term volatility. Historically, extreme fear levels can set the stage for short-term rebounds, though analysts caution that volatility is likely to remain elevated in the near term. These indicators serve as key references for assessing risk perception and adjusting strategies.

Overall Assessment

Regaining the $88,000 level is seen as critical for Bitcoin; otherwise, analysts are watching $83,000 and $80,000 as key support zones. Declines in Ethereum and XRP indicate ongoing risk aversion and profit-taking across the altcoin market. Global developments and the Bank of Japan’s interest rate decision could heighten short-term volatility. Investors are closely monitoring both the prevailing panic and potential signs of a rebound.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.