On Friday, November 7, the cryptocurrency market experienced a strong rebound led by Bitcoin (BTC). The total crypto market capitalization rose by 4% in a single day to reach $3.49 trillion. Bitcoin gained 3%, surpassing $103,600, while Ethereum (ETH) climbed more than 4% to trade around $3,446.

Overall sentiment indicates that the recent selling pressure is easing and the market is gradually entering a recovery phase.

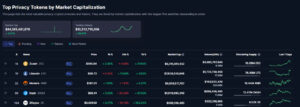

Privacy-Focused Altcoins Lead the Rally

One of the most notable trends of the week was the surge in privacy-focused altcoins. Projects such as NEAR, Zcash (ZEC), and Dash (DASH) outperformed the broader market, posting gains of 10% to 25% over the week.

Analysts attribute this to renewed investor interest in privacy, data protection, and user anonymity. In addition, several DeFi protocols are planning to integrate privacy layers, further boosting demand for these tokens. Experts suggest this could be an early signal of a potential “mini altcoin season.”

Institutional Demand Returns

Another major factor behind the rise is the resurgence of institutional interest. On Friday, financial giants JPMorgan and Ark Invest announced strategic stakes in the Ethereum-based investment firm BitMine — a move seen as a sign of renewed institutional confidence in crypto markets.

On-chain data supports this sentiment:

- Whale wallets accumulated 10,000 BTC in the last 24 hours.

- Total whale holdings reached 22 million BTC.

- Over the past week, whales withdrew 30,000 BTC (around $3 billion) from exchanges into cold wallets.

This suggests that large investors are buying the dip, while retail traders remain cautious a classic sign of market bottom formation.

Macroeconomic Factors and QE Expectations

Global liquidity remains tight, and uncertainty surrounding the U.S. economy continues to shape investment strategies. While the U.S. government’s partial shutdown and fiscal uncertainty have temporarily limited risk-on sentiment, analysts believe this effect will be short-lived.

Markets are now eyeing the Federal Reserve’s potential Quantitative Easing (QE) policy expected to begin next month. Increased dollar liquidity through QE could act as a major bullish catalyst for both Bitcoin and altcoins. Historically, such monetary easing cycles have preceded major crypto bull markets.

Technical Outlook: Investor Sentiment Recovering

Technical indicators show that Bitcoin has formed a strong support zone around $100,000, bolstered by whale accumulation and high open interest in futures markets. The Fear & Greed Index remains in the “Extreme Fear” zone a condition that often precedes major reversals. Historically, long-term investors tend to accumulate during these periods, right before a new uptrend begins.

Recovery Signal Strengthens

As of November 7, the market’s rebound appears to be an early sign of improving sentiment. The rally in privacy coins, whale accumulation, and expectations of monetary easing all point to strengthening fundamentals. Although short-term volatility may persist, analysts believe Bitcoin could test $110,000 and Ethereum $3,800 in the medium term. Experts describe the current phase as a “pre-bull accumulation period” — suggesting that patient investors may be entering another window of opportunity.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.