Positive signals from the macro environment, Bitcoin reclaiming critical support levels, and a strong rebound in total market capitalization have pushed the crypto market into a new wave of upward momentum. The market opened the new week with clear strength, with the total market cap (TOTAL) rising by $88 billion in the last 24 hours, reaching $2.95 trillion once again.

The recovery of Bitcoin’s $86,822 support level has significantly improved market sentiment, signaling that risk appetite is slowly returning and investors are beginning to re-enter positions.

TOTAL Market Cap Shows Strong Defense

TOTAL held the crucial $2.93 trillion area, revealing that downward pressure in the market has weakened. Defending this zone indicates renewed confidence and a growing desire for recovery across the crypto sector.

More importantly, the bounce from this level suggests that the market may attempt another move toward the $3.00 trillion psychological threshold. If momentum holds, a broader altcoin recovery could follow.

However, if uncertainty returns, TOTAL could fall back below $2.93T, opening the door to $2.87T or even $2.80T. The market remains volatile and sensitive to new developments.

Bitcoin Gains Strength Above Support

Bitcoin is currently trading in the $87,000–$88,000 range and has successfully held above the key $86,822 support, positioning itself to regain leadership in the market. The current structure indicates the short-term uptrend is being rebuilt.

For BTC to strengthen its recovery, two major levels must be broken:

- $88,000 (initial breakout zone)

- $92,000 (clear confirmation of a bullish move)

Breaking these levels could enable Bitcoin to re-test zones above $90,000. However, if BTC loses momentum, the downside risk areas remain at $85,204 and $82,503. The ongoing rise in the crypto market is supported not only by technical factors but also by improving macroeconomic conditions.

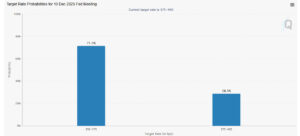

Fed Rate-Cut Expectations Are Increasing

Recent comments from Federal Reserve officials point to a higher likelihood of a short-term interest rate cut. This strengthens expectations that US dollar liquidity may ease, boosting risk appetite across markets.

More liquidity typically supports speculative assets such as Bitcoin, making rapid rebound movements more likely. The expectation of a softer monetary stance from the Fed has been one of the key drivers of the recent rally in cryptocurrencies.

This expectation may:

- Increase dollar liquidity

- Strengthen demand for risk assets

- Support the upward trend in crypto

The return of risk appetite is already reflected in Bitcoin’s sharp reaction from support levels.

Peace Hopes on the Russia–Ukraine Front

There are also positive signals on the geopolitical side. Recent statements from the Russia–Ukraine conflict suggesting progress toward peace or a ceasefire have softened global risk sentiment.

Such developments generally:

- Strengthen global equity markets

- Encourage capital inflows into the crypto market

- Reduce volatility and increase investor willingness to take positions

Overall Assessment

The crypto market is showing strong signs of bouncing upward from a tactical bottom, supported by both technical and macro factors. Bitcoin is gaining strength above support, TOTAL has re-entered a bullish region, and macro sentiment has notably improved. Together, these factors create a favorable short-term environment.

However, major resistance levels are still strong, meaning volatility has not fully disappeared. Investors should remain aware of potential fluctuations even as the market shows signs of recovery.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.