While most tokens in the crypto market lost value today, zkPass (ZKP) experienced a remarkable surge. zkPass is a privacy-focused, decentralized, and AI-powered ecosystem that allows users to perform secure computations without revealing their data. Market analysts attribute this price increase in ZKP to concrete developments such as the Binance listing and the launch of OKX futures.

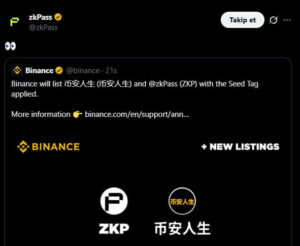

Binance Listing Triggered Demand

On January 7, 2026, ZKP was listed on Binance spot trading. As the world’s largest and most comprehensive crypto exchange, Binance instantly boosted the token’s popularity. ZKP began trading against USDT and TRY pairs, making it easier for users in different regions to purchase. The listing news provides investors with confidence and validation, triggering buying pressure on the price.

On the same day, ZKP futures also launched on OKX. Futures trading allows investors to take larger positions using leverage. This, in turn, increased short-term trading volume, supporting the price surge. However, investors should remember that using leverage increases volatility, and prices can move quickly.

Technical Indicators Support the Rally

Price charts show that zkPass has broken through previous resistance levels and gained positive momentum.

- RSI is above 60, indicating that buyers are dominating the market.

- The MACD indicator is also positive, showing strong upward momentum.

However, rapid increases may be susceptible to minor short-term corrections. This does not signal the end of the rally; rather, it suggests the price may enter a healthy consolidation phase.

Price–Volume Alignment Supports the Surge

Another key observation in the chart is that the volume increase aligns with the price movement. As $ZKP breaks upward, volume rises simultaneously, indicating that investors are responding to the rally by increasing positions rather than selling. Moreover, the fact that volume does not drop sharply during price pullbacks—but remains balanced—shows that selling pressure is limited and that there is strong holding (HODL) sentiment in the market. This suggests that zkPass’s surge is not a speculative pump but a controlled, demand-driven movement.

Short- and Medium-Term Price Expectations

- Short-Term Bull Scenario: If ZKP holds above $0.18, the rise could continue toward $0.22 and, with strong buying, $0.25.

- Short-Term Bear Scenario: If profit-taking increases, the price could fall to $0.16–$0.17.

- Medium-Term Bull Scenario: Even as listing excitement fades, if volume remains strong, the price could move toward $0.28–$0.30 in the coming weeks.

- Medium-Term Bear Scenario: If interest rates and macro risks rise, the price could drop to $0.14–$0.15.

Is the zkPass Rally Sustainable?

The price increase of zkPass (ZKP) is supported by the exchange listing and rising trading volume. The alignment of price and volume indicates that the rally is controlled and demand-driven. Momentum currently favors buyers, but rapid increases generally bring volatility. Investors are advised to be cautious of short-term fluctuations.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.