Although the U.S. Federal Reserve (FED) cut interest rates by 25 basis points in its October meeting, markets remain divided over whether another cut will come in December. FED Chair Jerome Powell has made it clear that further rate cuts are “not guaranteed,” yet markets continue to price in a more accommodative monetary stance.

Subadra Rajappa: “Markets Are Being Unrealistic”

Societe Generale’s interest rate strategist Subadra Rajappa stated that investors’ expectations are “overly optimistic.” According to Rajappa, despite Powell’s cautious tone, markets are still pricing in aggressive rate cut scenarios.

“Chair Powell clearly said that a rate cut in December is not certain. Yet the market continues to price in excessive monetary easing.”

Rajappa emphasized that the FED’s last two rate cuts were preemptive moves meant to anticipate potential labor market weakness, but noted that the room for policy maneuvering is narrowing. While the U.S. economy remains relatively strong, inflation pressures persist stubbornly high.

Wells Fargo CEO Scharf: “Rate Decisions Are a Part of Risk Management”

Charlie Scharf, CEO of Wells Fargo, shared his perspective at the New York Economic Club, offering key insights on the FED’s policy direction and economic risks. Scharf said that Jerome Powell’s communication style is transparent and that he views interest rate decisions as part of a broader economic risk management strategy.

“Powell is conducting his role as transparently as possible. There is never a risk-free answer when it comes to rate decisions — what matters is keeping downside risks under control.”

Scharf described the role of the FED Chair as an “ungrateful job,” emphasizing that every decision is subject to criticism. However, he noted that Powell has analyzed the situation clearly and is managing the decision-making process as transparently as possible.

A Gap Between Market Expectations and the FED

Although markets are still pricing in the possibility of a rate cut in December, comments from FED officials suggest that such expectations may be overly optimistic. Analysts like Subadra Rajappa believe that the FED is increasingly likely to maintain a wait-and-see approach in its final meeting of the year.

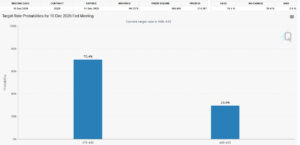

Following Powell’s statement that a December rate cut is not guaranteed, market expectations for a cut fell from 90% to 70%.

Despite this shift, some investors still anticipate that the FED could resume a gradual easing cycle in early 2026, depending on how inflation and employment data evolve in the coming months.

“Protecting Downside Risks Is More Important”

Scharf emphasized that the primary goal when deciding on rate cuts is effective risk management. He noted that the FED must maintain a delicate balance between economic growth and inflation control when shaping its policies. Scharf also highlighted the positive impact of lower interest rates on consumers, particularly in a rapidly changing labor market. Pointing to potential job losses amid the ongoing AI-driven transformation, he stated that “lower rates could provide crucial support to the groups struggling the most.”

December Decision Will Be Critical

The December meeting is expected to serve as a pivotal moment that will determine the direction of the FED’s 2025 monetary policy. Analysts note that Powell and FOMC members’ assessments of inflation persistence and labor market strength will guide the next rate decision. For now, the picture is clear: the FED will remain cautious, avoiding aggressive rate cuts until it is fully confident that inflation is under control.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.