The recent U.S. government shutdown has disrupted nearly every corner of the economy — from traditional markets to cryptocurrencies — by interrupting access to critical data that the Federal Reserve relies on when shaping monetary policy. As questions around the December meeting intensify, Richmond Fed President Thomas Barkin offered new clarity on where policy may be heading.

Fed’s Barkin: “A December Rate Cut Is Not Guaranteed”

Speaking to reporters, Barkin stressed that expectations of a December rate cut are premature. Citing Jerome Powell’s earlier remarks, he noted that policymakers have not committed to any move and emphasized that the decision remains fully data-dependent. According to Reuters, Barkin underscored that “a December cut is far from certain.”

He explained that inflation is still above the Fed’s 2% target, though it does not appear to be accelerating. While he expects the unemployment rate to rise slightly, Barkin indicated that this shift does not signal a major deterioration in labor market conditions.

Data Gaps Increase Uncertainty

The temporary shutdown delayed the release of several important economic indicators, creating gaps in the information available to the Fed. Barkin acknowledged that the absence of these metrics makes it harder for officials to build consensus around the next policy steps. “It is difficult to align within the committee without convincing data,” he said.

Turning to the labor market, Barkin suggested that conditions may be weaker than headline numbers imply. Recent slowdowns in job postings and hiring momentum support this more cautious interpretation. While not signaling alarm, he emphasized the importance of upcoming data in shaping the Fed’s next move.

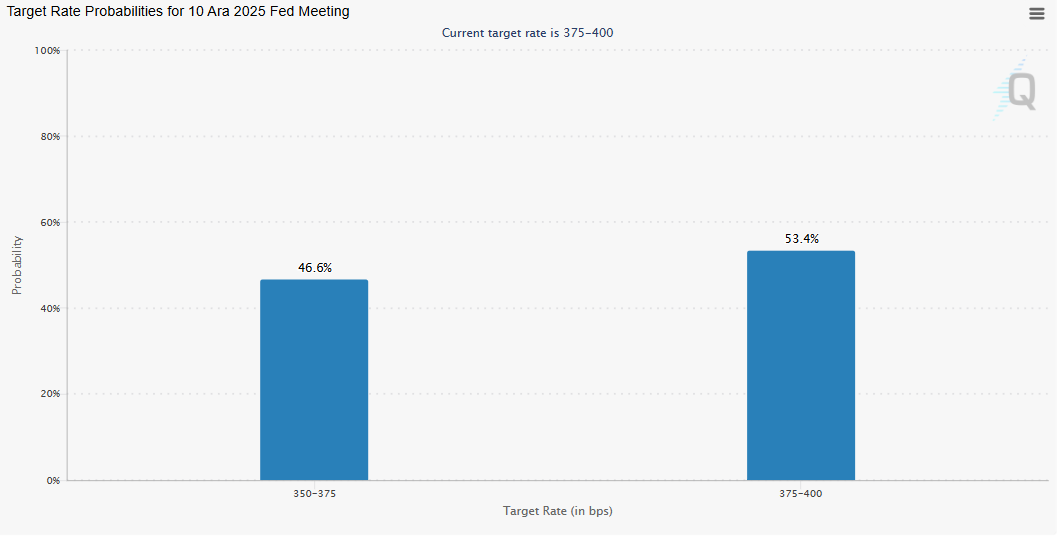

Market Expectations: FedWatch Shows a Split Outlook

The CME Group’s FedWatch Tool reflects a divided market ahead of the December meeting:

-

375–400 bps (current level): 53.4%

-

350–375 bps (25 bps cut): 46.6%

These probabilities show that markets are not fully convinced a cut will materialize, despite earlier optimism earlier in the year.

Barkin’s remarks reinforce the Fed’s cautious stance. While inflation has eased from its peak, it remains above target, and the labor market — though still resilient — may be softening beneath the surface. With crucial data still to come, December’s meeting is shaping up to be one of the most consequential policy moments of the year.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.