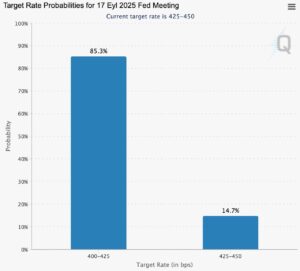

The U.S. Federal Reserve (Fed) may decide to cut interest rates at its Federal Open Market Committee (FOMC) meeting on September 17, 2025. Market expectations suggest a 25 basis point rate cut at this meeting. According to CME FedWatch Tool data, 87.2% of investors are pricing in this cut.

What Are Fed Officials Saying?

Fed Chair Jerome Powell, in his speech at the Jackson Hole Economic Policy Symposium, stated, “With policy in a restrictive zone, the underlying outlook and shifting risk balance may require us to adjust our policy stance.” This statement was seen as an important signal increasing the likelihood of a rate cut.

Fed Board Member Christopher Waller also mentioned that additional rate cuts could be on the agenda over the next 3 to 6 months after September, noting that rates should be gradually brought down to the neutral level of around 3%.

You may also find this article interesting: Ethereum’s On-Chain Volume Hits ATH! Highest Level Since 2021

Economic Data and Market Expectations

Recent economic data supports a Fed rate cut decision. While there are signs of weakening in the labor market, inflation remains close to the Fed’s 2% target. This increases the likelihood of the central bank adopting a looser monetary policy.

Major investment banks share the same expectation of a rate cut. Institutions like Morgan Stanley, Goldman Sachs, and JP Morgan see a high probability of a 25 basis point rate cut in September.

What Happens If Rates Are Cut?

If the Fed decides to cut rates, this could have various effects on global markets. The U.S. dollar may weaken, emerging market currencies may strengthen, and gold prices could rise. Additionally, a rate cut could boost investor risk appetite, creating a positive atmosphere in stock markets.

In general, the likelihood of a Fed rate cut in September appears high. Market expectations and Fed officials’ statements send strong signals in this direction. This decision could have significant effects not only on the U.S. economy but also on global markets. Investors and economic observers are advised to closely monitor this critical decision to be announced on September 17.

Is There a Recession Risk?

A recession is a period of economic slowdown characterized by a noticeable decline in production, consumption, and employment. In other words, it is a phase where the economy “slows down.”

In more detail:

- Production and GDP decline: A country experiences a recession when the total value of goods and services it produces (GDP) decreases for several consecutive quarters.

- Employment falls: Companies may lay off workers if demand drops, causing unemployment to rise.

- Consumer spending and investment decrease: People cut back on spending, and companies reduce new investments.

- Overall economic slowdown: Banks become cautious in lending, markets fluctuate, and confidence declines.

In short, a recession is a period when the economy slows down and many people are negatively affected in terms of both jobs and income.

As a possible rate cut is discussed in September, the most critical question on investors’ minds is: “Is the U.S. economy heading into a recession?”

Economic data:

- Although the labor market remains strong, employment growth has slowed in some sectors.

- Consumer spending and industrial production are showing a more cautious trend compared to previous periods.

- Inflation remains stable around the Fed’s 2% target, but elevated levels maintain price pressures.

These data show that the Fed is facing a double-edged sword:

- Keeping rates high helps reduce inflation but can slow economic growth.

- Cutting rates supports growth but may push inflation higher again.

Most economists state that the U.S. is not technically in a recession but that growth is slowing. If the Fed cuts rates in September, this move will both boost market sentiment and aim to reduce growth risk. However, some experts emphasize that multiple rate cuts may be necessary, and this does not entirely eliminate the risk of a recession.

In other words, a rate cut is seen as a measure to reduce recession risk, but it is not guaranteed to eliminate it entirely. It is critical for investors to closely monitor economic data and carefully evaluate Fed statements.

For the latest cryptocurrency news, click here.