Private sector employment data, a key indicator of the US economy, came in far below expectations. The May ADP Non-Farm Employment report showed an increase of only 37,000 jobs, marking the weakest growth in the last two years. The forecast was 111,000, while the previous figure stood at 62,000. This unexpected drop drew reactions not only from the markets but also from politicians.

Trump: “Now You Have to Cut Rates, Powell!”

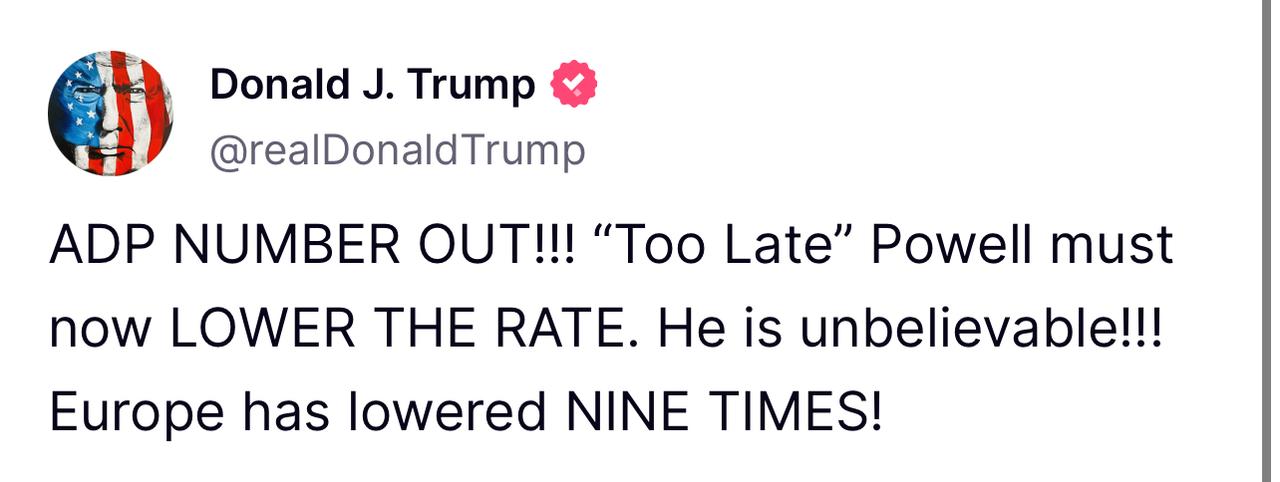

Immediately after the release of the data, US President Donald Trump harshly criticized Federal Reserve Chairman Jerome Powell in a post on the social media platform Truth Social.

Trump wrote: “ADP numbers are out!!! ‘Too late’ Powell, now you HAVE TO LOWER INTEREST RATES. Incredible guy!!! Europe cut rates nine times!”

This statement is a continuation of Trump’s long-standing anti-Fed rhetoric. The president has been pressuring Powell for months to cut interest rates. However, Powell continues to emphasize a data-driven approach and insists that decisions are shaped by macroeconomic indicators.

Weak Employment Growth, Strong Wage Gains

According to the report prepared in collaboration between the ADP Research Institute and the Stanford Digital Economy Lab, hiring in the private sector has significantly slowed. However, despite the decline in employment growth, wage increases remain strong. ADP’s Chief Economist Dr. Nela Richardson stated that wage growth remained robust in May for both job changers and those staying in their current positions.

Richardson also observed a slowdown in hiring momentum following a strong start to the year, which is seen as a sign of cooling in the economy.

Eyes on Friday’s Official Data

These figures serve as a key leading indicator ahead of the official non-farm payrolls report from the US Department of Labor, which is scheduled for release on Friday. Investors expect an increase of around 130,000 in employment for May, with the unemployment rate projected to hold steady at 4.2%.

Falling short of expectations, the ADP report adds further weight to upcoming Fed policy decisions, which play a central role in steering the economy.

Market Expectations for a Rate Cut Are Rising

The unexpectedly weak private sector data has reignited speculation that the Fed may cut interest rates in the second half of the year. While Powell maintains that decisions are purely data-dependent, political and public pressure seems increasingly difficult to ignore.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.