As 2026 gets underway, the crypto market has entered the year with notable momentum, and XRP has quickly emerged as one of the most talked-about assets. Delivering a sharp rally in the opening days of the year, XRP has drawn attention not only because of its price performance, but also due to the structural factors supporting its move. Compared to other large-cap cryptocurrencies, XRP’s recent strength has placed it firmly in the spotlight.

Strong Start Sets XRP Apart

Since the beginning of the year, XRP has posted gains of roughly 25%, clearly outperforming major peers. Over the same period, Bitcoin has risen by around 6%, while Ethereum has advanced close to 10%. This divergence suggests that XRP’s rally is not simply a reflection of broader market optimism, but rather the result of asset-specific drivers. Market participants increasingly view this move as potentially more than a short-lived spike.

ETF Demand Becomes a Key Catalyst

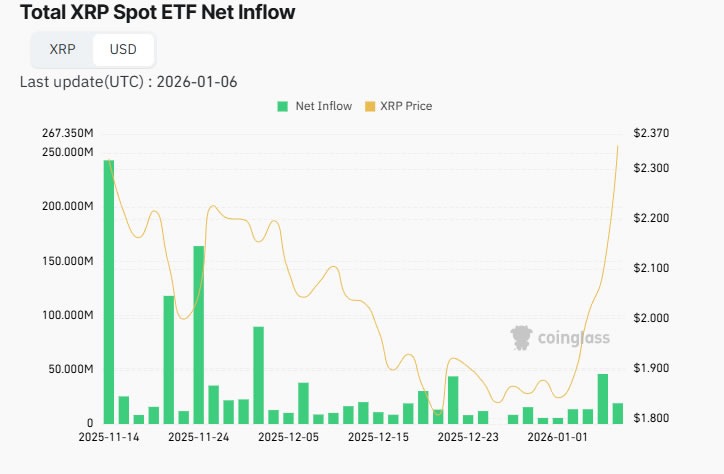

One of the most significant factors behind XRP’s outperformance has been sustained demand through exchange-traded products. During the quieter market conditions of the previous quarter, investors steadily accumulated XRP exposure via ETFs, a pattern that contrasted with the behavior seen in Bitcoin and Ethereum products, where flows often mirror price action.

Since the start of the year, spot XRP ETFs have attracted close to $100 million in net inflows. Aggregate inflows now stand at approximately $1.15 billion, with no recorded outflow days so far. This consistent flow profile highlights growing institutional confidence and reinforces the perception that XRP remains an underallocated trade relative to other major cryptocurrencies.

Social Sentiment and On-Chain Signals Align

Beyond financial instruments, market psychology has also turned in XRP’s favor. Social sentiment indicators point to a broadly optimistic outlook, with both retail participants and more sophisticated market actors expressing bullish expectations. AI-based sentiment analysis tools show a clear tilt toward positive positioning.

On-chain data adds another layer of support. XRP balances held on major exchanges, particularly Binance, have dropped to their lowest levels in nearly two years. Declining exchange reserves are often interpreted as reduced near-term selling pressure. At the same time, network activity has accelerated, with transaction volumes rising by more than 50% over the past two weeks.

Ripple’s Moves in Japan and the US

Developments at Ripple further strengthen the broader thesis. The company’s partnerships with major Japanese financial institutions aim to expand XRP Ledger adoption across the region. In the United States, Ripple’s conditional approval to establish a national trust bank signals progress on the regulatory front.

Taken together, these elements explain why XRP has entered 2026 with such strong momentum. Whether this trend evolves into a longer-term leadership role remains to be seen, but the foundations behind the current move are increasingly difficult for the market to ignore.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.