XRP price slid as low as $1.46 after roughly $50 million in selling hit Upbit within just 15 hours. The token is down 9% in the past 24 hours, marking a two-day low and intensifying panic signals across the market. More importantly, over 99% of the volume came from real spot sales, showing this wasn’t a routine fluctuation.

At first glance, it looks like a standard pullback. But once you dig into the numbers, the picture changes.

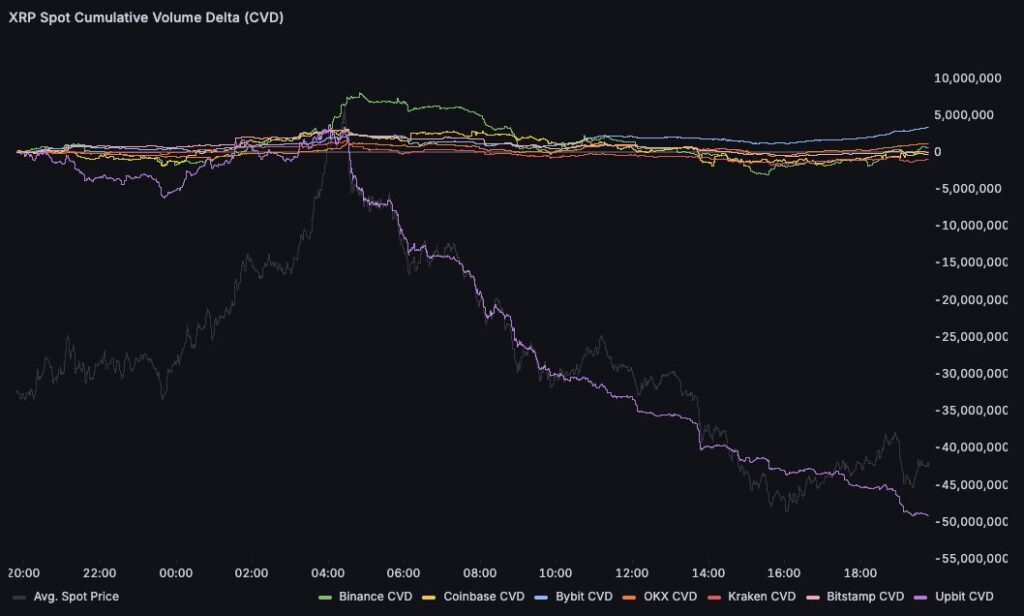

Upbit-driven selling dragged XRP sharply lower

On-chain analysts tracking order flow said most of the downside came directly from heavy sell orders on Upbit. At the same time, broader crypto risk appetite weakened—and XRP absorbed that pressure immediately.

Data shows exchange users unloaded around 50 million XRP in a very short window.

Two scenarios stand out. Either a large whale reduced exposure, or retail traders capitulated. It’s still unclear which.

The critical detail is elsewhere.

Only 0.07% of the activity was flagged as wash trading. In other words, nearly the entire volume reflects genuine spot selling pressure, not artificial liquidity.

Another data point stands out.

The exchange logged 12,775 different trade sizes. The most intense selling occurred between 08:00 and 12:00 Korea time, when the order book processed roughly 2,500 sell orders per minute. Individual trades clustered mostly between 100,000 and 250,000 XRP.

That pace explains why price unraveled so quickly.

As Asian-session selling accelerated, XRP re-entered a high-volatility zone. While spot data confirms authentic sell pressure, derivatives markets still show elevated open interest—often a setup for further short-term swings.

XRP firmly back in the red

Over recent months, Ripple native token has mirrored the broader market with sharp, unstable moves. A brief rebound recently pushed price toward $1.60, and attempts to hold the $1.40 area sparked short-lived bullish expectations among some traders.

That scenario didn’t last. Selling pressure returned. Total crypto market capitalization slipped about 3.13% to $2.34 trillion, while XRP dropped 9% in 24 hours. Weekly performance remains slightly positive, but the monthly decline is approaching 29%.

The move has placed XRP back under heavy pressure. Spot volumes are cooling, yet derivatives positioning remains aggressive. This structure typically appears around temporary bottoms. Flows from the Korean and U.S. sessions over the next several hours are likely to clarify XRP’s near-term direction.

XRP fell to $1.46 following Upbit’s roughly $50 million sell wave. Nearly all transactions were real spot sales. The 24-hour 9% loss has put the altcoin back under strain. The market appears paused for now—but incoming data suggests volatility may persist in the days ahead.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.