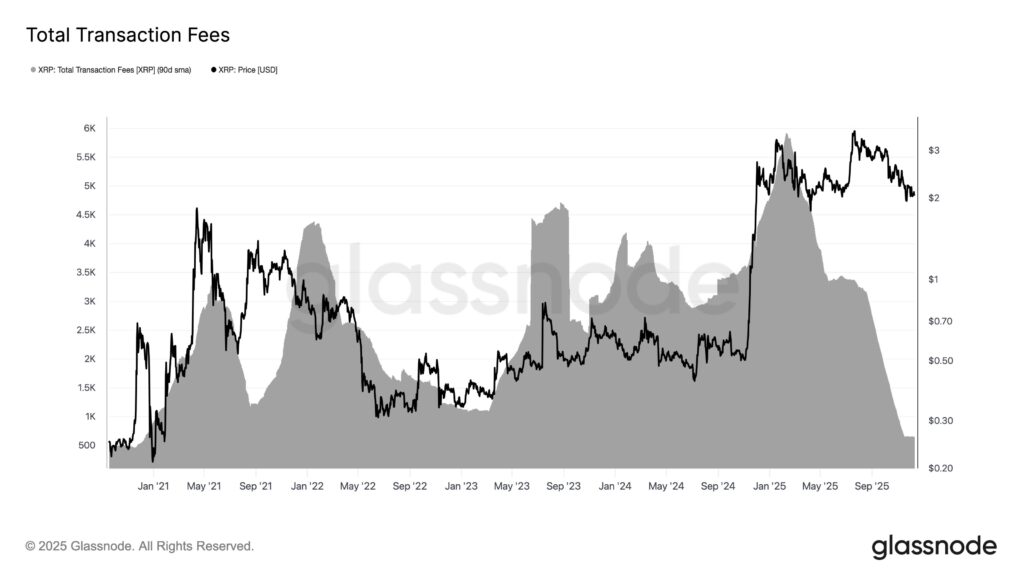

Ripple’s XRP price fell below $2 as transaction fees dropped sharply. According to Glassnode, daily total fees fell from 5,900 XRP in early February to 650 XRP. This 89% decline marks the lowest level in five years. Investors are closely monitoring this decrease, as lower transaction costs may exert pressure on the price.

Transaction Fee Decline Factors

Since the beginning of the year, XRP transaction fees have fallen dramatically. Open interest in the futures market also dropped significantly, from 1.75 billion tokens in early October to 0.74 billion tokens. This signals that derivatives traders have reduced confidence in ripple recovery potential. Social sentiment toward XRP has also slipped into the “fear” zone, reflecting rising caution among investors.

Data from blockchain analytics firm Santiment shows that large wallets increased selling pressure. Over the past week, wallets holding 1 to 10 million XRP collectively moved 510 million tokens. These wallets represent some of the largest investors in the market, holding positions worth approximately $2 to $20 million at current prices. This activity adds short-term downside pressure.

Technical Analysis: Downside Risks for XRP

XRP/USD is forming a descending triangle pattern, with support at $2. If the price breaks below this level, the measured target points to $1.73, roughly a 15% decline. The $2–$1.98 zone remains a critical support area. If this support fails, the price could fall toward $1.61.

Opportunities and Market Sentiment

Some analysts argue that the drop in transaction fees and negative sentiment could precede a strong token rally. Market psychology and technical indicators together suggest investors should monitor short-term declines carefully. Additionally, XRP ETF products reached $1 billion in assets under management in under four weeks and now total approximately $1.23 billion. Four ETFs manage over 597 million XRP, with net inflows of $935 million, highlighting strong institutional demand.

-

Transaction fees hit five-year lows

-

Descending triangle pattern targets $1.73

-

Social sentiment in the “fear” zone

-

Futures open interest dropped sharply

-

Support range $2–$1.98 is crucial

**Not investment advice.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.