An unusual trade on the crypto prediction platform Polymarket highlighted how low weekend trading volumes and liquidity can be turned to an advantage. It was reported that a trader, executing a carefully coordinated strategy in the XRP markets, exploited this low-liquidity environment to outperform automated market-making bots, earning approximately $233,000 in profit. This move has also sparked important debates about the functioning and integrity of prediction markets.

Low Liquidity, High Impact

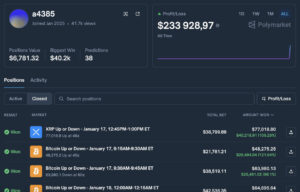

The event took place during Saturday night, a period when trading volumes in crypto markets are typically low. On Polymarket, a trader using the handle @a4385 began aggressively accumulating “UP” shares in a contract predicting XRP’s price direction. The intense buying drove the contract price up to $0.70, while the spot price of XRP on major exchanges declined by about 0.3%. This divergence exposed weaknesses in Polymarket’s automated market-making bots.

Polymarket’s bots continued to provide liquidity, evaluating price movements without context. Even as XRP’s spot price fell, the rising contract price caused the bots to sell more “UP” shares, allowing the trader to accumulate around 77,000 “UP” shares at an average of $0.48. The critical move came just minutes before the market closed.

Critical Purchase via Binance

Approximately two minutes before market close, the trader reportedly executed an XRP purchase worth around $1 million from a linked Binance wallet. This temporarily pushed XRP’s price up by about 0.5%, ensuring the Polymarket contract resolved in the “UP” direction, and the trader’s shares became eligible for payout at $1 each. The XRP position was then quickly sold, bringing the spot price back down.

According to data provider PolymarketHistory, the entire operation cost the trader only about $6,200, while the bots suffered significant losses. Reports suggest the trader repeated similar strategies during other weekend sessions, forcing some bots to shut down. The incident has raised debates about whether such tactics constitute market manipulation.

“Smarter Bots Are Needed”

Chris Tremulis, Global Head of Commodity Compliance at Goldman Sachs, commented on the situation, emphasizing the importance of market integrity:

“Prioritizing market integrity is critical for prediction markets to achieve meaningful institutional adoption. Stronger rule enforcement and rapid audit mechanisms are essential.”

Experts agree that this incident demonstrates the need for context-aware, advanced algorithms on platforms like Polymarket that can analyze trading volume, timing, adversarial strategies, and near-consensus price behavior.

Assessment

The XRP event on Polymarket is a striking example of how automated systems can be exploited during low-liquidity periods. While such trades may yield short-term profits, they raise significant questions about market reliability and institutional trust in the long term. Moving forward, technical and regulatory measures to strengthen prediction market integrity are expected to become a central focus.