On March 7, U.S. President Donald Trump signed an executive order to establish a Strategic Bitcoin Reserve (SBR). White House Crypto Director David Sacks announced that this reserve would be funded with approximately 200,000 BTC seized by the federal government. However, following this announcement, Bitcoin (BTC) experienced a 6% decline in price.

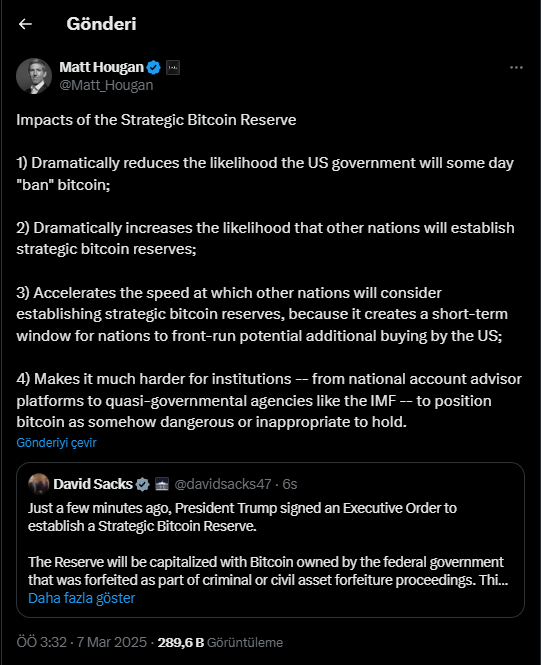

Some market analysts, however, believe this move could be bullish for Bitcoin in the long run. Here are four reasons why experts see this decision as a positive signal:

1. The Risk of a Bitcoin Ban Decreases

Bitwise Chief Investment Officer Matt Hougan stated that the creation of a U.S. Strategic Bitcoin Reserve significantly reduces the likelihood that the government will ever ban Bitcoin. Previously, the Federal Reserve Bank of Minneapolis suggested that Bitcoin could force the federal government to balance its budget, which could lead to regulatory restrictions. However, this scenario now seems far less likely.

2. Other Countries May Follow the U.S.’s Lead

The U.S. government’s move may encourage other nations to establish their own Bitcoin reserves. According to BitBO data, the U.S. currently holds 207,189 BTC, making it the largest state-held Bitcoin reserve. China follows with 194,000 BTC, while the United Kingdom holds 61,000 BTC. El Salvador, the only country that has made Bitcoin legal tender, has accumulated 6,103 BTC so far. Coinbase CEO Brian Armstrong suggested that this decision could influence G20 nations to adopt similar strategies.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

3. Bitcoin Becomes More Legitimate for Institutional Investors

The establishment of a U.S. Bitcoin reserve makes it more difficult for institutions like the International Monetary Fund (IMF) to label Bitcoin as dangerous or inappropriate for holding. The IMF has previously opposed Bitcoin investments by sovereign nations, pressuring El Salvador to halt its Bitcoin accumulation in exchange for a $1.4 billion financial aid package. However, the U.S. backing Bitcoin could weaken the IMF’s stance and encourage institutional adoption.

4. Fears of a U.S. Bitcoin Sell-Off Diminish

Bitwise Head of Research Ryan Rasmussen outlined key takeaways from the U.S. Bitcoin Reserve announcement:

- Other countries are now more likely to accumulate Bitcoin.

- Institutional investors have no excuse to avoid Bitcoin.

- The fear of a U.S. Bitcoin sell-off is now gone.

- The likelihood of state governments buying Bitcoin has increased.

- The probability of the U.S. government banning Bitcoin is now effectively zero.

Crypto lawyer John Deaton pointed out that Treasury Secretary Scott Bessent and Secretary of Commerce Howard Lutnick have been instructed to find “budget-neutral” ways to acquire more Bitcoin. ETF Store President Nate Geraci added, “Two years ago, people would have laughed at the idea of the U.S. government creating a Bitcoin reserve.”

Despite an initial drop, Bitcoin (BTC) quickly rebounded and reached $88,200 at the time of writing.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.