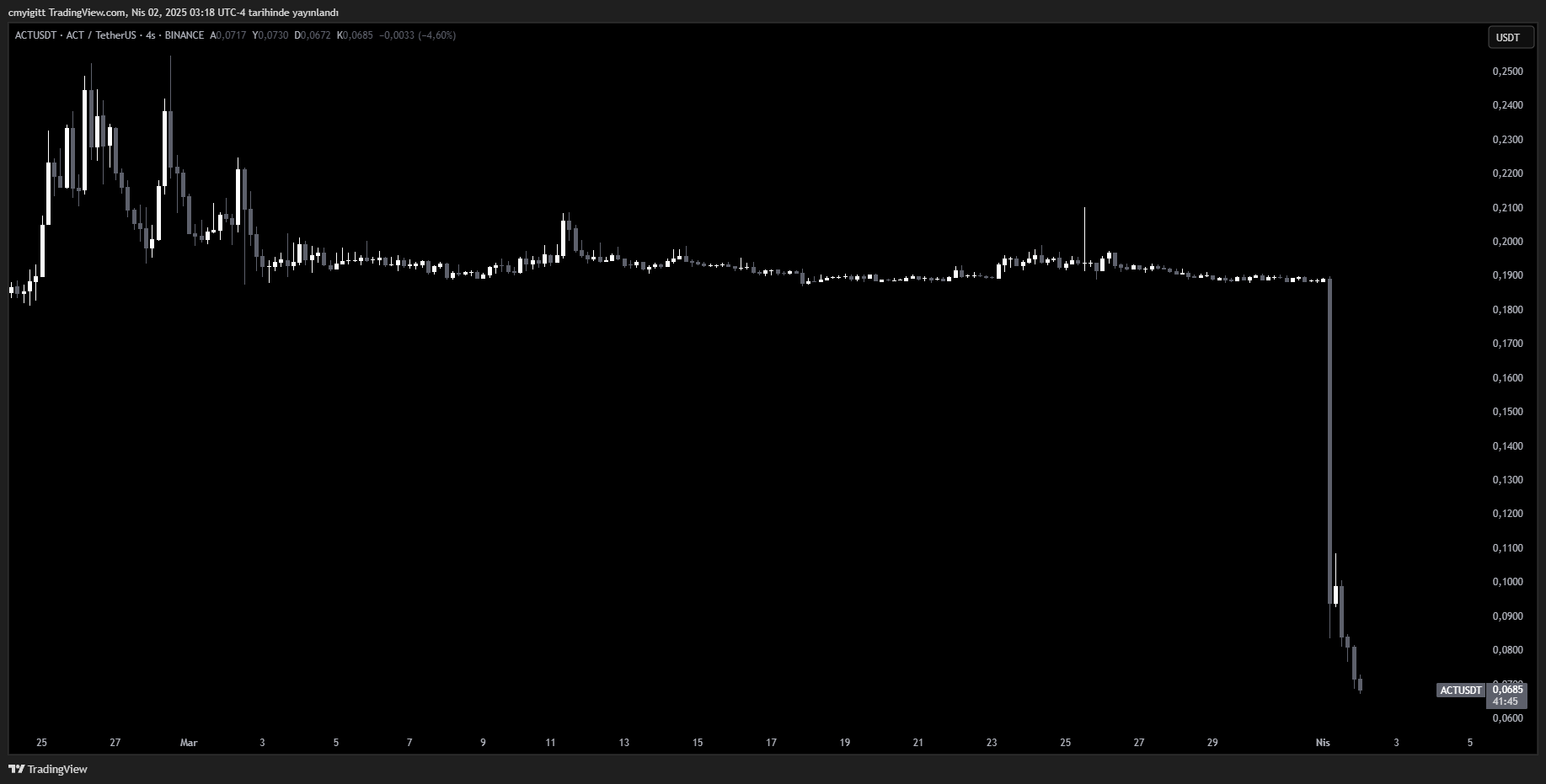

Earlier today, several altcoins crashed on Binance, despite an overall positive trend in the cryptocurrency market. Tokens like ACT, DEXE, and DF plunged between 20% and 50% within minutes.

What Caused the ACT Crash?

The ACT crash may be linked to leverage trading changes on Binance. The exchange announced margin adjustments for ACTUSDT and five other altcoins, but since other tokens listed in the update didn’t suffer similar declines, market observers speculated on alternative causes.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Some traders believe that the new ACTUSDT perpetual contract margin change may have triggered a liquidation event for a market maker, forcing them to sell other tokens. Arkham data suggests that Wintermute, a major market maker, sold a significant amount of ACT on April 1.

Binance’s Statement!

Binance later confirmed that the ACT crash resulted from spot market sales by four accounts. Three VIP users sold around 514 million USDT worth of ACT, while a non-VIP user liquidated 540,000 USDT worth of ACT.

These sales caused ACT’s price to plummet rapidly, dragging other low-market-cap tokens down with it. Binance stated that its investigation is ongoing.

ACT’s Market Value and History

ACT was a key player in last year’s Solana-based AI memecoin boom, combining viral meme culture with AI hype.

At its peak, ACT reached a market capitalization of $890 million, becoming one of the few AI memecoins listed by Binance. However, its value has since plummeted over 85% to around $95 million.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.