Fetch. AI’s FET token has been on a tear lately, surging 54% in just the past week, thanks to renewed interest in the Artificial Intelligence (AI) sector. This surge was largely driven by the hype surrounding OpenAI ‘s launch of Sora, an AI-powered video generation app.

However, beneath the surface of excitement lies a potential storm of caution. While FET continues to climb, some technical indicators suggest the rally might not be sustainable.

Concerns Mount Despite Price Rise (FET)

- The token’s Relative Strength Index (RSI) sits at 66, indicating it’s in “overbought” territory, suggesting a potential pullback.

- Despite the price increase, the Chaikin Money Flow (CMF) indicator has dropped significantly, implying the rise might not be backed by strong buying pressure.

- The MVRV ratio, which measures profitability for token holders, is at its yearly high. This often precedes profit-taking, potentially leading to a price dip.

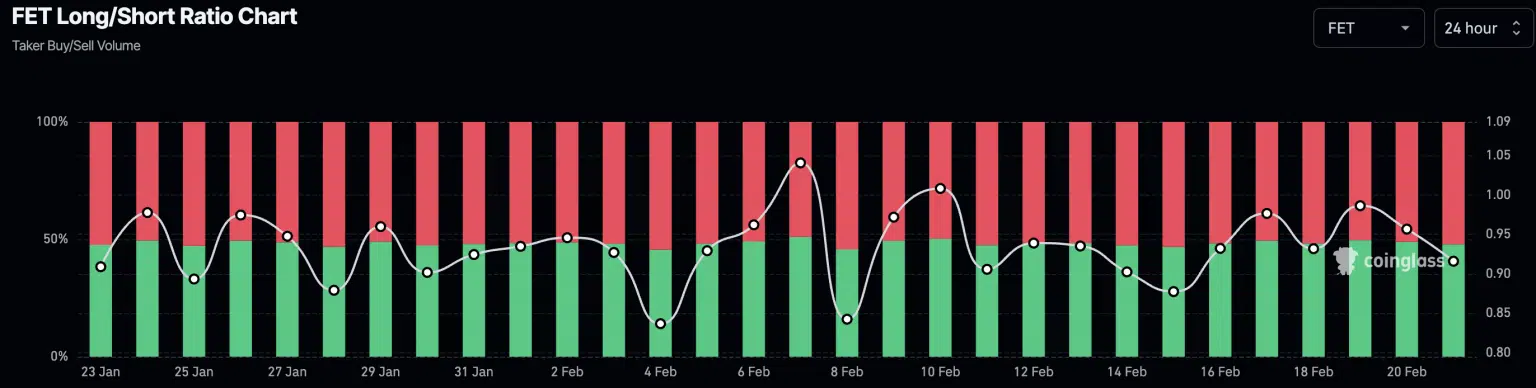

- Short positions against FET have risen to 52.6%, indicating traders are wary of the recent surge.

Possible Price Retracement

Analysts believe the price could retrace to $0.788, a previous resistance level, if selling pressure intensifies.

This was indicated by coinglass’ data which showed that, in the last few days, the percentage of short positions taken against FET had grown to 52.6%.