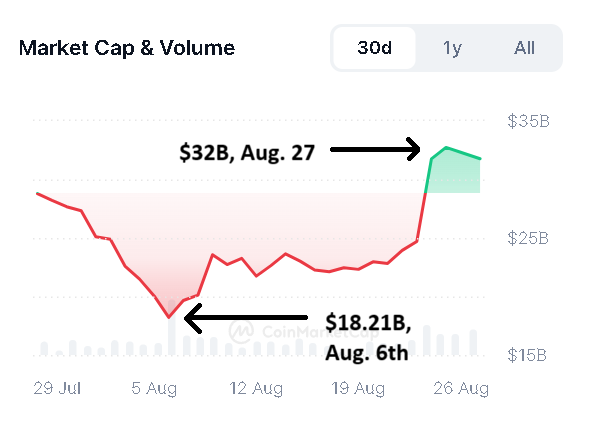

The market for artificial intelligence (AI) and big data cryptocurrencies has seen a significant resurgence, with market capitalization soaring by 79.7% over the past three weeks. This rebound reflects renewed confidence among investors in these emerging technologies.

As of August 6, the AI and big data crypto market cap hit a yearly low of $18.21 billion. This downturn was largely attributed to the overall decline in the broader cryptocurrency market, particularly the falling price of Bitcoin, which dropped sharply below $50,000 according to TradingView data.

Bitcoin’s Influence on the AI Token Market

The recovery of AI and big data tokens has closely mirrored the price movements of Bitcoin. CoinMarketCap data reveals that the market capitalization of this sector exceeded $38 billion by August 25, coinciding with Bitcoin’s own price recovery.

As of August 27, some of the leading AI and big data tokens by market capitalization include Near Protocol, valued at $4.80 with a market cap of $5.5 billion; Internet Computer, priced at $7 with a market cap of $3.8 billion; Artificial Superintelligence Alliance (FET), with a market cap of $3.4 billion; and Bittensor (TAO), at $2.8 billion.

Might interest you: Bitcoin Runes Recorded 15.6 Million NFT Transactions in 4 Months

Market Volatility and Shifts in Investor Sentiment

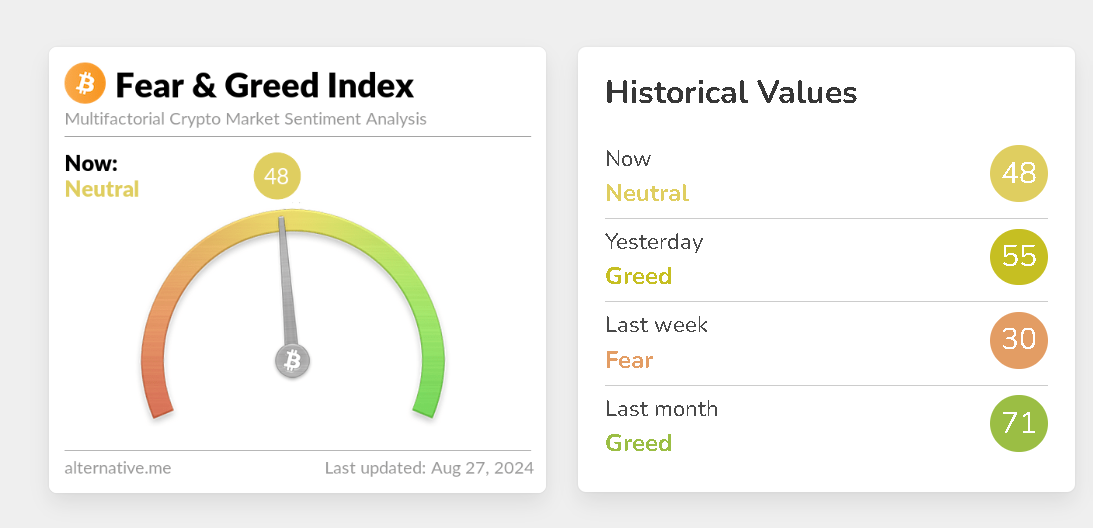

During the recent market slump, investor sentiment was notably negative. The Fear & Greed Index, a tool that measures the emotions of crypto investors, registered levels of “extreme fear” as market volatility increased. However, as markets began to recover, sentiment shifted to “neutral,” encouraging investors to re-enter the market and attempt to recover previous losses.

Renewed Confidence and Whale Activity in the AI Token Market

The shift in market sentiment and renewed investor confidence have played a crucial role in the resurgence of AI tokens. Notably, the Fear & Greed Index has become a valuable tool for investors looking to gauge market sentiment and make informed decisions.

On August 26, on-chain analytics platform Lookonchain highlighted some significant market activity, particularly involving a large transaction (or “whale”) in the FET token. A whale, who seemingly regretted selling at a lower price earlier, spent $2.38 million in Tether to repurchase 1.79 million FET tokens from Binance at a higher price of $1.33 on August 25. This action underscores the fluctuating sentiment and trading strategies in the AI and big data crypto market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.