We are evaluating the chart formation, market trends, trading volume, and possible future moves by Avalanche (AVAX).

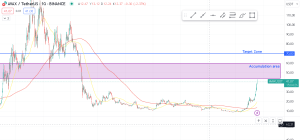

Avax surpassed $40 with its recent uptrend and is currently in a crucial area. If Avax starts closing daily above this level, it could experience an uptrend towards $70. However, it is likely to undergo accumulation in the range of $41-$45 because this zone has served as significant resistance in the past. If it surpasses this area, there won’t be any obstacles for Avax up to the $70 level.

AVAX is the native token of the Avalanche blockchain platform. Avalanche provides a scalable and secure blockchain infrastructure. AVAX is the cryptocurrency used for making payments, paying transaction fees, ensuring network security, and performing other functions within this network. Avalanche offers a flexible infrastructure for developing various blockchain applications, and AVAX is used to transact within the core of this ecosystem.

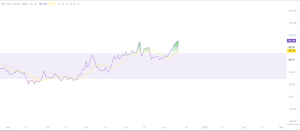

The RSI (Relative Strength Index) is currently overbought. Our expectation is that if there is an accumulation in the range of $41-$45, we might see a pullback in RSI, which could be a positive signal for an upcoming upward movement.

A similar situation is observed on the Stochastic RSI side as well; the chart is highly overbought, and the probability of a pullback is quite high. Therefore, individuals using high leverage may consider moving with caution and using stop-loss to manage their positions more accurately.

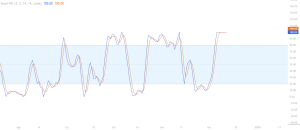

The MACD indicator still appears to support the bullish signal; however, since this indicator provides instant signals in both upward and downward movements, it may not necessarily reflect the expected impact on short-term movements, even if it indicates that the uptrend is sustainable.