XRP is said to be in a “leverage-driven” price surge, reaching annual highs. This trend could be attributed to leveraged trading in the market, potentially creating a risky pattern.

Analysts have warned that as the price of Ripple’s XRP token rises to levels not seen since 2021, it may be experiencing a “leverage-driven” increase.

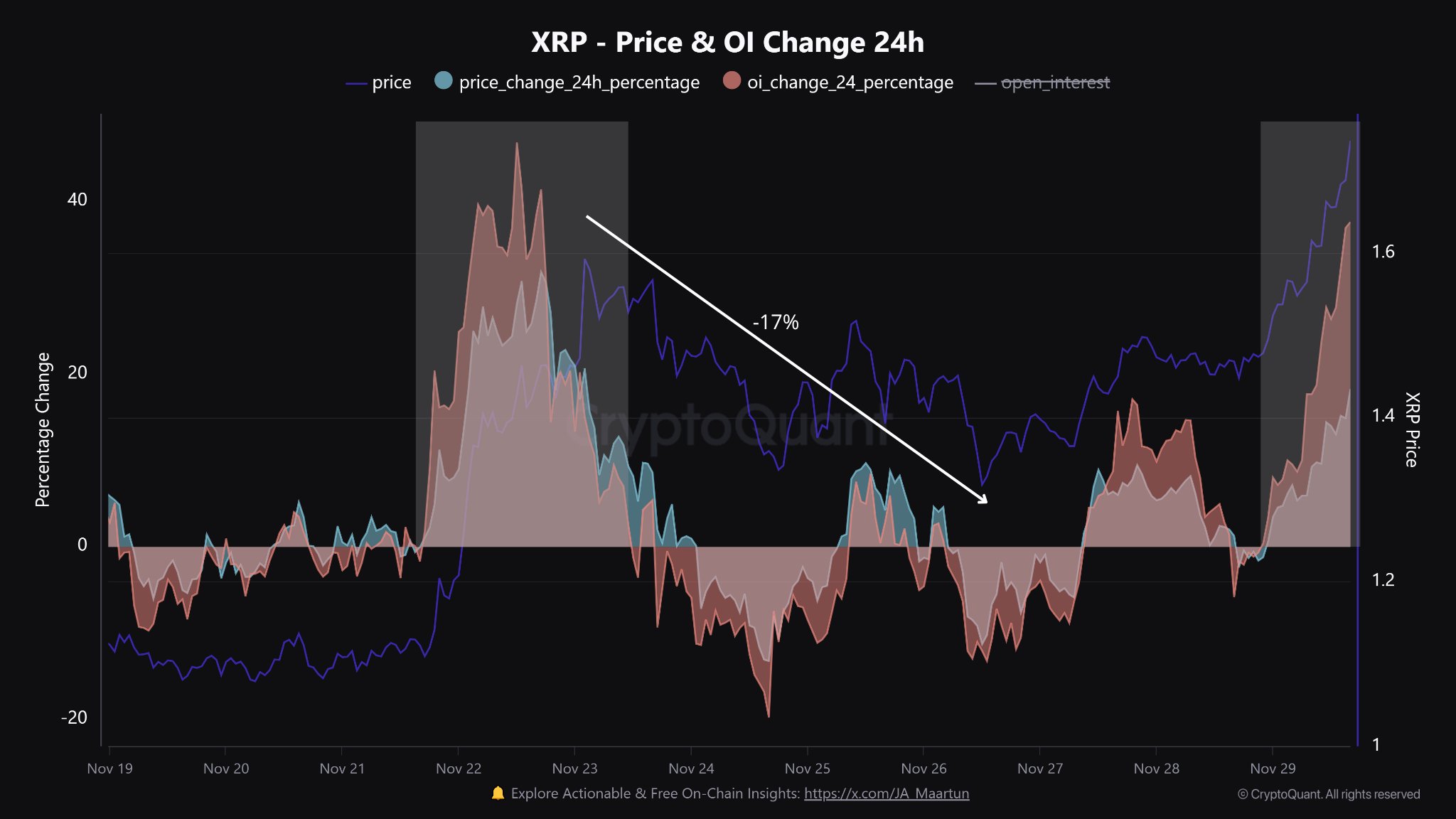

CryptoQuant analyst Maarten Regterschot, in a December 1 post on the X platform, noted that XRP’s open positions had significantly increased in the last 24 hours and cautioned that sharp price increases could result in quick sell-offs. Open interest measures the number of active contracts in derivative trading.

Maartuun:

“Open Interest is up 37% already watch for volatility. The last similar event led to a -17% drawdown.”

“Stay sharp, manage risk accordingly.”

According to CoinGlass data, XRP’s open positions increased by 30% in the last 24 hours, reaching a total of $4 billion across major exchanges and trading platforms.

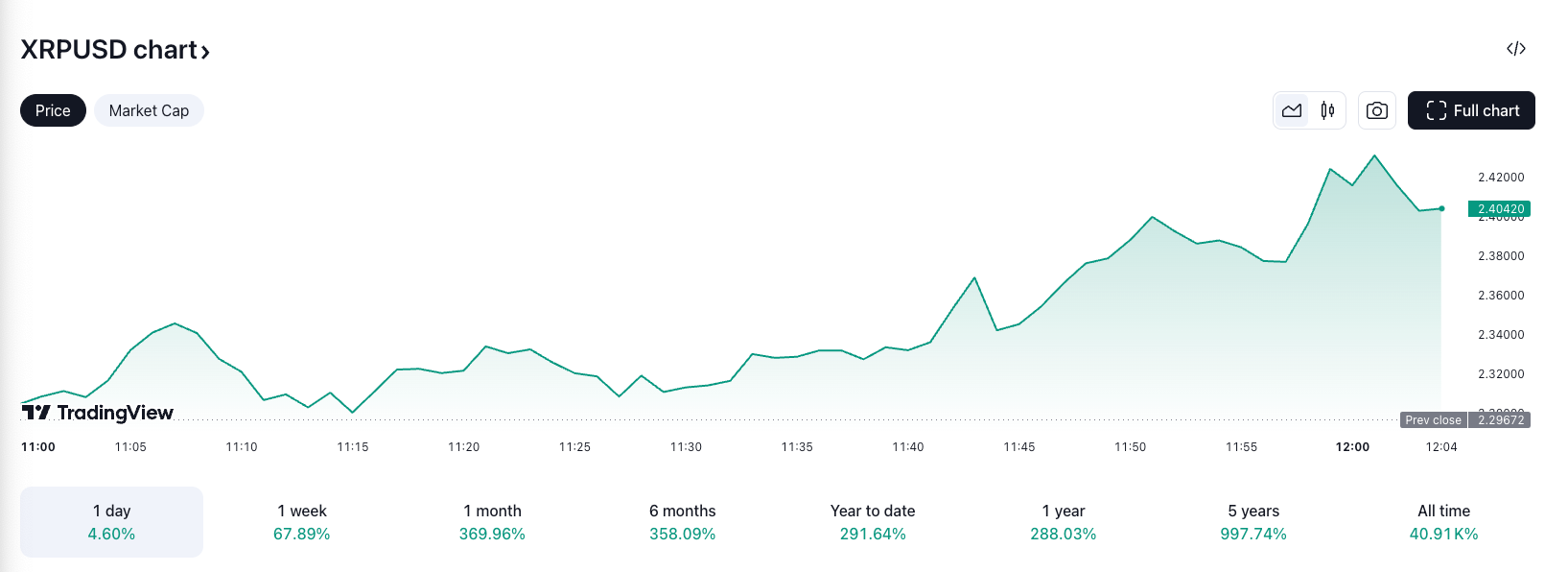

At the time of publication, XRP was trading at $2.39, showing an impressive 68% increase over the past month, according to TradingView data. Additionally, the asset has experienced nearly a 370% rise over the past year.

After Donald Trump‘s victory in the U.S. presidential election on November 5, Ripple began to gain value alongside major crypto assets, but it started to outperform other major tokens.

XRP’s strong price performance is supported by Ripple Labs’ increasing number of key partnerships, new product developments, the possibility of a Ripple ETF, and unverified rumors that Elon Musk may make a significant investment in Ripple and XRP.

Asset management company 21Shares filed for an XRP ETF on November 1, 2024, which has raised investor expectations that the U.S. Securities and Exchange Commission (SEC), likely to have new leadership starting January 2025, may approve the ETF applications.