The price of Ethereum may soon break out against Bitcoin based on its correlation with the four-year Bitcoin halving cycle.

Despite Bitcoin breaking the $100,000 record for the first time in crypto history on December 6, Ethereum has been unable to stay above the critical $4,000 psychological threshold.

However, according to a market report published by Bybit and Block Scholes, Ether is expected to start catching up to Bitcoin’s gains following last week’s crypto market deleveraging.

The report indicates that this situation is “indicative of a reset in leveraged long positions.”

Reduced leverage could set Ethereum up for a rally to a new all-time high during the first quarter of next year.

Bybit analysts:

“We expect a new all-time high in the first quarter of 2025.” they said.

They also added, “ETH is showing strength in the derivative markets, and the expectation of a price recovery is progressing at full speed.”

ETH-BTC 6 Months Chart

However, Bitcoin has proven to be a more profitable investment product for 2024. Over the past six months, Bitcoin has risen by more than 54%, while Ethereum has only provided a 12% return on investment.

Ethereum Is Expected To Catch Up To Bitcoin And Reach $8,800

Ethereum may be preparing for a rally above $8,800 based on the ascending triangle formation on the daily chart. This formation is used to predict the continuation of an uptrend.

However, according to popular crypto analyst The Long Investor, Ether needs to break through the critical $4,100 resistance level first.

In a post on X, the analyst wrote:

“If a breakout above $4,100 occurs, the price could reach the all-time high level of $4,865. I am holding $ETH until $8,800.”

Ether Triangle Formation To $8.8k.

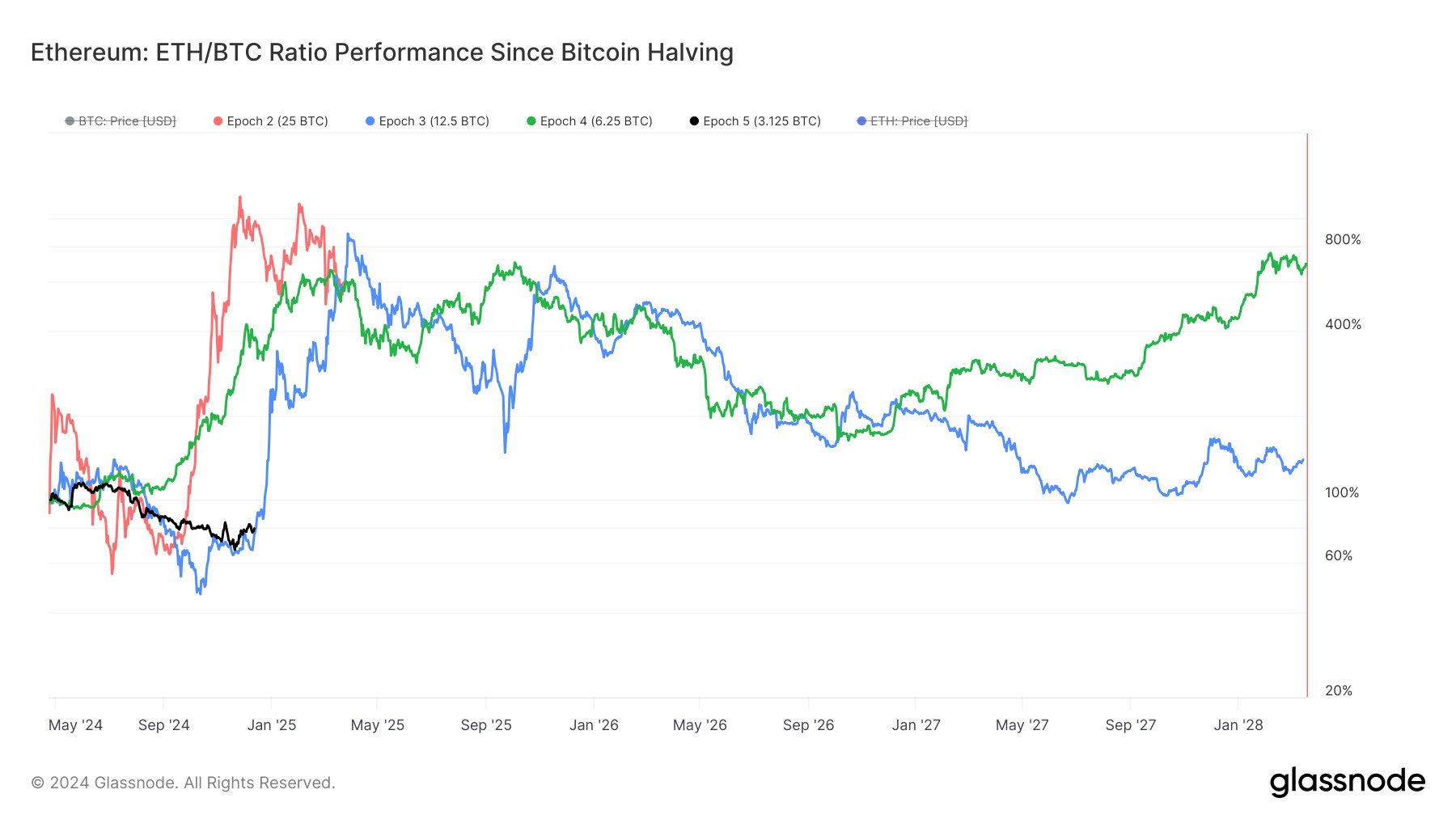

Based on Ether’s historical correlation with the Bitcoin halving cycle, ETH may begin to eclipse more of Bitcoin’s momentum in December.

Popular crypto analyst Venture Founder stated in a post on X:

“In every cycle, following the Bitcoin halving, Ethereum underperforms BTC for no more than 8 months and then explodes against BTC.”

Venture Founder continued in the post:

“We are currently in the 8th month. Everything is on track. After the halving, the ETH/BTC ratio typically increases by at least 700%. For this cycle, this means the ETH/BTC ratio could reach 0.39.”

ETH, BTC Ratio Post Halving

Another sign of growing investor interest in Ether is the high number of newly created wallets.

According to market intelligence platform Santiment, over 130,000 Ethereum addresses were created daily on average in December. This marks the highest level in over eight months, last seen in April.

However, other established crypto market participants are setting more conservative price targets.

VanEck predicts a target of $6,000 for Ether and $180,000 for Bitcoin in 2025.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.