Newly revealed court documents have rocked the crypto world. According to the filings, FTX secretly liquidated $1.53 billion worth of Three Arrows Capital (3AC) assets just two weeks before the hedge fund’s collapse in 2022. This disclosure adds a new dimension to the narrative that 3AC’s downfall was solely due to market conditions.

3AC Increases Its Claim Against FTX to $1.53 Billion!

Once valued at over $10 billion, 3AC suffered massive losses in mid-2022 due to leveraged trading positions. When Bitcoin (BTC) plummeted to $16,000, the fund was unable to repay its creditors. However, new evidence shows that FTX liquidated $1.53 billion worth of 3AC assets just two weeks before the hedge fund went into liquidation.

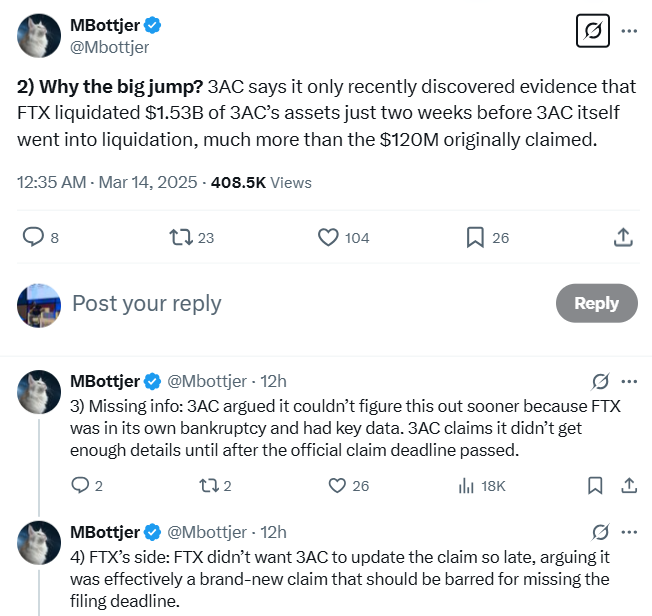

Mbottjer, one of the pseudonymous co-founders of FTX Creditors, stated that 3AC had initially claimed $120 million, but after discovering new documents, it increased its claim to $1.53 billion.

Court Sides With 3AC!

3AC argued that it was unaware of these liquidations because of FTX’s own bankruptcy. The court ruled in 3AC’s favor, allowing the hedge fund to proceed with its full $1.53 billion claim in the FTX bankruptcy case.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Meanwhile, Teneo, the firm handling 3AC’s liquidation, revealed that creditors are still owed about $3.3 billion. In December 2023, a British Virgin Islands court froze $1.14 billion worth of assets belonging to 3AC co-founders Kyle Davies and Su Zhu.

According to Nicolai Sondergaard, research analyst at Nansen, even if 3AC had received the additional $1.5 billion in 2022, it still would not have been able to repay all creditor claims. “While 3AC is allowed to pursue a higher claim, it’s uncertain whether they’ll receive the full $1.53 billion,” Sondergaard added.

CZ Raises Questions: Was FTX Involved in LUNA/UST Crash?

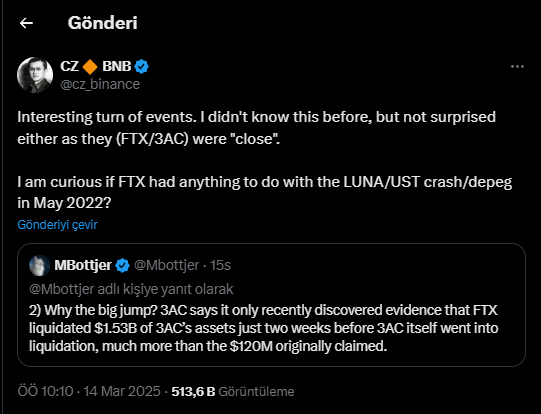

Binance founder and former CEO Changpeng Zhao (CZ) called these developments an “interesting turn of events.” In a post on March 14, CZ questioned whether FTX had any involvement in the LUNA/UST crash in May 2022.

The 3AC collapse came just one month after the downfall of Terraform Labs’ LUNA and UST, and shortly before Celsius paused all user withdrawals as its token, CEL, dropped by 90%.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.