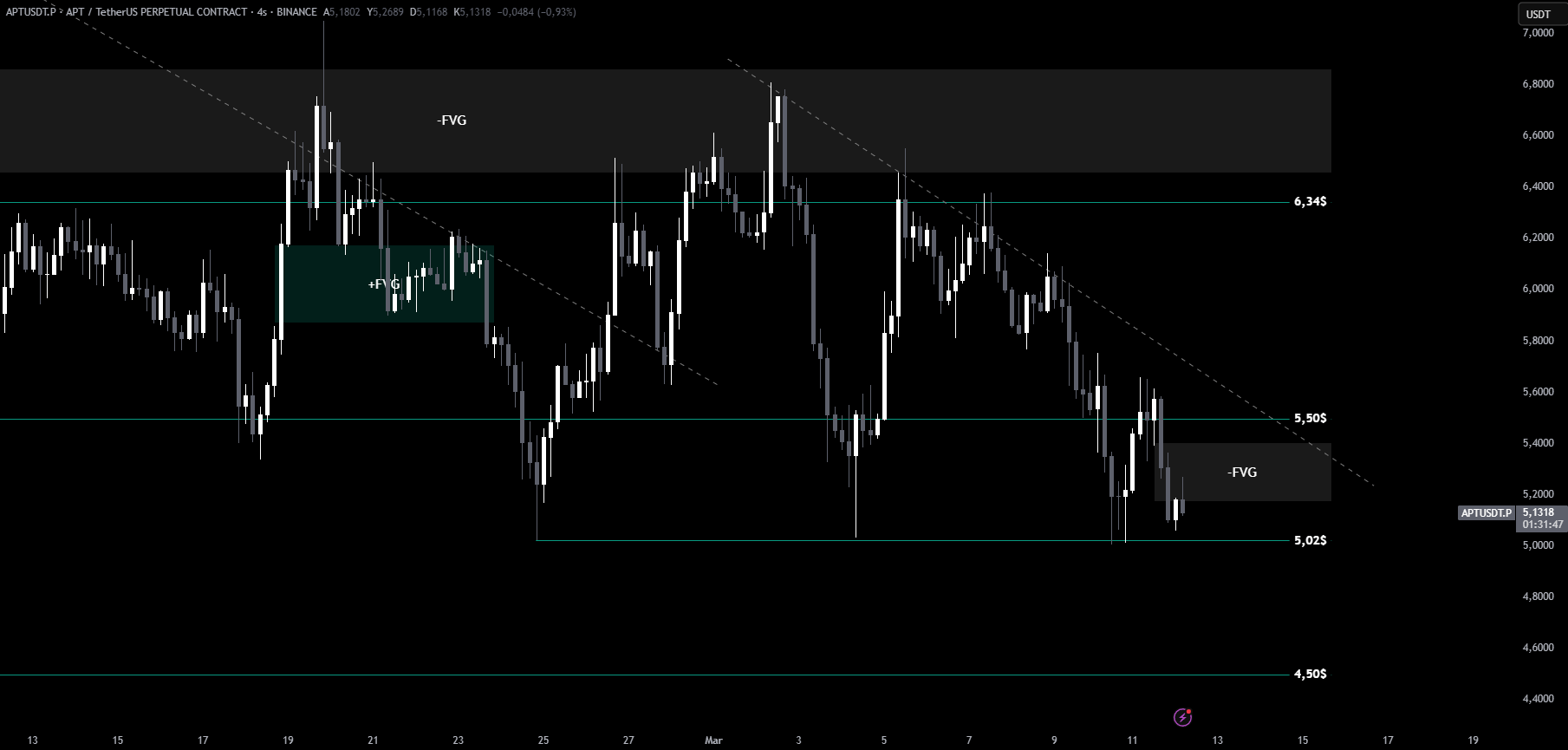

While volatility continues in the cryptocurrency market, APT price movements remain in the spotlight. Especially after the positive ETF news, a short-term upward move was observed in the APT/USDT pair. However, this rally started to face strong resistance at key levels. Let’s take a closer look at the latest developments and the technical outlook.

The Downtrend Was Broken on the 4-Hour Chart!

In recent days, APT managed to break its long-standing downtrend on the 4-hour chart. One of the main factors behind this breakout was the ETF news, which sparked excitement across the markets. Following this development, the price quickly moved upward and drew significant attention from investors.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

However, after the rise, APT faced several rejections from the bearish FVG (Fair Value Gap) zone. This indicates that the price is encountering strong resistance. Currently, the price has formed a new minor downtrend, suggesting that caution is warranted in the short term.

Support Level at $5.02 Holds Critical Importance!

At the moment, APT is trying to hold above the $5.02 support zone. This level is a key point that will likely determine the direction in the short term. If the $5.02 support is lost, the next support level to watch will be $4.50. This zone has previously attracted strong buying interest, making it a critical area to monitor.

On the other hand, if the price breaks through the bearish FVG zone, the next resistance level will be at $5.50. A sustained close above $5.50 would signal a complete break of the downtrend. In this scenario, a rapid move toward $6.00 could be expected.

APT Is at a Decision Point!

APT is currently at a decision point and attracting the attention of investors. In the short term, the direction the price will take may also influence the broader market sentiment. Adopting stop-loss strategies and proper risk management will offer a safer approach during uncertain periods like this.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.