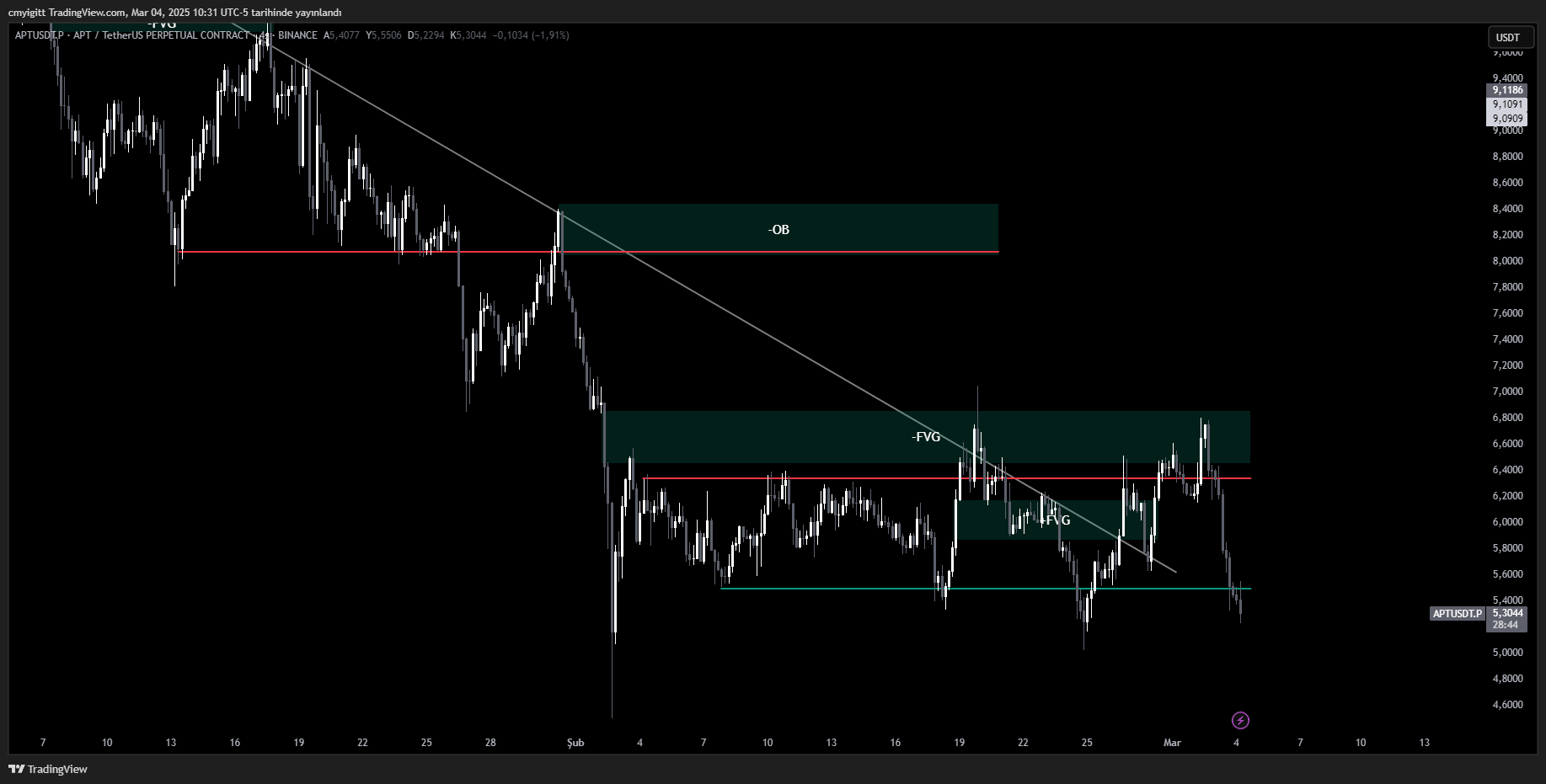

After breaking the downtrend identified in the previous analysis, APT climbed to the bearish FVG (Fair Value Gap) zone. However, it faced two strong rejections from this level and has now retreated to a critical support zone. A 4-hour close below $5.50 could push the price down to $5, making caution advisable for traders.

From a technical perspective, APT’s price action remains uncertain. If it manages to hold above $5.50, bulls may regain control and drive the price higher. However, if this support is lost, downward momentum could accelerate, leading to a potential drop towards $5.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Indicators suggest weakening momentum, with decreasing volume and bearish signals. The RSI (Relative Strength Index) is approaching neutral levels, while the MACD indicator is flashing a sell signal. This indicates that selling pressure may persist in the short term. However, if strong buying support emerges at this level, APT could rebound and target the $5.80 – $6.00 range.

Traders should closely monitor whether APT can hold above $5.50. If this level is lost, $5.20 and subsequently $5.00 will be key support levels to watch.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.