Hayes states that Bitcoin’s price may have reached its lowest point in the recent downturn and is ready to rise again.

Hayes: Fed’s Shift in Monetary Policy Could Trigger Bitcoin Price Surge!

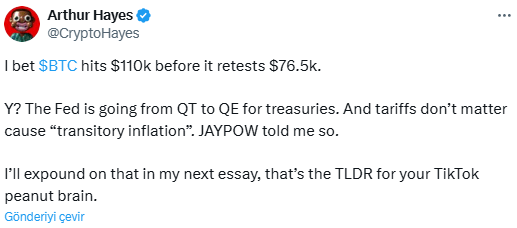

BitMEX co-founder Arthur Hayes predicts that Bitcoin will experience a significant surge, reaching $110,000 before dipping back to $76,500. This forecast is based on the expectation that the central bank’s shift from tightening to easing, injecting liquidity into the market, will boost digital asset prices.

Hayes stated on X, “I bet BTC hits $110k before it retests $76.5k. Why? The Fed is moving from QT to QE for treasuries.”

He dismisses concerns about tariffs negatively affecting Bitcoin’s price, arguing that inflation is “transitory.”

Markus Thielen: Bitcoin Ready to Recover After Recent Dip

Markus Thielen, founder of 10X Research, forecasts Bitcoin’s potential to recover. In a report dated March 23, Thielen noted that Bitcoin may have reached its lowest point during the recent downturn and is poised for a rebound.

According to Thielen, the Fed’s more flexible stance on inflation and Trump’s more lenient approach to tariffs could ease market concerns and boost investor confidence.

“The Fed signaled it might overlook short-term inflationary pressures, laying the groundwork for potential future easing,” he said.

Thielen also mentioned that the relaxed political climate and favorable economic forecasts have turned Bitcoin’s indicators bullish.

The analyst pointed to supporting factors such as Bitcoin holders’ behavior and ETF performance. Thielen believes Bitcoin won’t enter a deep bear market because large Bitcoin holders are likely long-term investors.

Bitcoin ETF Inflows Signal Positive Outlook: Bitcoin Climbs to $87,000

On the other hand, new inflows into US-based spot Bitcoin ETFs are seen as a positive signal, indicating reduced selling pressure from arbitrage-focused investors.

According to Farside Investors data, US-listed spot Bitcoin ETFs collectively saw net inflows of around $744 million last week. BlackRock alone attracted approximately $537 million in new investments.

Despite being bullish, Thielen acknowledges that there is no “clear catalyst” for an immediate parabolic rally.

As of writing, Bitcoin was trading at approximately $87,000, up 3.5% in the last 24 hours. The total crypto market cap rose slightly to $2.9 trillion.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.