Australia, with the third-largest number of crypto ATMs, is concerned that these machines may facilitate financial crimes.

The country’s national financial intelligence agency has prioritized cryptocurrency for the upcoming year and is forming a task force to take action against crypto ATM providers that may be violating Anti-Money Laundering laws.

In a statement made on December 6, Brendan Thomas, CEO of the Australian Transaction Reports and Analysis Centre (AUSTRAC), stated that the government agency will focus on the cryptocurrency sector in 2025. Brendan Thomas said:

“Cryptocurrency and crypto ATMs are attractive avenues for criminals looking to launder money, as they are widely accessible and make near-instant and irreversible transfers,”

“This is the first step in AUSTRAC’s focus to reduce the criminal use of cryptocurrency in Australia. We will be focusing on this industry over the course of next year.”

According to AUSTRAC, the task force will focus on ensuring that crypto ATM operators meet minimum standards to eliminate the risk of illicit cash passing through the machines.

Leading crypto ATM providers in Australia include Coinflip with 680 ATMs, Localcoin with 465, and Cryptolink with 75. Crypto ATM operators are already required to register with AUSTRAC, monitor transactions, and conduct Know Your Customer (KYC) checks on users.

They are also expected to report suspicious activities and submit threshold transaction reports for cash deposits and withdrawals over $6,500 (10,000 Australian dollars). Thomas stated that any operation failing to comply with regulations “risks facing significant financial penalties.”

He added, “As the use of cryptocurrency increases, so too will criminal exploitation, which is why this task force will work to eliminate non-compliant high-risk operations.” In Australia, penalties for money laundering can include up to 12 years in prison, fines exceeding $100,000, or both. If the value of laundered funds exceeds $644,400, jail sentences can be as long as 25 years, and fines can reach up to $214,585, or both may be applied.

Australia Rising as a Crypto ATM Hub

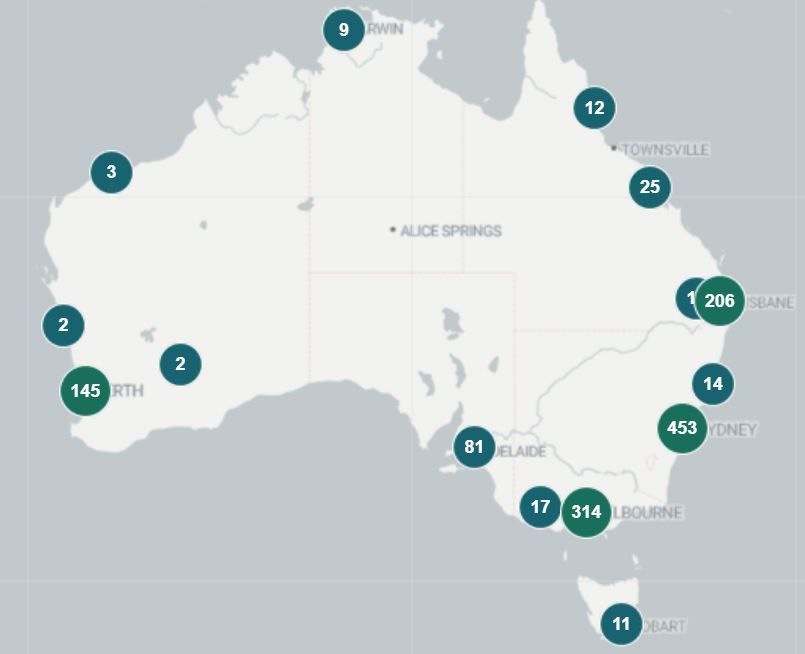

Australia has become the third-largest hub for Bitcoin and crypto ATMs. According to Coin ATM Radar data, the country now has over 1,302 ATMs, a significant increase from 67 ATMs in August 2022.

AUSTRAC has disclosed that 400 digital currency exchanges are registered, but only a few operate crypto ATMs.

Australia started as a slow market for crypto ATMs, but adoption surged rapidly towards the end of 2022 as private companies entered the market in force.

Australia has the world’s third-largest number of crypto ATMs, behind the US and Canada. Source: Coin ATM Radar

As of April 2023, Australia’s Bitcoin ATM count surpassed that of Asia, which includes major economies such as China, Japan, Singapore, and India.

The US has the most Bitcoin ATMs, with 31,647 machines representing over 81% of the global market. Canada ranks second with 3,022 crypto ATMs, holding 7.8% of the market.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.