The crypto custody firm Bakkt experienced a sharp drop in its stock price after announcing that two of its major clients will not be renewing their agreements. The company’s shares closed the trading session on March 18 with a significant 27.28% loss.

Bank of America and Webull Decisions Increased Selling Pressure

In a regulatory filing dated March 17, Bakkt disclosed that two key clients would not renew their commercial agreements. Bank of America will terminate its existing agreement on April 22, while the brokerage platform Webull will end its contract on June 14.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

According to the filing, Bank of America accounted for 17% of Bakkt’s loyalty services revenue for the nine months ending September 30, 2024. Webull contributed 74% of the company’s crypto services revenue during the same period.

Shares Crash to New Lows!

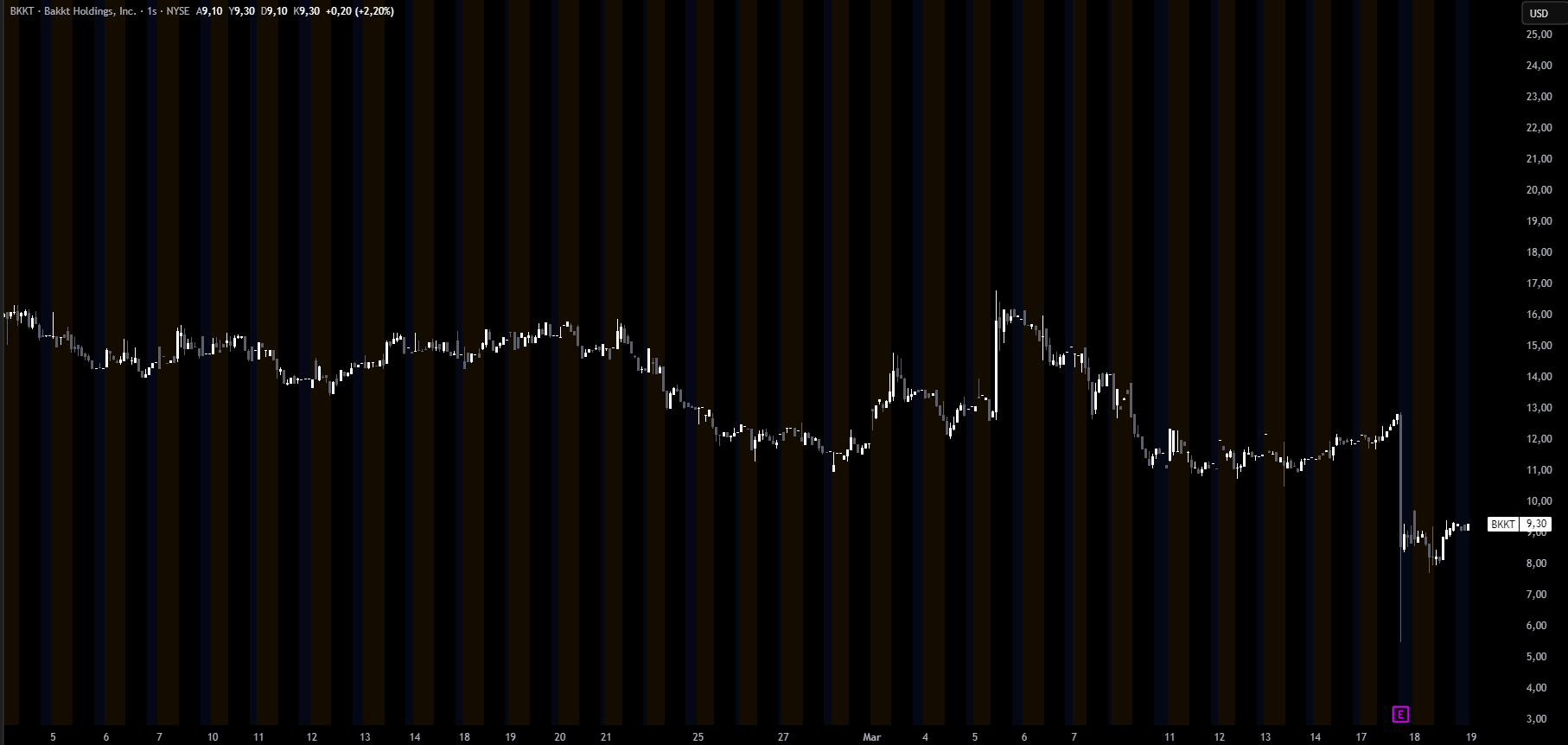

Following this development, Bakkt (BKKT) shares dropped 27.28% on March 18, closing at $9.33. In after-hours trading, the shares fell an additional 2.25%, reaching $9.12.

Bakkt’s stock price has plummeted more than 96% from its all-time high of $1,063, recorded in October 2021.

Bakkt has postponed its previously announced earnings conference call twice. The latest rescheduling sets the call for March 19. These delays have added further uncertainty for investors.

Class Action Lawsuit on the Horizon!

The Law Offices of Howard G. Smith announced a potential class action lawsuit against Bakkt following the termination of agreements with Bank of America and Webull. The statement claims that the canceled agreements and the delayed earnings call led to a sharp decline in Bakkt’s stock price, “thereby injuring investors.”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.