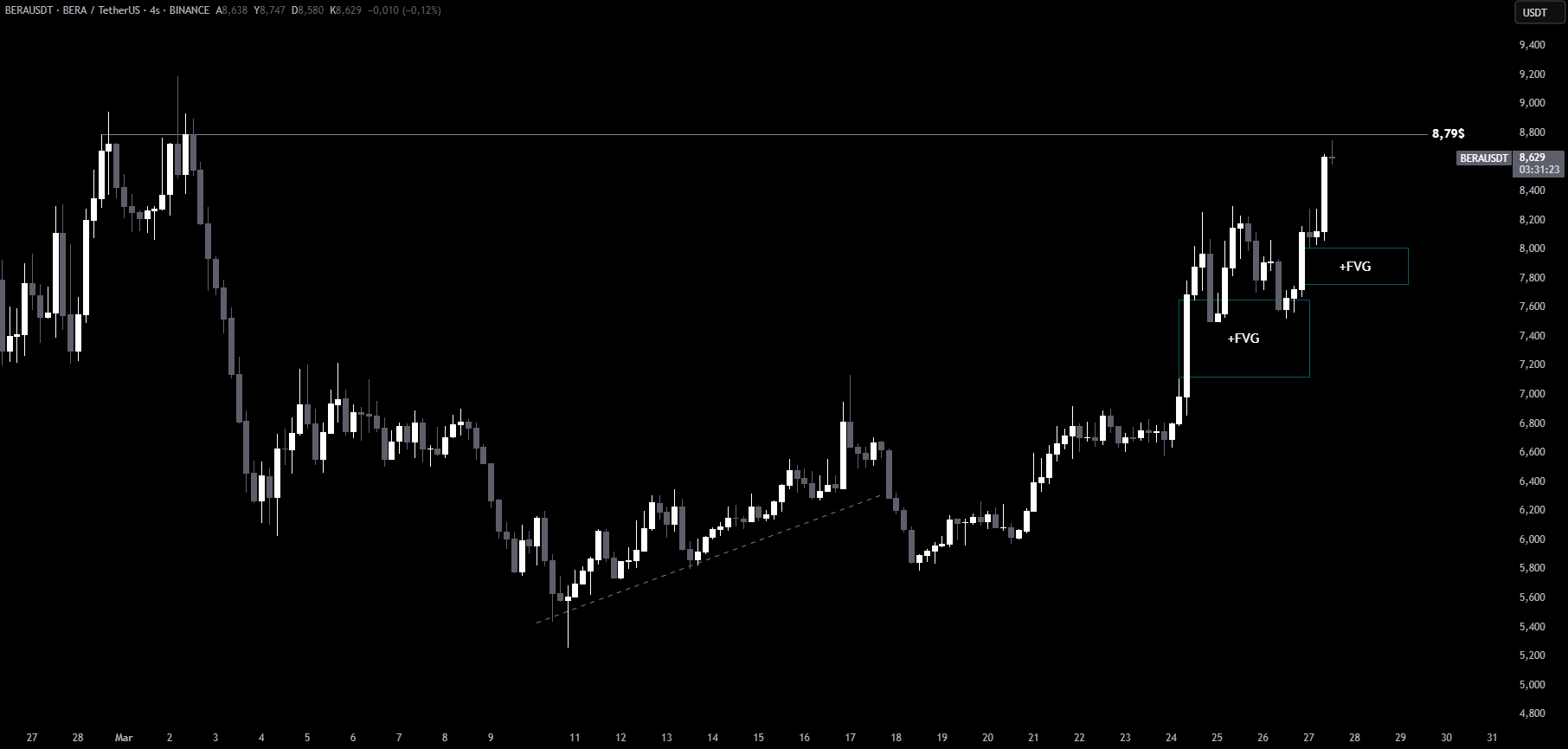

In recent days, Berachain (BERA) has shown a remarkable upward movement. However, it has now reached a critical resistance at $8.79. Traders should exercise caution when opening long positions at this level, as a break above this point could determine the future price direction.

$8.79 Resistance and Possible Pullback

Berachain (BERA) has experienced a strong upward trend, surpassing key levels, but $8.79 remains a critical resistance point. This level is confirmed by Fibonacci retracement and technical indicators as a key resistance. Traders looking to open long positions should monitor the price closely before deciding to enter.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

In the event of a pullback, the following levels may act as support:

-

FVG (Fair Value Gap) Region: This region, also known as the upward FVG region, will likely act as a support level in the event of a pullback.

Volume Breakout and Potential Uptrend

If Berachain breaks the $8.79 resistance with strong volume, it could move towards the next target at $9.25. $9.25 stands as the next key resistance point, and a strong push towards this level could follow after a successful breakout.

Volume-driven breakouts are key signals for continued upward momentum. Traders should keep a close eye on whether Berachain can break through this resistance level with substantial volume.

Berachain investors should tailor their strategies based on both market trends and these technical levels.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.