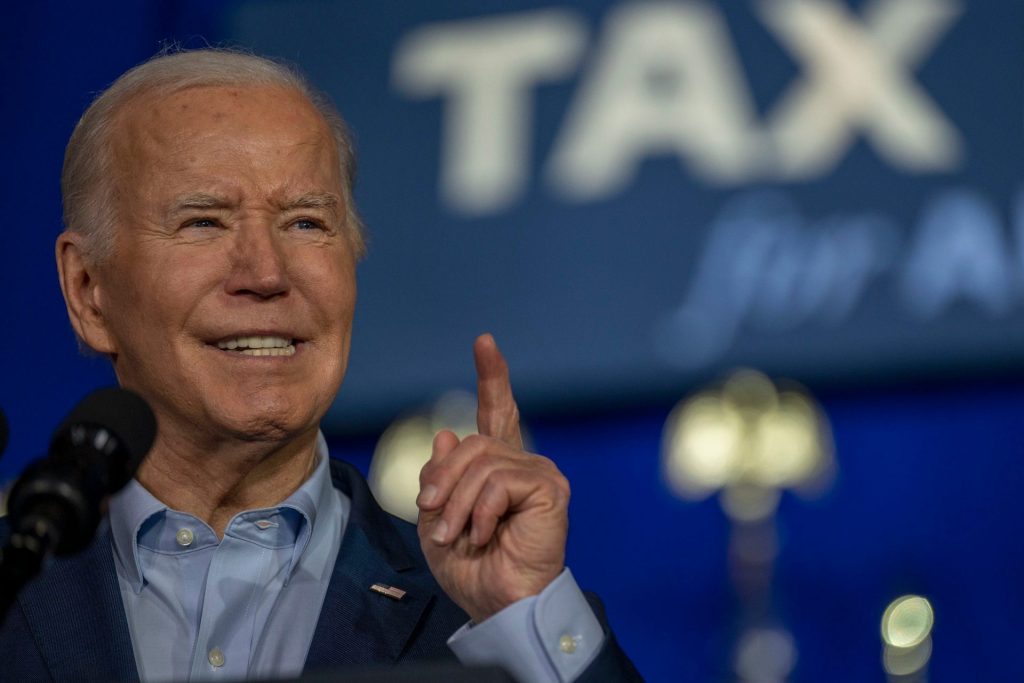

The proposal put forward by President Joe Biden to raise the federal capital gains tax to an astronomical 44.6% has prompted heated discussion and dread within financial circles, but the crypto community experts argue it could be a lot less harmful than is anticipated.

Analysis on Biden’s Tax Proposal Impact on Crypto

Malcolm Walrath, founder of CryptoTaxMadeEasy, snuffs out the alarm stating that Biden’s tax hiking plan is a “big, fat nothing burger” for 99.5% of the crypto lovers. “Aside from 99.9% of people, it’s a big, fat nothing burger because it’s basically just a proposal,” Walrath stressed.

The proposal was announced in the Department of Treasury’s document on March 11 and only applies to individuals who earn more than $1 million a year, meaning the average crypto user is not the target of the tax, as Walrath puts it. High-earning individuals may, in fact, in future, face a much higher rate of capital gains tax. However, for the most part, it’s not likely to bother the average crypto user,” Walrath described.

In this connection, SqueezeTaxes, a pseudonymous crypto accountant, compared the turmoil to a “headline catfish,” noting that majority of the proposal hits the people in the highest tax brackets. Squeeze clarified that the Biden’s plan proposes to elevate the maximum federal tax bracket to 39.6% and 5% for Net Investment Income Tax, which would round off the highly talked figure of 44.6%.

Expert Insights and Social Media Reactions

Amid the undertow of anxiety on social media, the data from the crypto payment company TripleA reveals that the average global crypto investor makes roughly $25,000 a year. The number, though, incorporates statistics from countries with an average income lower than that of the US, indicating a limited effect on the greater crypto population.

Apart from capital gains, Biden’s Federal Budget proposal, however, details a 25% tax on unrealized gains for ultra-high-net-worth individuals. Referring to this step as “insane,” a Bitcoin commentator Jason Williams has predicted serious economic backlash. Nevertheless, tax experts at Grant Thornton elaborate this tax would apply only to people with more than $100 million in net assets, leaving the majority of crypto devotees untouched.

Regarding Biden’s tax proposals Walrath notes that these are just political ploys to placate low-income voters, saying, “It’s more of a posturing political play…[the] Democratic Party has kind of made an enemy out of wealthy people, and that’s one of the ways that they play to a low-income, low-education base.”

This potentially means while Biden’s tax proposals may rattle the traditional financial sectors, they may indeed not shake the crypto community leaving the investors to chart the storm with cautious optimism.