The famous on-chain investigator has exposed the much-discussed Hyperliquid whale. Allegedly, the whale has made $9 million in profits using stolen funds.

A major development has shaken the crypto investment world. Well-known on-chain investigator ZachXBT has claimed that the so-called “Hyperliquid whale,” who trades with 50x leverage on the Hyperliquid exchange, is in fact a cybercriminal gambling with stolen funds.

This whale managed to survive liquidation attempts by crypto investors and secured an impressive $9 million in net profit. ZachXBT emphasized that this whale has no connection to the North Korea-backed Lazarus Group. Earlier this year, in February 2025, ZachXBT had linked the $1.5 billion Bybit hack to that hacker collective. Now, he has followed the trail to this Hyperliquid whale.

“Crypto Twitter Is Speculating, But the Truth Is More Sinister”

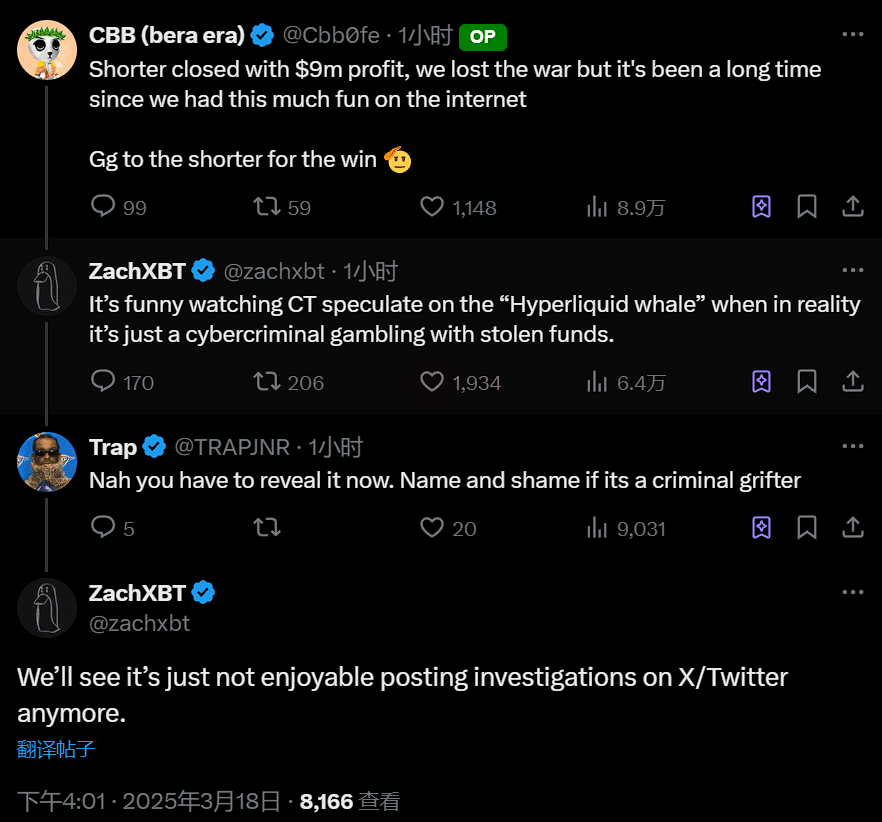

ZachXBT made the following statement on X (Twitter):

“It’s funny watching CT speculate on the ‘Hyperliquid whale’ when in reality it’s just a cybercriminal gambling with stolen funds.”

Responding to a follower’s question regarding potential ties to the Lazarus Group, ZachXBT replied:

“No, there’s no connection to Lazarus.”

Some users asked ZachXBT to reveal the whale’s identity. However, he responded by saying:

“We’ll see, it’s just not enjoyable posting investigations on X/Twitter anymore.”

Failed Attempts to Liquidate the Whale

For weeks, the crypto market has speculated about who the Hyperliquid whale is and how they could be stopped. The whale had opened 40x and 50x short positions on Bitcoin (BTC) and Ethereum (ETH), drawing massive attention.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

The whale notably opened a $450 million short position on BTC, which triggered a major reaction across the market. Traders attempted to counter this by aggressively buying up BTC, trying to force a liquidation. However, they ultimately failed. According to Lookonchain, the whale deposited an additional $5 million USDC to increase margin and avoid liquidation.

Aside from BTC and ETH, the whale also opened a $31 million short position on Chainlink (LINK) with 10x leverage and placed short orders on GMX.

A Major Threat in the Crypto Market: Stolen Funds and High-Leverage Trades

ZachXBT’s comments have reignited concerns about stolen funds re-entering circulation through decentralized finance (DeFi) protocols. The situation also highlights how cybercriminals exploit high-leverage trading to gamble with illicit funds, posing a significant risk to the overall market.

While the true identity of this whale remains undisclosed, the broader question for the crypto ecosystem is how to address these high-risk scenarios and prevent bad actors from destabilizing the markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.