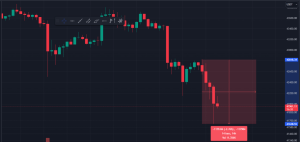

Bitcoin (BTC) market experienced a significant loss in value in the last few hours. The cryptocurrency quickly dropped by around 5%, falling from $43,794 to $41,620. This sudden decline increased market volatility, leading to notable movements in liquidation data.

This development comes as an unexpected turn of events for both Bitcoin and the general altcoin market. The rising trend previously demonstrated by Bitcoin and the flow of positive news in the industry had kept the expectations of investors and market observers on the upside. However, this unexpected selling wave resulted in a sharp decline when buyers couldn’t meet the demand.

Why Is The Market Falling?

Market fluctuations like these once again highlight the inherent risks and volatility in cryptocurrency markets. For investors, it emphasizes the importance of closely monitoring market movements and implementing effective risk management strategies.

These sudden changes can be seen as a reflection of the dynamic nature of the cryptocurrency market, underscoring the need for investors to be prepared for such movements. Constantly keeping track of market news and analyses can enable investors to make more informed decisions in the face of unexpected situations.

The Future of Bitcoin and Expert Comments

Bitcoin Analysis: The current status and future trajectory of Bitcoin are shaped by various factors. Experts emphasize the consideration of short-term fluctuations when assessing Bitcoin’s long-term potential.

Upcoming ETF launches, investment strategies of major companies, and global economic trends will play a significant role in Bitcoin’s price movements. These factors will influence both investor behavior and the overall direction of the market.

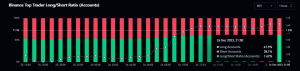

Market Dynamics and Investor Reactions

The recent downturn in the market may lead investors to reconsider their risk management strategies. Many investors might shift their focus from short-term gains to long-term investment opportunities. Additionally, downtrends can present opportunities to attract new investors to the market.

You might like: Binance Delists Trading Pairs of These Altcoins!

During such times, it is crucial for investors to make informed and research-based decisions. Market experts advise investors to closely monitor market news and trends and base their investment decisions on this information.

General Market Commentary

Current developments and predictions in the Bitcoin market are notable. Throughout 2023, Bitcoin’s price has seen a 160% increase, with a 60% gain in the fourth quarter of the year. In December alone, there was a 15% increase, marking Bitcoin’s best December performance since 2020. This surge is considered a revival after the longest bear market for Bitcoin.

The price of Bitcoin reached $44.4K recently, driven by an increase in whale wallets and growing optimism about Exchange-Traded Funds (ETFs). This uptrend is supported by the return of 22 whale wallets containing 100+ Bitcoins each to the network after a two-week decline. Additionally, increasing expectations for Bitcoin ETFs contribute to a positive sentiment in the market.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.