Spot bitcoin ETFs in the U.S. recorded $817.5 million in daily net inflows on November 13, following $1.1 billion in inflows the day before. The crypto market saw a broader rally, but Bitcoin dropped 3.4% in the past 24 hours, currently trading at $86,855, suggesting that some profit-taking might be occurring, according to an analyst from BRN.

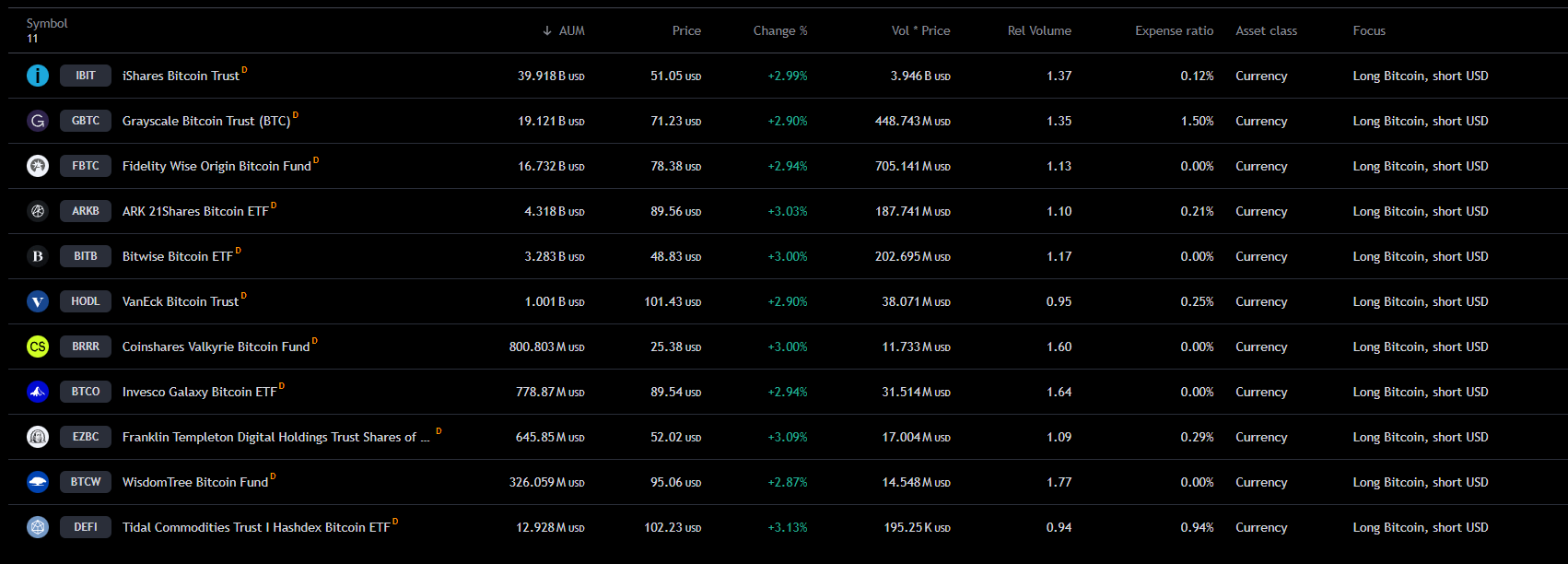

The daily trading volume for the 12 spot bitcoin ETFs was $5.7 billion on Tuesday, compared to $7.3 billion on Monday and $2.8 billion on Friday. BlackRock’s IBIT led the inflows, drawing $778.3 million into the product, and accumulating $1.93 billion this week. Fidelity’s FBTC also contributed $37.2 million in inflows, and Grayscale’s Mini Bitcoin Trust and VanEck HODL saw over $10 million in inflows.

However, Grayscale’s GBTC, the second-largest spot bitcoin ETF by net assets, saw $17.8 million in outflows, while Ark and 21Shares’ ARKB experienced $5.4 million in net outflows on Tuesday.

These large inflows into bitcoin ETFs came amid a broader crypto market rally, with Bitcoin hitting new highs following President-elect Donald Trump’s victory. But, after briefly breaking above the $90,000 level, Bitcoin fell by 3.4%, trading at $86,855 at the time of writing. Ether also fell by 7.35%, trading at $3,142.

Might interest you: Who Could Replace Gary Gensler as SEC Chairman?

According to BRN analyst Valentin Fournier, “Bitcoin’s rally paused with its first red candle yesterday, after an intraday peak of $90,000. We believe this indicates profit-taking by large investors, potentially leading to a brief correction before prices resume their upward momentum.”

He also mentioned that upcoming events and technical indicators may signal a potential reversal in prices. “Currently, the upside potential appears stronger than the immediate downside risk. However, the upcoming CPI release today could introduce market volatility if the numbers exceed expectations.”

Ether ETFs Record Strong Inflows

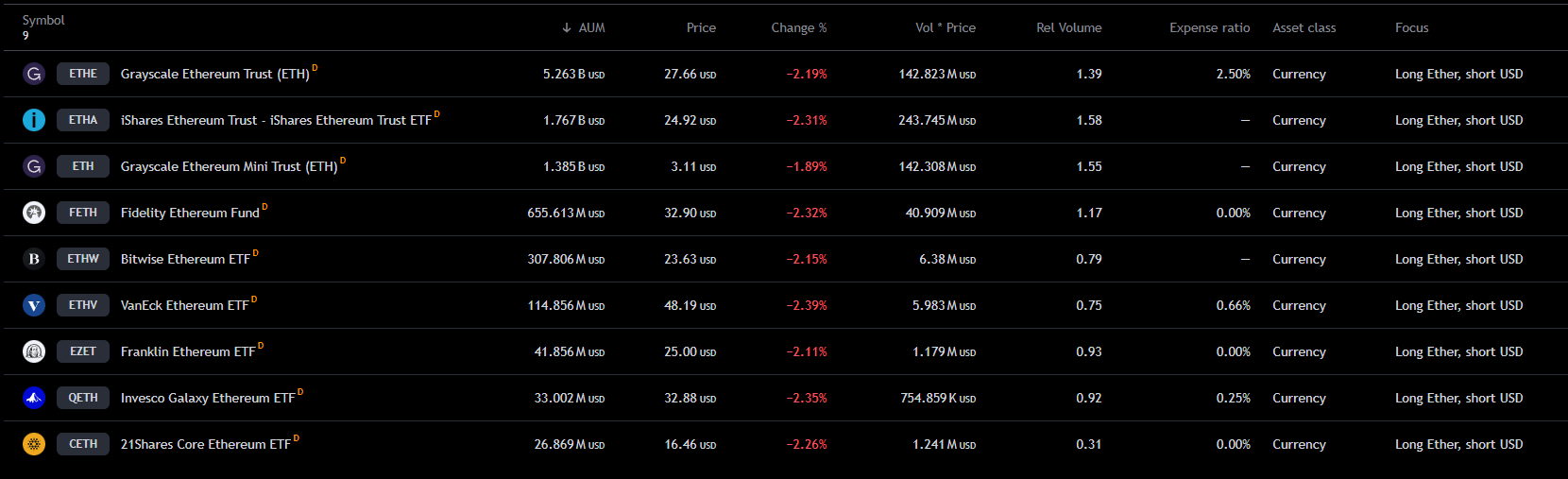

Meanwhile, spot Ethereum ETFs in the U.S. saw $135.9 million in net inflows on Tuesday, marking their second-largest inflows since launch. BlackRock’s ETHA saw the largest daily inflows among these ETFs, with $131.5 million in inflows. Bitwise’s ETHW recorded nearly $17 million in inflows, while Grayscale’s Mini Ethereum Trust saw $12.7 million in inflows.

However, Grayscale’s ETHE was the only spot ether ETF to report negative flows, with $33.2 million exiting the fund.

The total cumulative flows of the nine ether funds turned positive for the first time since their launch, standing at $94.62 million. The figure had been – $686 million on September 23, according to SoSoValue.

Spot Ethereum ETF trading volume dropped to $582.2 million on Tuesday, down from $913 million the previous day. Despite this, Tuesday’s volume remains the second-largest since July 29.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.