Binance’s Bitcoin reserves have dropped below 570,000 BTC, the lowest level since January.

The Bitcoin reserves on Binance, the world’s largest crypto exchange by trading volume, have fallen to levels not seen since January 2024. This decline comes just two months before Bitcoin’s price surged by 90% in March. If Bitcoin follows the same pattern, its current price of $98,680 could reach $187,500 in a few months.

Signals Indicate That Investors Are Confident

The drop in Binance’s Bitcoin reserves below 570,000 BTC, reaching the lowest level since January, typically indicates that investors are moving Bitcoin into cold storage and are optimistic about its long-term price prospects.

At The Time of Publication, Bitcoin’s Price Was $98,680

Binance’s reserves dropped to a similar level in January, and two months later, on March 13, BTC surged to $73,679, marking its highest level at that time.

Darkfrost: “When withdrawal periods occur, it usually signals that positive momentum is building in the markets.”

Bitcoin Dominance Is Hovering Just Below 60%

According to TradingView data, BTC dominance currently stands at 58.4%, just below the critical 60% level.

However, some analysts suggest that the 60% level could signal a broader rotation towards other crypto assets.

On August 18, Into The Cryptoverse founder Benjamin Cowen stated that he believed Bitcoin would make its “final move” toward 60% by December, and this prediction came true two months later on October 30.

At The Time of Publication, Bitcoin Dominance Is At 58.4%

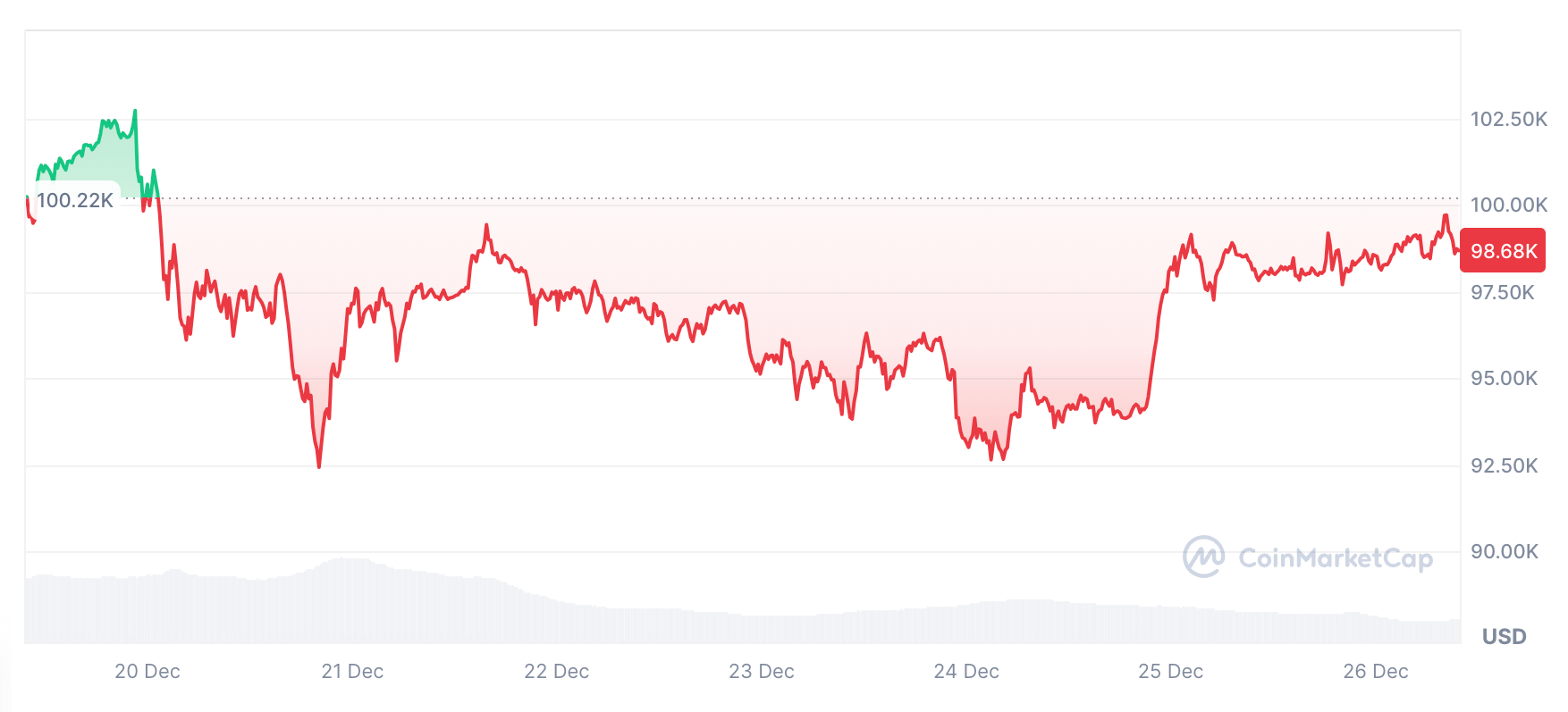

Meanwhile, Bitcoin has struggled to hold above the psychological level of $100,000 since first breaking it on December 5.

Bitcoin’s price has been trading under the $100,000 mark since December 19, after reaching a new high of $108,300 on December 17. According to Ryan Lee, chief analyst at Bitget Research, Bitcoin’s price could exceed $105,000 once liquidity returns after the Christmas holidays.

Lee stated that Bitcoin’s current downtrend is a typical sign of holiday illiquidity.

“Post-Christmas, market activity typically picks up again, with funds expected to actively position for sectors that might benefit from Trump’s upcoming inauguration… The expected trading range for BTC this week is $94,000 – $105,000.”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.