Cryptocurrency exchange Binance has launched its Copy Trade feature. So, what is this Copy Trade feature?

In today’s rapidly changing financial markets, investing has become more complex than ever. However, a method known as copy trading is helping both beginners and experienced investors to survive in this challenging world. Furthermore, Binance, one of the leading cryptocurrency exchanges worldwide, offers more options to investors by providing this copy trading feature.

You May Be Interested: Coinbase to Launch Futures Trading for Dogecoin, Litecoin, and Bitcoin Cash on April 1

What Is Copy Trading?

Copy trading offers investors the opportunity to copy the portfolio of an experienced investor in real time. This means investors can follow the transactions of a leading trader before developing their own investment strategies. Here are the two main actors of this system:

1. Leading Traders: These are experienced investors recognized by their own success. They allow followers to track and copy their trades.

2. Those who do Copy Trading: This group includes investors who follow leading traders and automatically copy their trades.

How to Use Binance Copy Trade in Futures?

Copy trading is a great feature offered on the Binance Futures platform. Here is a short and understandable guide on how to invest using this feature:

Step 1: Log in to your Binance Account

First, log in to your Binance account. If you don’t have a Binance Futures account, you can register using this link to get discount on commission.

Step 2: Choose the Portfolio You Want to Copy

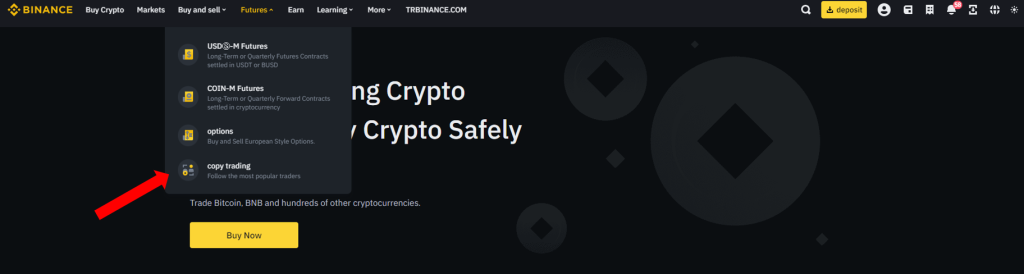

Go to the [Futures] tab and then select the [Copy Trading] section. Also, you can select the portfolio of the leading trader you want to copy.

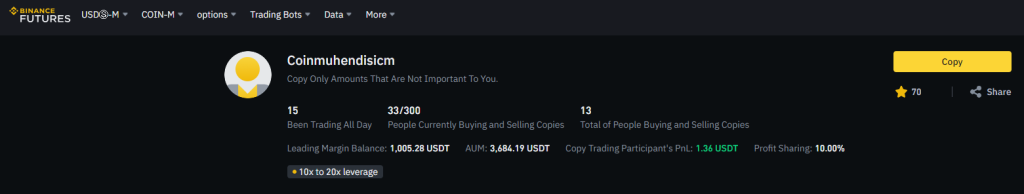

If you want to do copy trading together with Coin Engineer, you can visit Coin Engineer’s profile by clicking here and start investing together.

Step 3: Choose the Copying Mode

After choosing the portfolio, set the copying mode. Thus, you have two options:

- Fixed Amount: Determine how much you want to invest per transaction.

- Fixed Ratio: Determine your total investment and the system will trade according to this amount.

Step 4: Customize Other Settings

You can further personalize your copy trade. Specifically, you can set the:

- Copy Amount

- Cost Per Order (Fixed Amount Mode)

- Margin Mode (Follow Leader’s Margin Mode or Fixed Margin Mode)

- Leverage (Follow Leader or Fixed Leverage)

- Take Profit and Stop Loss Settings

- Maximum Position Per Trade Pair

Step 5: Start Copying

After setting up, click the “Copy” button to start copying. Thus, your investment will be transferred from your Spot Wallet to your Copy Trade account.

Risks in Copy Trading

Copy trading, like any investment, carries risks. If the strategy of the leading trader you follow fails, you may lose your investment. In addition, when trading in a volatile market or with low liquidity assets, you can be exposed to other risks such as slippage. Therefore, you should control your risk and be prudent when investing.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.