Binance has responded to rumors circulating on social media platforms about a large-scale asset sale. The exchange clarified that the significant reduction in its Bitcoin and Ethereum reserves was not due to asset liquidation but rather internal accounting adjustments.

Binance Statement: “No Asset Sales”

On February 11, 2025, Binance issued a statement explaining that the on-chain changes were simply part of an internal accounting process. A spokesperson for the exchange said, “Binance is not selling assets. This is merely an adjustment in the Binance treasury’s accounting process. User funds are SAFU, as always.”

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Recent rumors about a dramatic decline in Binance‘s Bitcoin and Ethereum reserves—down over 90% in January—spread rapidly on social media. However, crypto analysts clarified that this change stemmed from past revenue, not user funds, and that user funds were unaffected. Additionally, a significant portion of these holdings had been converted into USDC, with Binance Coin (BNB) showing the smallest reduction.

Proof of Reserves Data and Adjustments

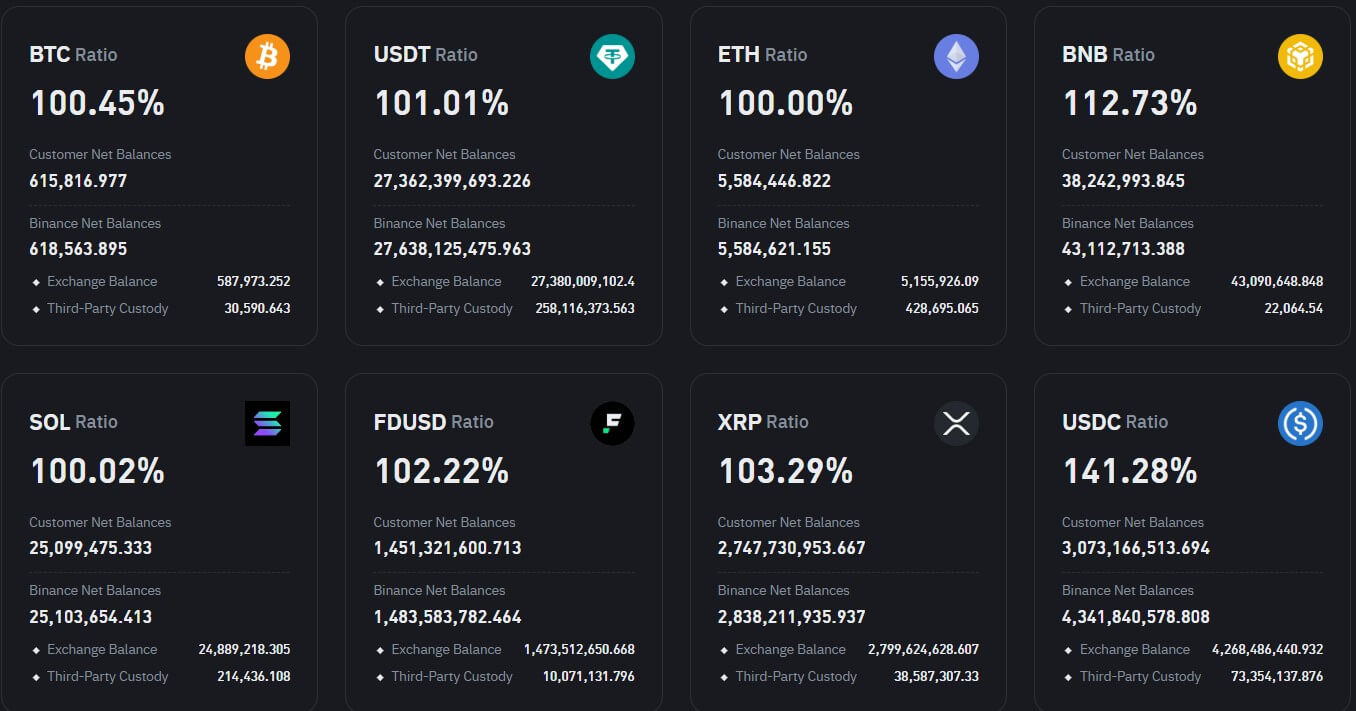

According to Binance‘s proof of reserves, on January 1, 2025, the exchange had a substantial surplus of assets, surpassing the 100% customer guarantee. However, by February 1, 2025, this surplus had shrunk significantly, with the collateralization rate for Bitcoin and Ethereum dropping to as low as 0.01%. Only Binance Coin (BNB) retained a collateral surplus of 12.37%.

While other crypto assets saw a decline in collateral, Binance’s USDC reserves saw a dramatic increase during the same period. The exchange’s reserve data shows that the USDC balance grew by over $1 billion, pushing the collateralization rate above 40%. Binance reiterated that these changes were part of internal adjustments and accounting processes, with user funds remaining fully secure.

With this statement, Binance aims to alleviate concerns about the safety of crypto funds and reassure investors that no user funds were impacted by these internal adjustments.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.