Binance has discontinued spot trading pairs with Tether’s USDT in the European Economic Area (EEA) to comply with the Markets in Crypto-Assets Regulation (MiCA).

The cryptocurrency exchange Binance has delisted several non-MiCA-compliant tokens, following the plan it announced in early March.

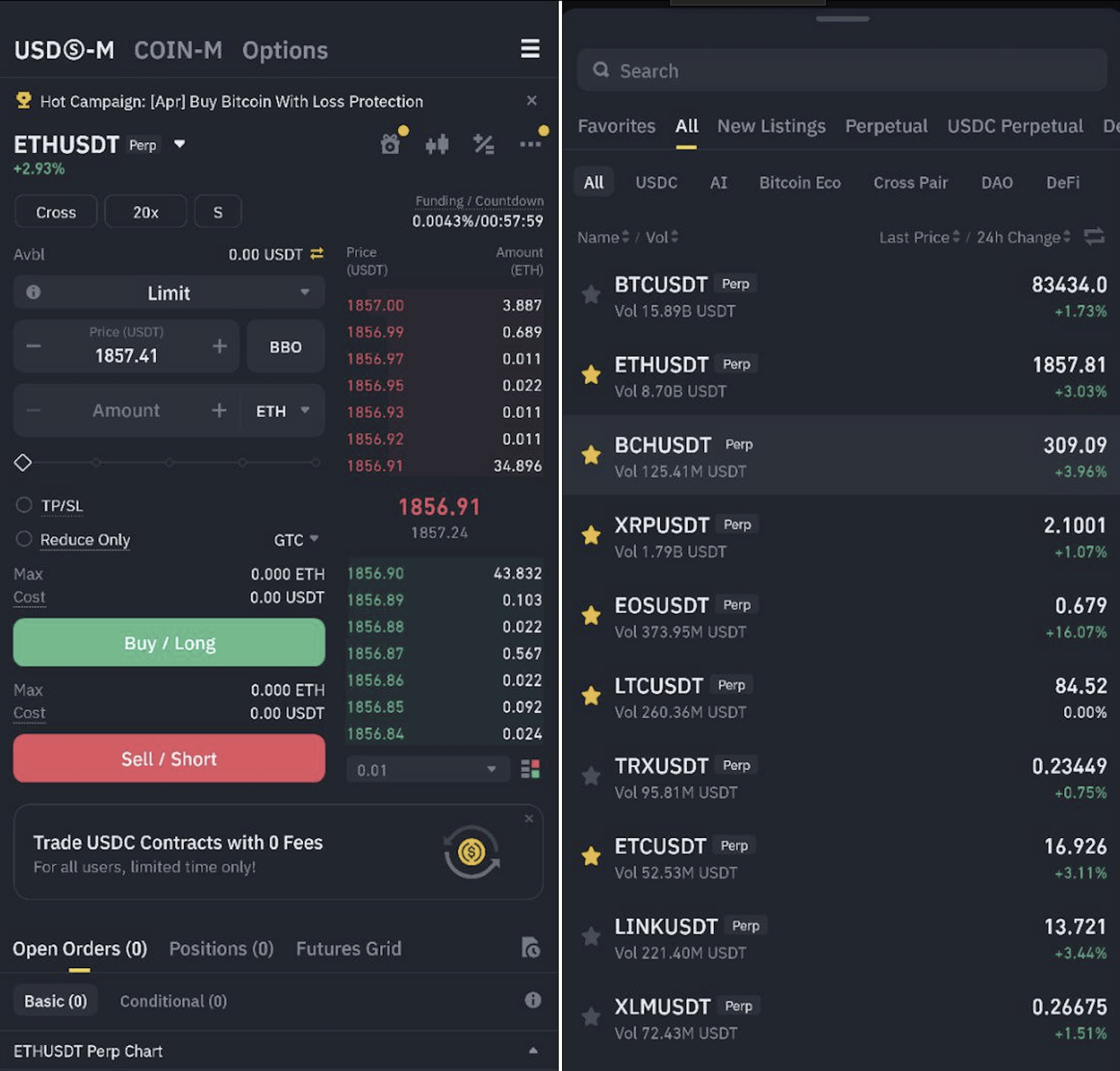

While spot trading pairs for tokens like USDT are now delisted, EEA users can still custody the affected tokens and trade them in perpetual contracts.

According to Binance’s previous announcement, spot trading pairs for non-MiCA-compliant tokens were to be delisted by March 31, in line with local requirements.

Other Exchanges Also Delisting Non-MiCA-Compliant Tokens

Binance is not the only crypto exchange delisting non-MiCA-compliant tokens in the EEA.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Exchanges like Kraken have also removed spot trading pairs for USDT in the EEA after announcing their plans in February.

On March 24, Kraken moved USDT into sell-only mode in the EEA, preventing users from buying the affected token.

Additionally, Binance has delisted DAI, FDUSD, TUSD, USDP, AEUR, UST, USTC, and PAXG spot trading pairs due to MiCA restrictions.

ESMA and MiCA Compliance

Binance and Kraken’s decision to continue custody services for non-MiCA-compliant tokens aligns with previous MiCA compliance communications.

On March 5, an ESMA spokesperson stated that providing custody and transfer services for non-MiCA-compliant stablecoins does not violate MiCA regulations.

However, the same regulator had earlier advised crypto service providers to halt transactions involving these tokens after March 31, leading to confusion among market participants.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.