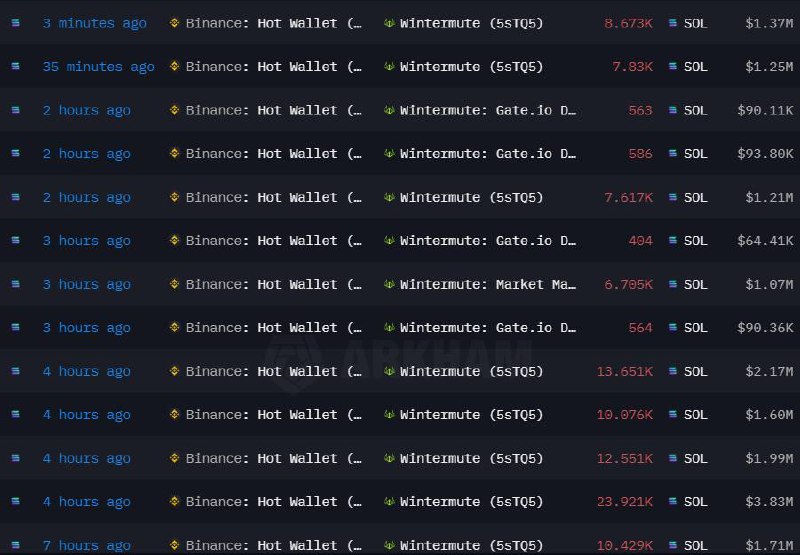

Binance conducted a large-scale Solana ($SOL) sale through leading market maker Wintermute.

According to Crypto Rover’s post on the X platform, these sales began at 06:00 UTC and continued for the past four hours. Binance reportedly sold a total of 5,000,000 $SOL at an average price of $120. This development led to a significant drop in $SOL’s price, causing it to decline from $125 to $118.

During this period, $SOL trading volume on Binance surged by 150%, reaching 10,000,000 SOL. This unusual activity raised concerns among investors and triggered volatility in $SOL’s trading pairs with Bitcoin and Ethereum. The $SOL/BTC pair dropped by 2%, while $SOL/ETH declined by 1.5%.

Market Impact of Binance’s Solana Sell-Off

Binance’s high-volume $SOL sale created strong selling pressure in the market. This, in turn, prompted other investors to follow suit, further pushing the price downward. On-chain data indicates that the number of active addresses on the Solana network decreased by 10%, signaling a drop in network activity.

This selling pressure on Binance also affected other major exchanges. Coinbase reported a 70% increase in $SOL trading volume, reaching 3,500,000 SOL, while Kraken saw a 50% rise, bringing its volume to 2,000,000 SOL. These figures suggest that Binance’s sell-off had a broader market impact, negatively affecting liquidity and price stability.

A downward trend was also observed in the futures market. According to Binance Futures data, the funding rate for $SOL turned negative, falling to -0.01%. This indicates that futures traders are leaning towards short positions, reflecting a generally bearish market sentiment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.