In Bitcoin, where leveraged positions have stalled due to repeated liquidations, the price is expected to break records soon.

BTC achieved its highest daily close in history on December 11, with six-figure price action making a strong comeback.

BTC/USDT Daily Chart

BTC/USD recently closed its daily candle at around $101,200. On Bitstamp, this matched the December 8th close, marking the highest recorded closing so far.

Bulls have managed to move away from the local lows of $94,000 seen earlier in the week. “The crucial level in Bitcoin is still defined,” said trader, analyst, and entrepreneur Michaël van de Poppe in his latest analysis on X.

“If the markets stay above that area, it’s likely that we’ll see new ATH’s in the coming days.”

Will Bitcoin Set a New ATH?

BTC/USDT 4-hour chart with RSI data. Source: Michaël van de Poppe/X

Market observers commenting noted that market stability has continued alongside Bitcoin’s recent journey to $100,000 and beyond.

“Bitcoin quietly achieved its highest daily close ever,” wrote Charles Edwards, founder of the quantitative Bitcoin and digital asset fund Capriole Investments, in a December 12th X post.

“Meanwhile funding rates are below normal, leverage still wiped and ETFs are seeing day after day of relentless inflows.”

Edwards referred to the clearing of leveraged positions resulting from the sudden market volatility seen this week and last.

Short positions felt the pressure during the rebound, and according to data from CoinGlass, 24-hour crypto liquidations reached a total of $270 million at the time of writing.

Liquidations Chart

Speculation on Bitcoin Futures

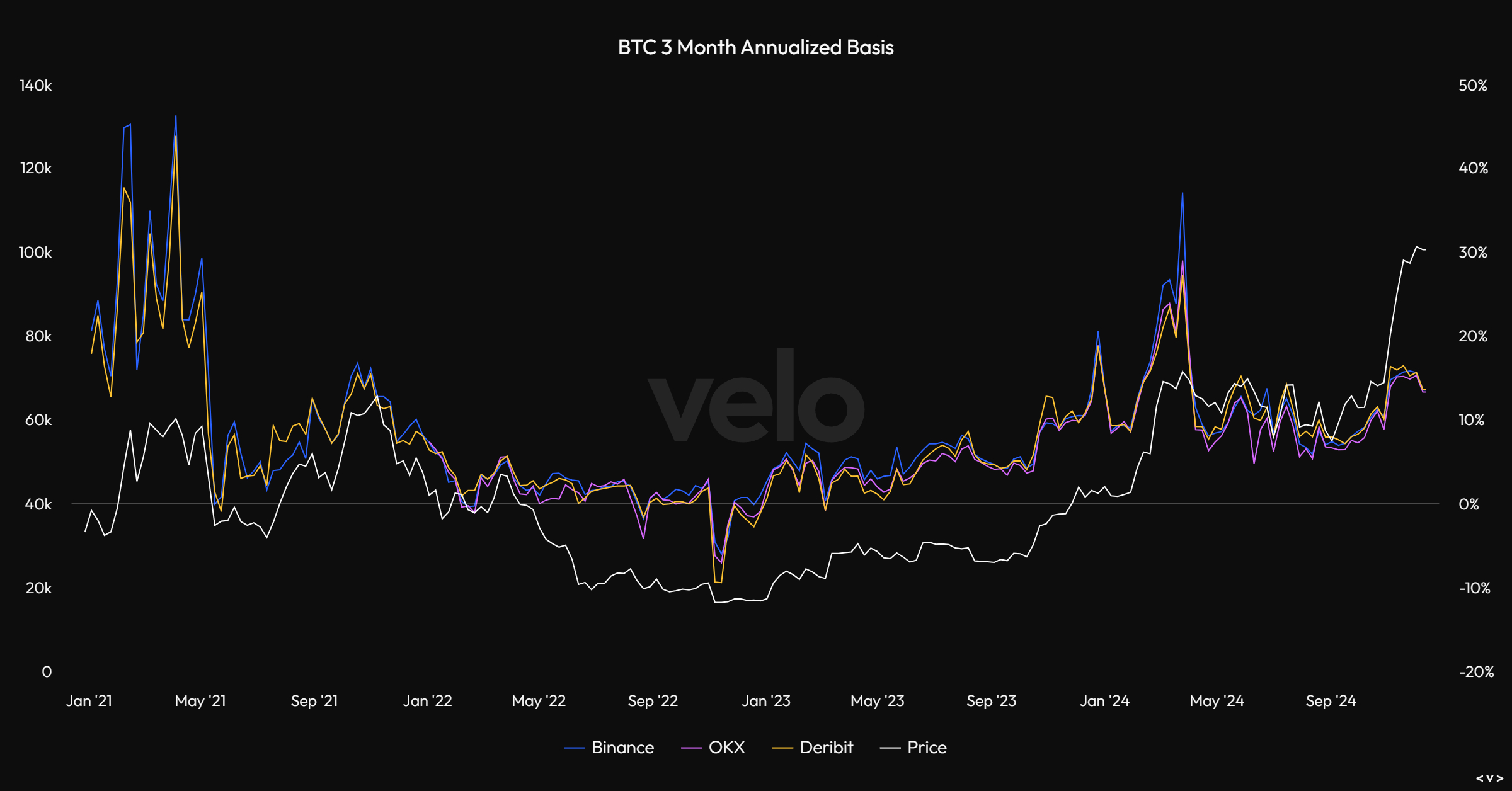

Bitcoin Futures Basis Comparison. Source: Zaheer Ebtikar/X

Zaheer Ebtikar, co-founder of the crypto fund Split Capital, shared additional data supporting the lack of excessive market risk. He noted that while Bitcoin approaches all-time highs, the futures basis remains unusually low.

Zaheer Ebtikar wrote, “I can’t explain to you how absolutely insane this image is.”

He shared this with his X followers, alongside an explanatory chart. The futures basis refers to the difference between spot and futures market prices, measured as a percentage of the spot price.

In Bitcoin bull markets, when all-time highs are reached, this difference can reach 30% or more, reflecting increased speculation about future BTC price growth.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.