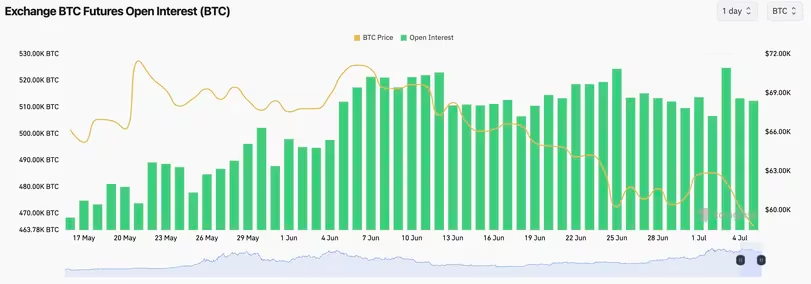

Despite a 7 billion drop in Bitcoin (BTC) notional open interest (Open Interest) in fixed value, actual open contract numbers expressed in Bitcoin remained. This dynamic, along with product funding rates, suggests renewed demand for long-term targets amid the recent price decline.

What Bitcoin Open Interest Data Explains to Us?

Open Interest refers to the total number of active or open contracts at any given time. Calculated by multiplying unit durations in a contract by the current spot market price, in obvious ways, from changes in asset prices to direct sales and contract numbers changing, interpretations of market activity can be potentially misleading.

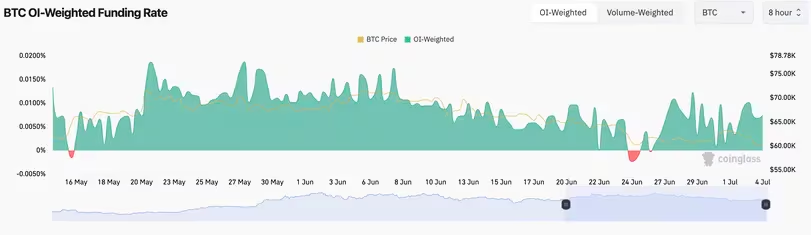

Bitcoin‘s open interest scenario appears to be coming true. According to Coinglass, the number of BTC contracts remained at 500,000 BTC for four weeks. Simultaneously, the permanent funding rates charged by exchanges every eighth year are also consistently positive, indicating a trend towards bullish bets.

Laurent Kssis, crypto ETF expert at CEC Capital, notes that BTC shortfalls, combined with positive funding rates and a decline in consistent open roles, suggest that the slowdown is imagining the launch of new long strategies. This counters that bullish bets are unraveling. Kssis added that traders are reluctant to place long-term orders, but they also apply hedging methods due to market uncertainty. The market’s recent liquidity disruptions at the $60,000 level have not deterred buying in the long term, but hedging activity has increased.

Traders, Mt. This sentiment is supported by the positive difference between expiry and spot prices, known as base products. Noelle Acheson, author of the Crypto Is Macro Now newsletter, notes that despite a slight decline, the basis remains attractive, indicating continued demand for longs as spending anticipates a breakout triggered by macroeconomic headwinds and the dissipation of selling pressure.

Other signs of upward momentum come from activity in the spot and options markets. Griffin Ardern, head of options trading and research at crypto finance platform BloFin, notes the influx of Bitfinex whales buying dips since late June, although similar signals have been observed in other derivatives markets. Margin long positions on Bitfinex, which include portions of borrowed funds to purchase spot holdings, have rallied and increased since June.

A large number of top bets are also being purchased, according to QCP Capital. Despite the recent sell-off, the options market remains largely bullish, indicating expectations for a year-end rally. QCP is observing significant buying interest in long-term options with strikes at $100k and $120k.

Overall, the combination of combination open interest in BTC terms, positive funding rates, and change in the spot and options markets suggests that secrecy has positioned themselves for a potential rebound in Bitcoin prices.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.