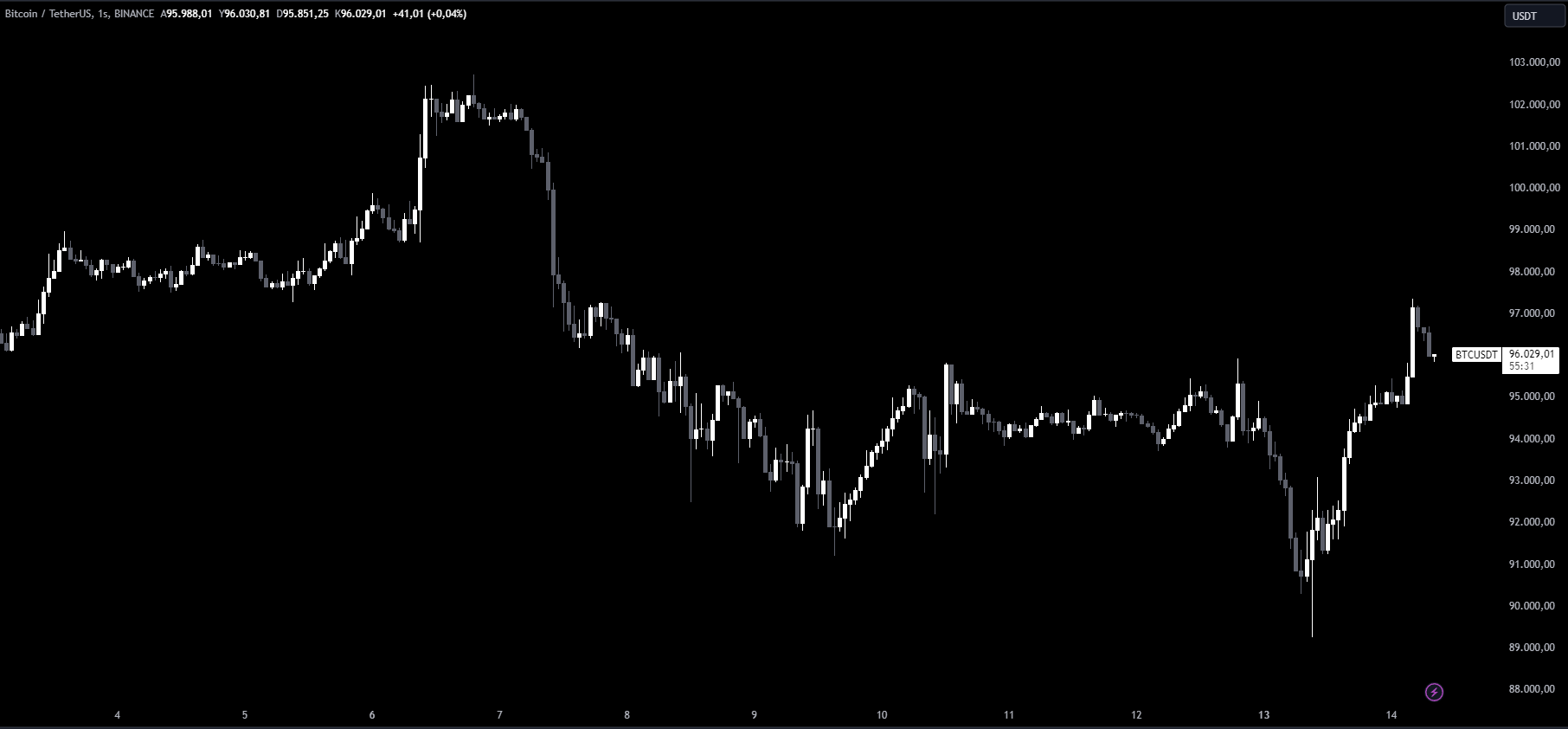

In the last 24 hours, the cryptocurrency world has been akin to a journey through a stormy sea. Bitcoin, which had dropped below $90,000 just yesterday, suddenly surpassed the psychological level of $95,000 this morning and even approached $97,000. So, what is driving this dramatic change? Singapore-based analysis firm QCP Capital has been trying to uncover the mystery behind this surge.

Changing Expectations and Economic Data

According to QCP Capital’s analysis, one of the main reasons behind Bitcoin’s rise is the release of the US Producer Price Index (PPI) data. The PPI data came in lower than expected, reinforcing investor expectations that high interest rates would not persist in the short term. This could increase interest in cryptocurrencies. A low PPI indicates that inflation is under control, which could lead to a bullish movement in the cryptocurrency market.

The Trump Factor: His Influence on Crypto

Analysts are not solely attributing Bitcoin’s revival to economic data. Interestingly, they are also seeing the upcoming political atmosphere in the US and the possibility of Donald Trump’s return to the presidency as key factors.

You Might Be Interested In: Elon Musk Shared, That Memecoin Flew: Up 500%!

Trump’s influence on cryptocurrencies is based on the potential removal of pressures applied by previous administrations. Analysts believe that with Trump’s return to the presidency, a crypto-friendly policy could be adopted. For instance, the controversial SAB 121 accounting rules and the challenges that banks face in offering cryptocurrency services could be wiped out by Trump with a single stroke.

The QCP Capital report notes: “It’s likely that Trump will take crypto-friendly steps from his first day in office. The cancellation of SAB 121 and providing more space for markets will further support this positive atmosphere.”

Volatility and Uncertainty Continue

Bitcoin’s recent price movement reflects the volatility in the market. Analysts suggest that market participants are remaining cautious in the face of uncertainties, such as the US Congress’s veto of SAB 121 and Joe Biden’s decision to block it.

Additionally, the volatility index (VIX) is currently at 18.6. This indicates that the fluctuating movements in the markets are likely to continue for some time. QCP Capital mentions that this volatility throughout January may create both opportunities and risks for investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.