The cryptocurrency markets remain active ahead of the weekly close. Bitcoin and Ethereum are trading at critical resistance and support levels. There are key areas and potential scenarios that investors should closely monitor.

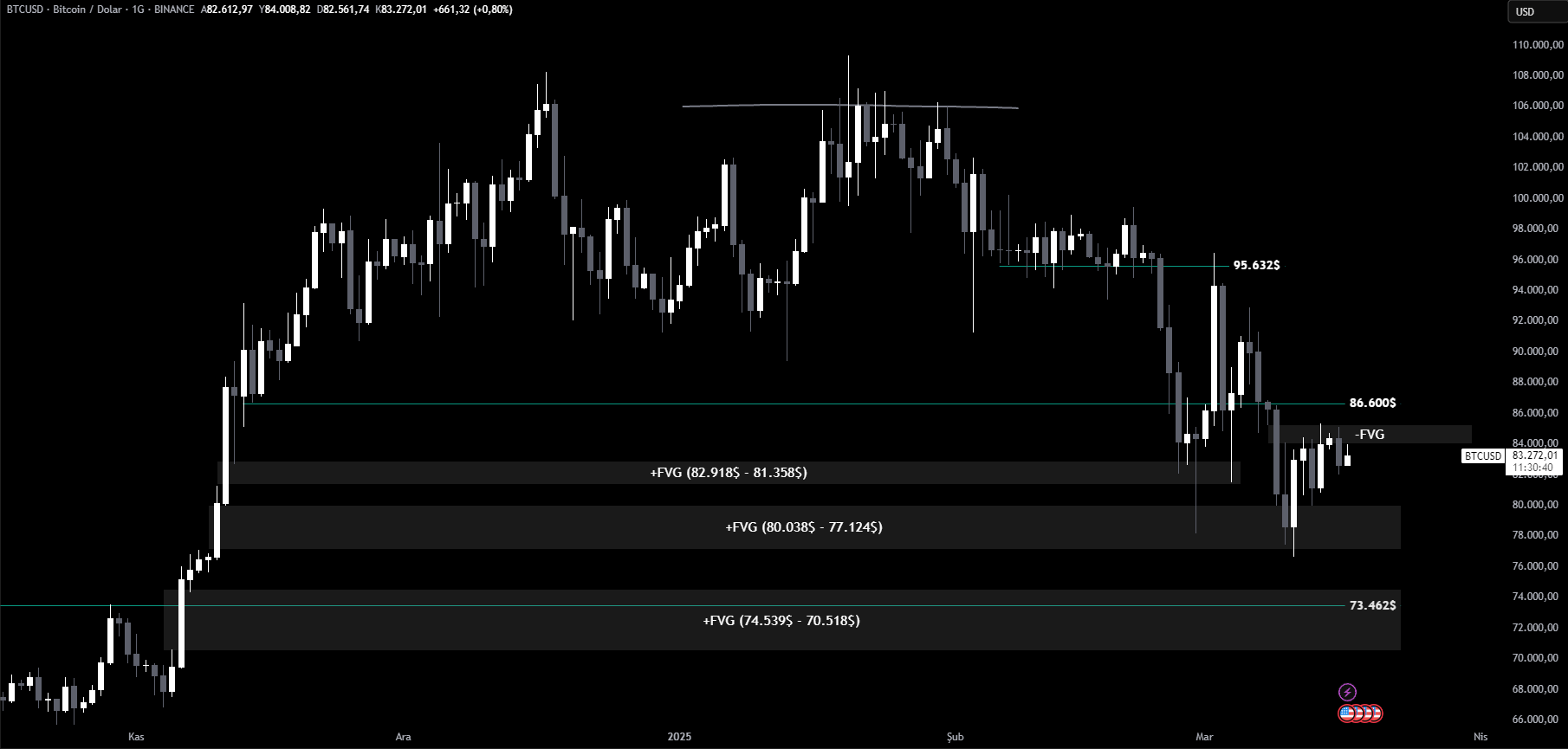

Bitcoin (BTC) Analysis: Testing a Key Resistance Zone!

Bitcoin has rebounded strongly from its bullish FVG (Fair Value Gap) zone, climbing towards the bearish FVG area that formed during its previous decline. However, over the weekend, no major movement was observed in this area, and for now, the price appears to have faced a sharp rejection.

This region serves as a critical resistance zone, and investors looking to open long positions should be cautious here. If Bitcoin fails to break through this resistance, there’s a potential for a pullback towards the $80,000 level.

On the other hand, if there’s a bullish breakout and this resistance is surpassed, the price could rally quickly toward the $86,000 resistance zone. A daily close above these levels may signal a continuation of the strong uptrend in the market.

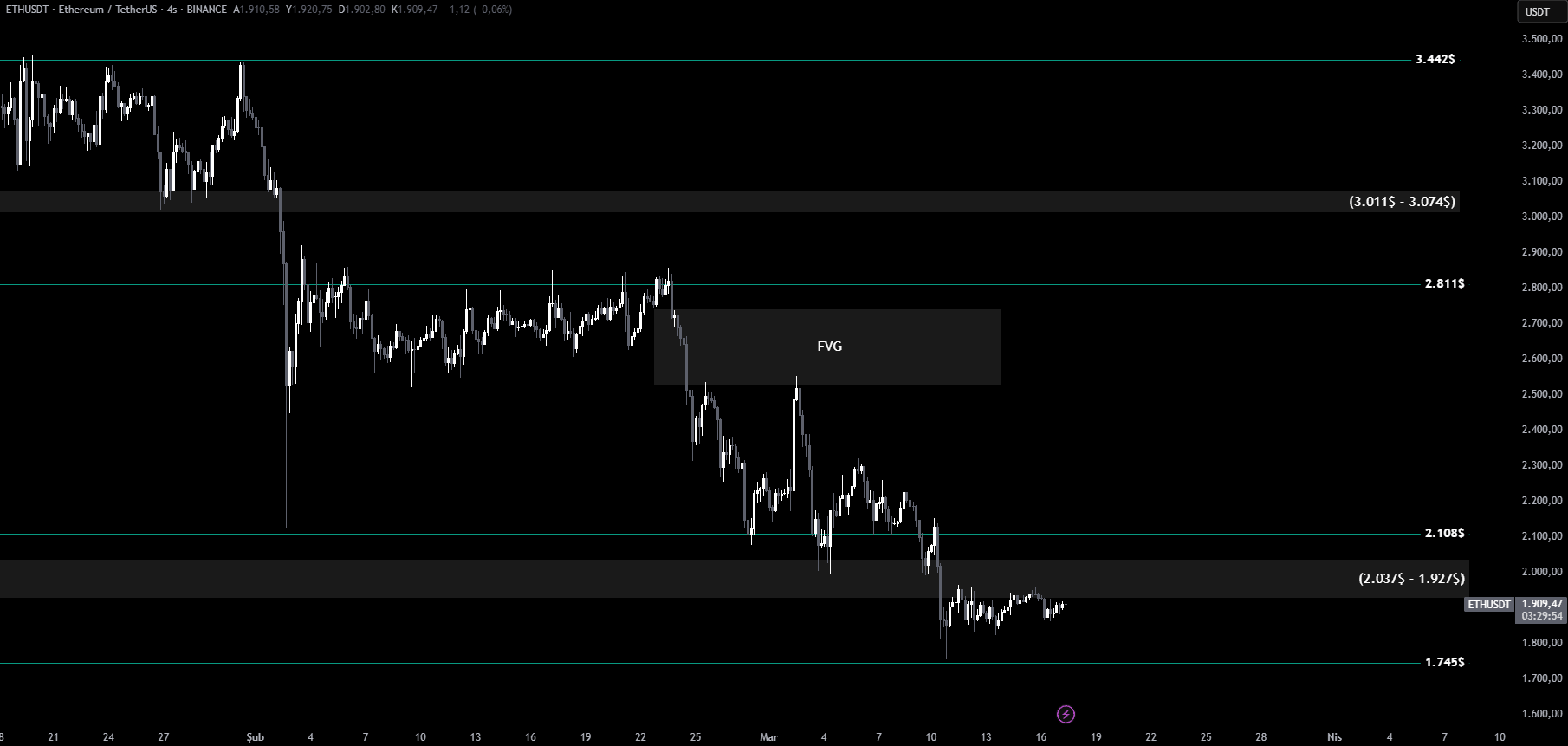

Ethereum (ETH) Analysis: Will It Reclaim the Key Support?

On the 4-hour chart, Ethereum has lost the critical support zone between $2,037 and $1,927, leading to a decline as low as $1,745. Currently, Ethereum remains priced below this former support area and has yet to establish a clear direction.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

If Ethereum fails to reclaim the $1,927 – $2,037 range, the price may revisit the $1,745 support level. This region acts as a crucial support in the short term.

However, if Ethereum manages to break through the resistance and regain the $2,037 level, a potential rally towards $2,108 could follow. A successful breakout and daily close above $2,108 could trigger rapid upside moves and increased buyer volume.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.