The cryptocurrency market continues to surprise investors with its volatile structure. On April 10, 2025, there were remarkable movements in Bitcoin (BTC) and Ethereum (ETH) spot ETFs. Bitcoin ETFs saw a net outflow of $154.8 million, while Ethereum ETFs saw a net outflow of $38.8 million.

Major Outflows from Bitcoin ETFs!

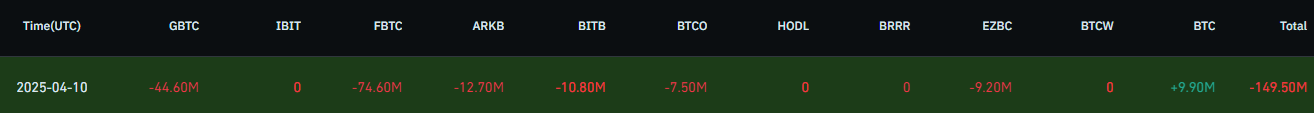

On April 10, Bitcoin investors pulled a total of $154.8 million from spot ETFs. Outflows from several major funds, in particular, have raised concerns about the future of the market.

- FBTC: -$74.60 million

- BITB: -$25.90 million

- IBIT: -$22.10 million

- ARKB: -$12.70 million

- BTCO: -$9.70 million

- EZBC: -$9.20 million

- BTC: +$9.90 million

- GBTC: -$44.60 million

- HODL, BRRR, BTCW: 0

Although there was a $9.90 million inflow into BTC funds, it wasn’t enough to offset the overall outflow volume.

What About Ethereum ETFs?

While Bitcoin ETFs experienced significant outflows, Ethereum ETFs also recorded a net outflow of $38.8 million. The positive movement in the ETHA spot Ethereum ETF stood out.

- FETH: -$36.00 million

- ETHV: -$4.40 million

- ETHW: -$2.50 million

- ETHE: -$2.30 million

- ETHA: +$6.40 million

- ETH, EZET, CETH, QETH: 0

Outflows from Crypto ETFs Increasing: Uncertainty Weighs on the Market

The recent wave of outflows from crypto ETFs has raised correction expectations in the market. Outflows amounting to hundreds of millions of dollars from major funds like FBTC, BITB, and FETH indicate that investors are taking more cautious positions.

According to experts, these outflows are not only due to technical reasons but also linked to macroeconomic factors such as Trump’s revived tariff agenda, global economic uncertainty, and rising recession expectations.

Similar outflows observed in Ethereum ETFs further signal a growing sense of caution across the market. Closely monitoring ETF flows in the coming days may be crucial for anticipating the direction of the crypto market.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.