The cryptocurrency market continues to surprise its investors with its volatile nature. On March 20, 2025, there were notable movements in both Bitcoin (BTC) and Ethereum (ETH) spot ETFs. Bitcoin ETFs saw a total inflow of +1.91K, while Ethereum ETFs experienced an outflow of -6.08K.

Bitcoin ETFs Show Investor Uncertainty

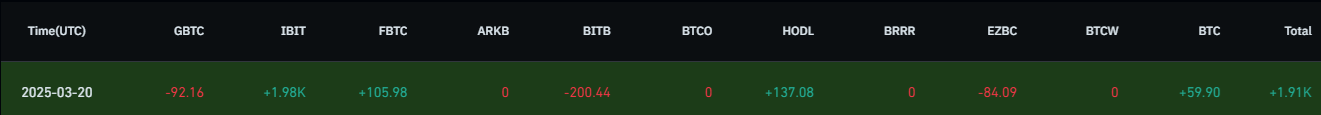

On March 20, a total of +1.91K net inflows were observed in spot Bitcoin ETFs. While these inflows present a positive signal for the market, there has been a notable increase in outflows from certain large funds. This situation has led to investor uncertainty, strengthening concerns about Bitcoin’s short-term direction and creating a negative sentiment in the market.

- FBTC: +105.98

- HODL: +137.08

- IBIT: +1.98K

- GBTC: -92.16

- BITB: -200.44

Ethereum ETFs Show a Different Trend!

On March 20, Ethereum ETFs experienced a general outflow, with a total of -6.08K recorded. The largest outflows came from the ETHE and FETH funds. ETHE saw the biggest outflow of -4.38K, while FETH experienced a -1.70K outflow. No significant changes were observed in other funds.

Unlike the outflows in Bitcoin ETFs, investors appear to be more cautious in the Ethereum market, and interest in ETH investments seems to have declined.

ETF Market Overview

As of March 20, Bitcoin ETFs saw a 1.91K net inflow, while Ethereum ETFs experienced -6.08K outflows. The inflows in Bitcoin ETFs suggest increased investor interest and positive expectations for Bitcoin’s future. On the other hand, the outflows from the ETHA fund indicate that some investors are more cautious, considering short-term risks and signaling growing uncertainties surrounding Ethereum.

The inflows in BTC ETFs reflect an increase in market risk appetite, while the outflows in ETH ETFs suggest a more cautious stance towards Ethereum. The contrasting fund flows between Bitcoin and Ethereum ETFs highlight the varying levels of risk and stability in the markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.