Bitcoin struggles to hold monthly support, but key metrics offer hope for bulls, suggesting potential for a rebound.

As 2024 draws to a close, Bitcoin is trading in a critical price range, with monthly support levels under pressure and signs of short-term volatility emerging.

Analysts predict a potential pullback to $90,000, with a deeper correction possible in 2025. The transformation of old support levels into new resistance reinforces the confirmation of a technical downturn.

BTC/USD Daily Chart

On the macroeconomic front, while U.S. unemployment data takes center stage, stagflation concerns are threatening risk assets.

Rising inflation and increasing unemployment risks are causing investors to worry about a scenario similar to the 1970s. The Federal Reserve’s uncertain stance on interest rates further reinforces this outlook.

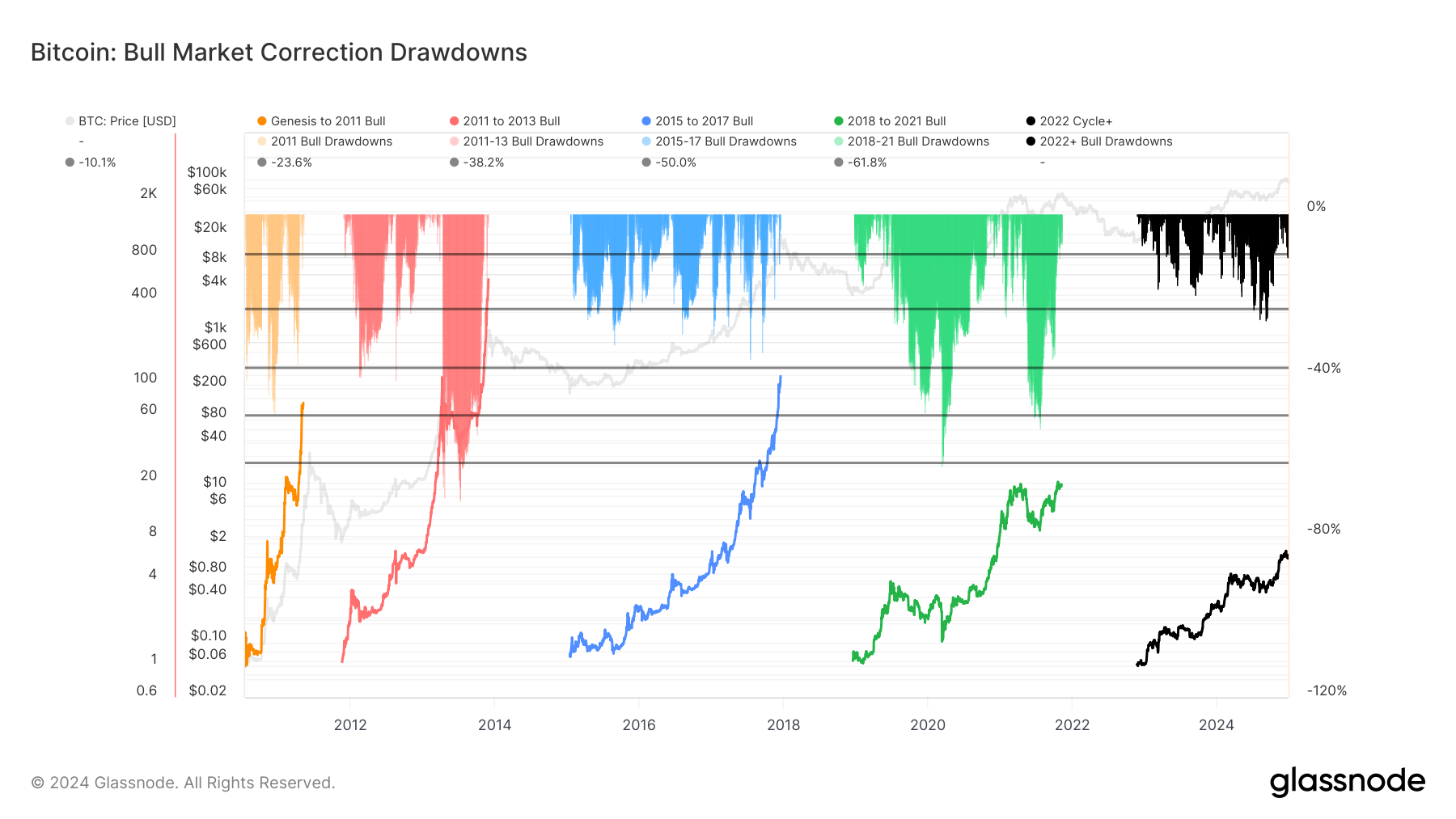

Bitcoin Bull Market Correction Drawdowns

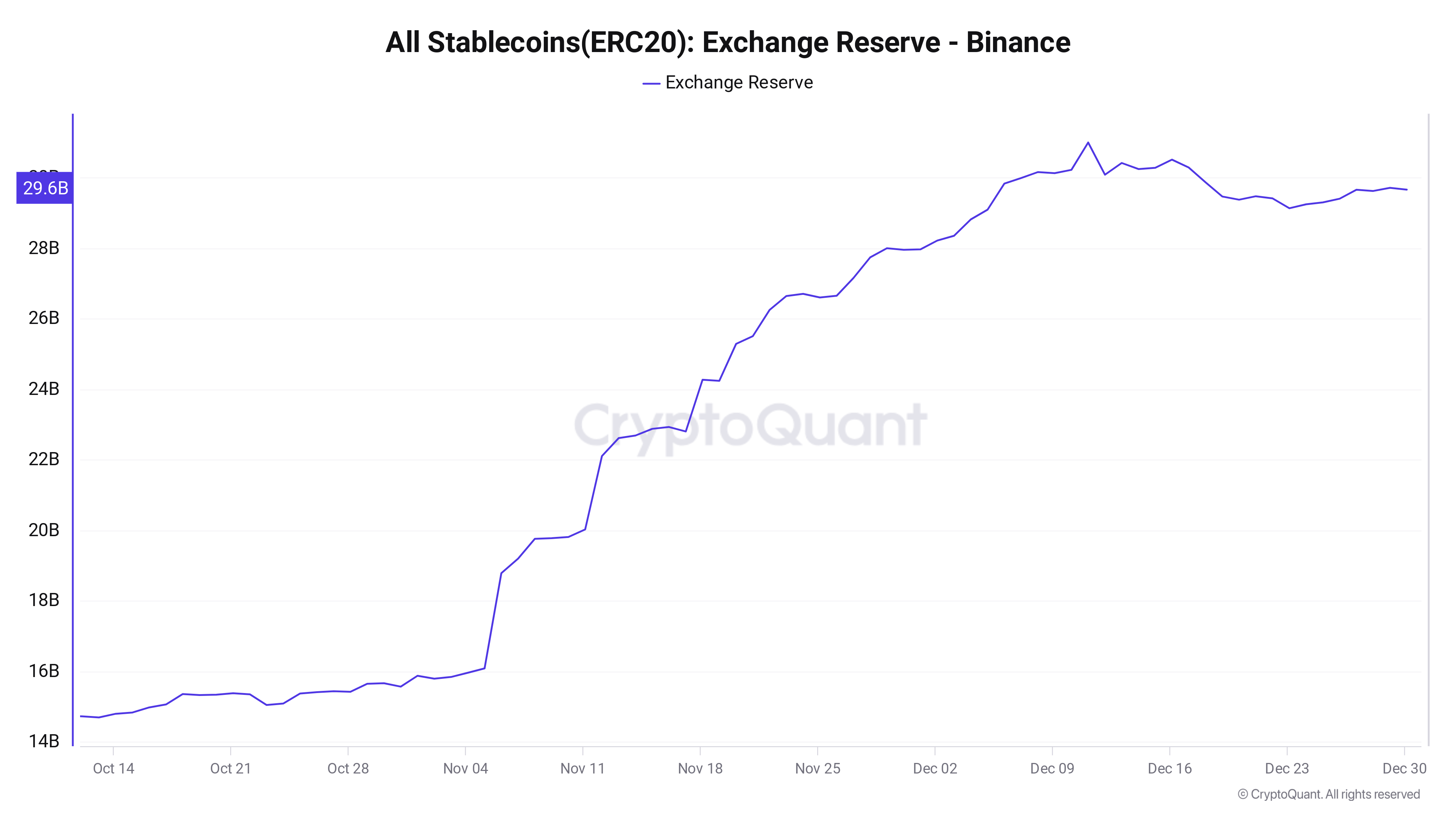

Despite low market volume, active whale purchases are fueling optimism for positive price movement. Binance’s stablecoin reserves stand at $29.7 billion, maintaining market confidence. However, stablecoins alone are not expected to drive price increases.

In November, CryptoQuant CEO Ki Young Ju stated that high reserves alone wouldn’t cause a BTC price surge. Referring to the BTC-stablecoin reserve ratio metric, he told his X followers, “Stablecoins alone cannot provide enough buy-side liquidity for Bitcoin.”

Binance ERC-20 Stablecoin Reserves

Binance ERC-20 Stablecoin Reserves

Short-term investor profitability is at a critical turning point, with signs of seller exhaustion. Despite declining retail interest towards the end of the year, whales’ accumulation trend increases the likelihood of an unexpected price surge.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.