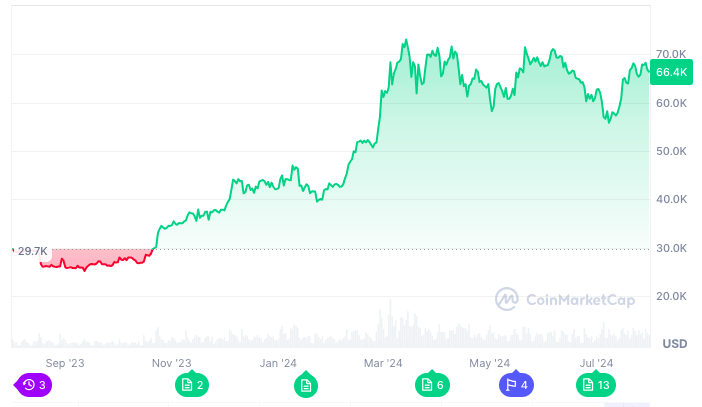

As of July 31, 2024, we analyze the current status of BTC and ETH coins, two leading cryptocurrencies in the market.

Bitcoin (BTC) Analysis

As of July 31, Bitcoin is trading at $66,231.25. This price represents a 126% increase from the beginning of the year.

Technical Indicators: Bitcoin has established a strong support level at $66,000, indicating a solid base. The resistance level is identified at $69,000. Currently, MACD and RSI indicators show a neutral outlook.

Investor Sentiment: The increasing interest from institutional investors and the limited supply of Bitcoin suggest that its long-term value is likely to continue rising. However, short-term volatility means investors should remain cautious.

Ethereum (ETH) Analysis

Ethereum is trading at $3,309.62 as of July 31, marking a 78% increase since the start of the year.

Technical Indicators: Ethereum has a robust support level at $3,200, while the resistance level stands at $3,500. MACD and RSI indicators point towards a short-term bullish potential for Ethereum.

Future Outlook: With the completion of ETH 2.0, Ethereum has become a more scalable and eco-friendly platform. This development is likely to increase interest in Ethereum and positively impact its price.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.