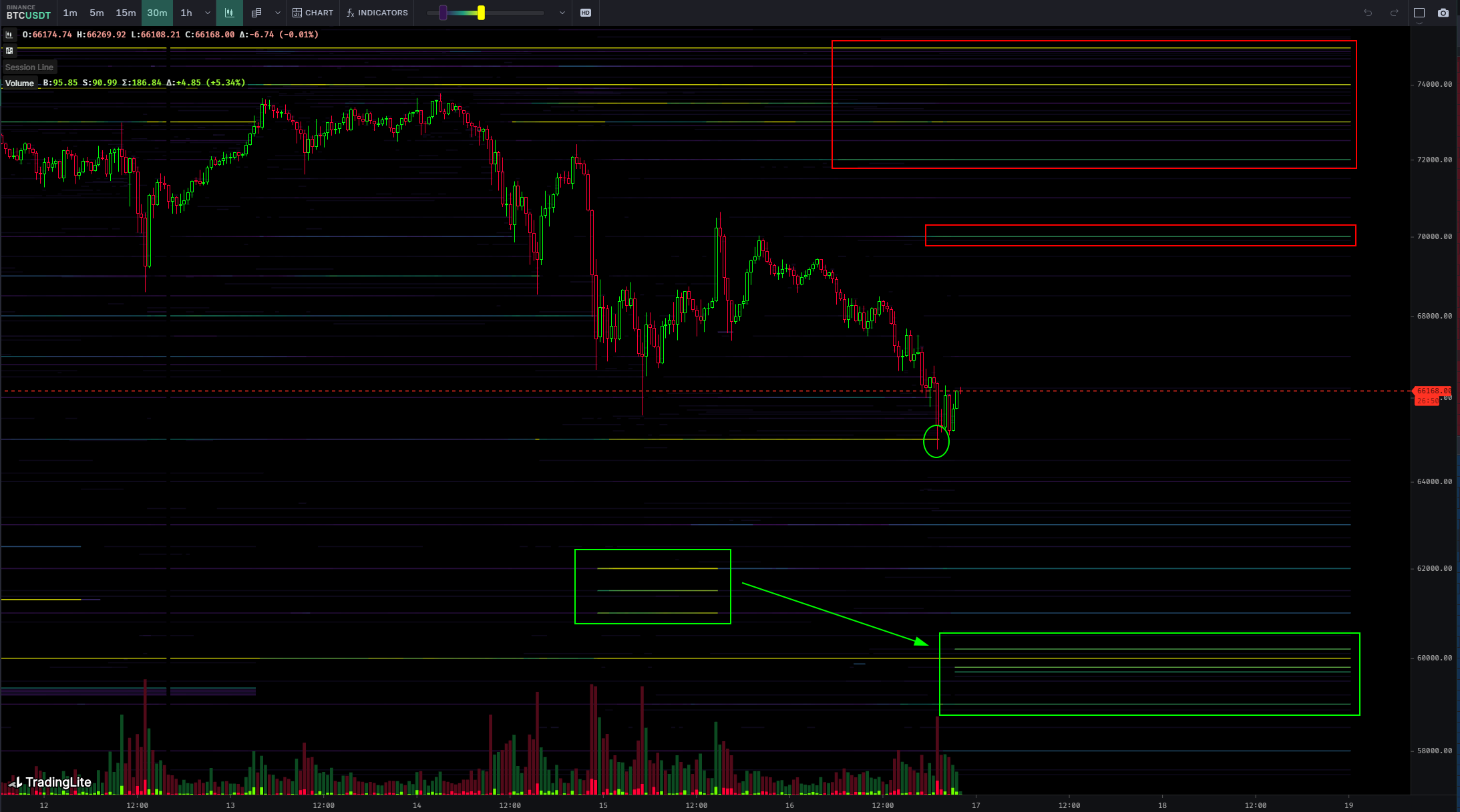

Bitcoin traders are closely monitoring the $60,000 support level as a significant futures gap emerges, signaling potential price movements.

Despite Bitcoin experiencing its lowest levels since March 6 in a sharp weekend sell-off, bullish sentiment remains strong among investors.

On March 17, Bitcoin edged closer to the $60,000 mark amid sustained selling pressure over the weekend. Data from TradingView indicated that BTC reached new lows of $64,522 on Bitstamp.

Following a week of reaching new all-time highs, Bitcoin faced considerable downward pressure, resulting in a series of lower lows and failed rebound attempts.

Analysts, including popular trader Skew, identified key support zones for buyers on major exchanges, primarily ranging between $60,000 and $64,000.

Skew noted that most of the selling pressure was driven by market selling, but some entities were engaging in large-scale dollar cost averaging (DCA) at the lows, contributing to short-term price rebounds.

The recent correction in Bitcoin’s bull market amounted to approximately 12%, a relatively modest pullback compared to previous cycles while maintaining the broader uptrend.

Despite the bearish sentiment, optimistic market observers pointed to ongoing buying activity from United States spot Bitcoin exchange-traded funds (ETFs), expected to resume on March 18. This activity led some to speculate that the current market conditions could be a bear trap.

Meanwhile, with more than 12 hours left until the weekly close, others are eyeing the potential for an early-week rebound. The widening gap in CME Group’s Bitcoin futures market, which closed on March 15 at $69,135, could provide an impetus for relief, as historically observed.

The gap between CME futures and spot price presents an opportunity for price convergence, potentially driving upward momentum in Bitcoin’s price.

In the comment section, you can freely share your comments about the topic. Additionally, don’ t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.