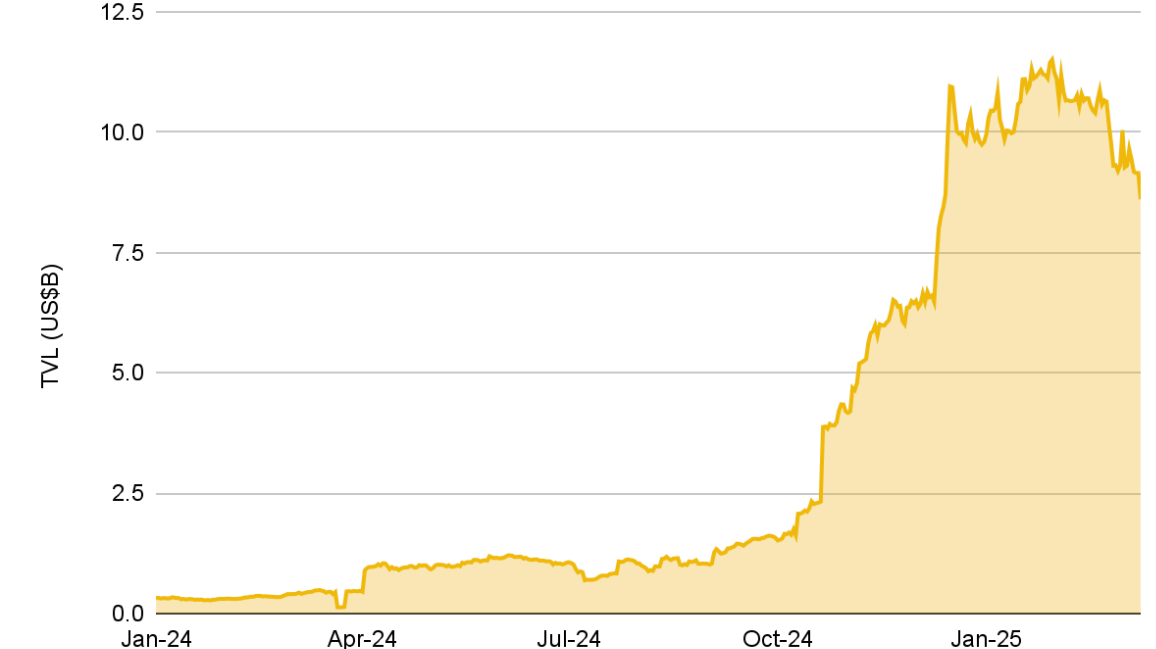

The value locked in Bitcoin-based decentralized finance (BTCFi) has grown over 2,700% in the past year, potentially transforming BTC from a passive store of value to a productive, yield-bearing asset, according to a Binance Research report.

BTCFi is a fast-evolving sector that integrates DeFi functionality into Bitcoin’s base layer. The total value locked in BTCFi now exceeds $8.6 billion.

“The growing value of BTCFi, coupled with potential interest rate cuts, may reinforce positive sentiment for Bitcoin in the medium to long term,” Binance wrote in the report.

New Yield Opportunities Through BTCFi

A Binance spokesperson noted that continued growth of BTCFi could allow BTC holders to generate yield via lending, liquidity provision, and other DeFi tools — shifting its perception from a store-of-value to a productive on-chain asset.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Interest in BTCFi spiked following the April 2024 Bitcoin halving, which introduced Runes, the first fungible token standard built on the Bitcoin blockchain.

Notable BTCFi initiatives include:

- Babylon enabled BTC staking for the first time, allowing passive income.

- Hermetica launched USDh, the first Bitcoin-backed synthetic dollar, offering 25% yield to investors.

Long-Term Holders Resume BTC Accumulation

According to Binance Research, BTC long-term holders — defined as wallets holding Bitcoin for at least 155 days — have resumed accumulation. This has reduced supply on exchanges, potentially setting the stage for a supply shock-induced price rally.

The trend aligns with broader Bitcoin adoption, including growing institutional interest and the establishment of a strategic reserve.

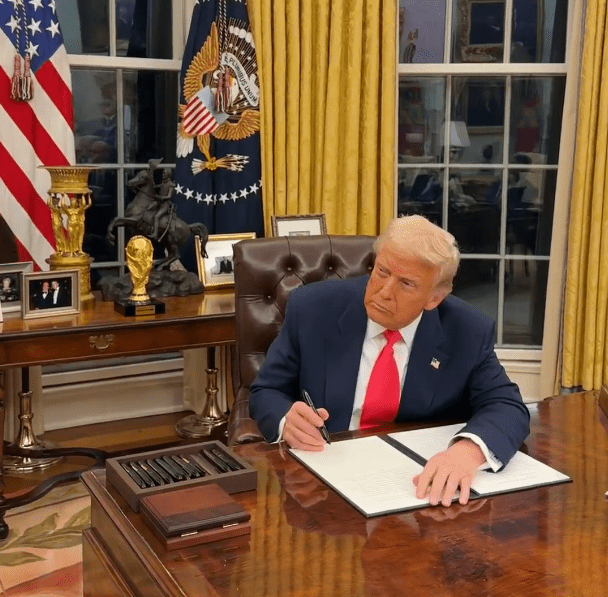

Donald Trump Signs Bitcoin Reserve Order at White House

On March 7, Donald Trump signed an executive order to form a strategic Bitcoin reserve using seized BTC assets. The move preceded the first White House Crypto Summit, which sparked mixed reactions from the crypto community.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.