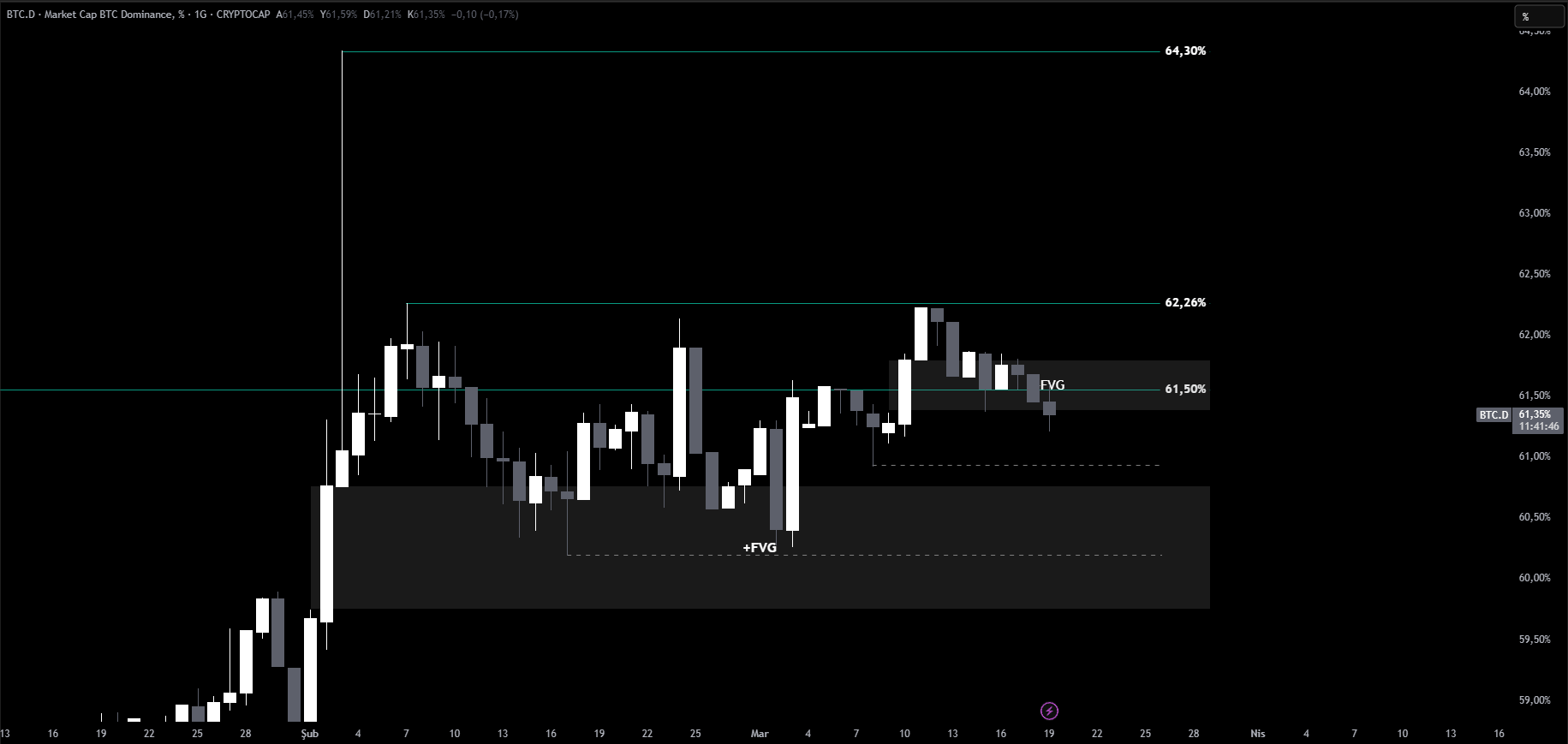

Bitcoin dominance continues to play a decisive role in market trends. Currently testing a key support at the bullish FVG zone, a daily close below this level could signal further decline in dominance.

- The first support target is 60.93%, with a stronger level at 60.20%.

- A drop in dominance typically signals capital rotation into Ethereum (ETH) and altcoins, fueling potential rallies in these assets.

If dominance falls towards the 60.20% support, we may see a stronger altseason emerge.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

- Ethereum could push beyond $2,300, potentially testing $2,500 levels if bullish momentum accelerates.

- Major altcoins could experience gains ranging from 10% to 30%, especially projects within Layer-1 ecosystems, AI-focused coins, and DeFi tokens.

Alternative Scenario

If the FVG support zone holds and dominance climbs back to 62.26%:

- Bitcoin strengthens as the dominant force in the market.

- Altcoins may face selling pressure, and ETH/BTC pairs could weaken.

- Capital likely flows back to BTC, reducing altcoin gains.

Bitcoin dominance will shape the next moves for Ethereum and altcoins. Monitoring key support and resistance levels is crucial for building strategies in the coming weeks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.