Bitcoin, Ethereum, and other major cryptocurrencies have suffered a significant drop in the past 24 hours. The market-wide sell-off deepened following Donald Trump’s announcement of new tariffs on Canada and Mexico, increasing uncertainty.

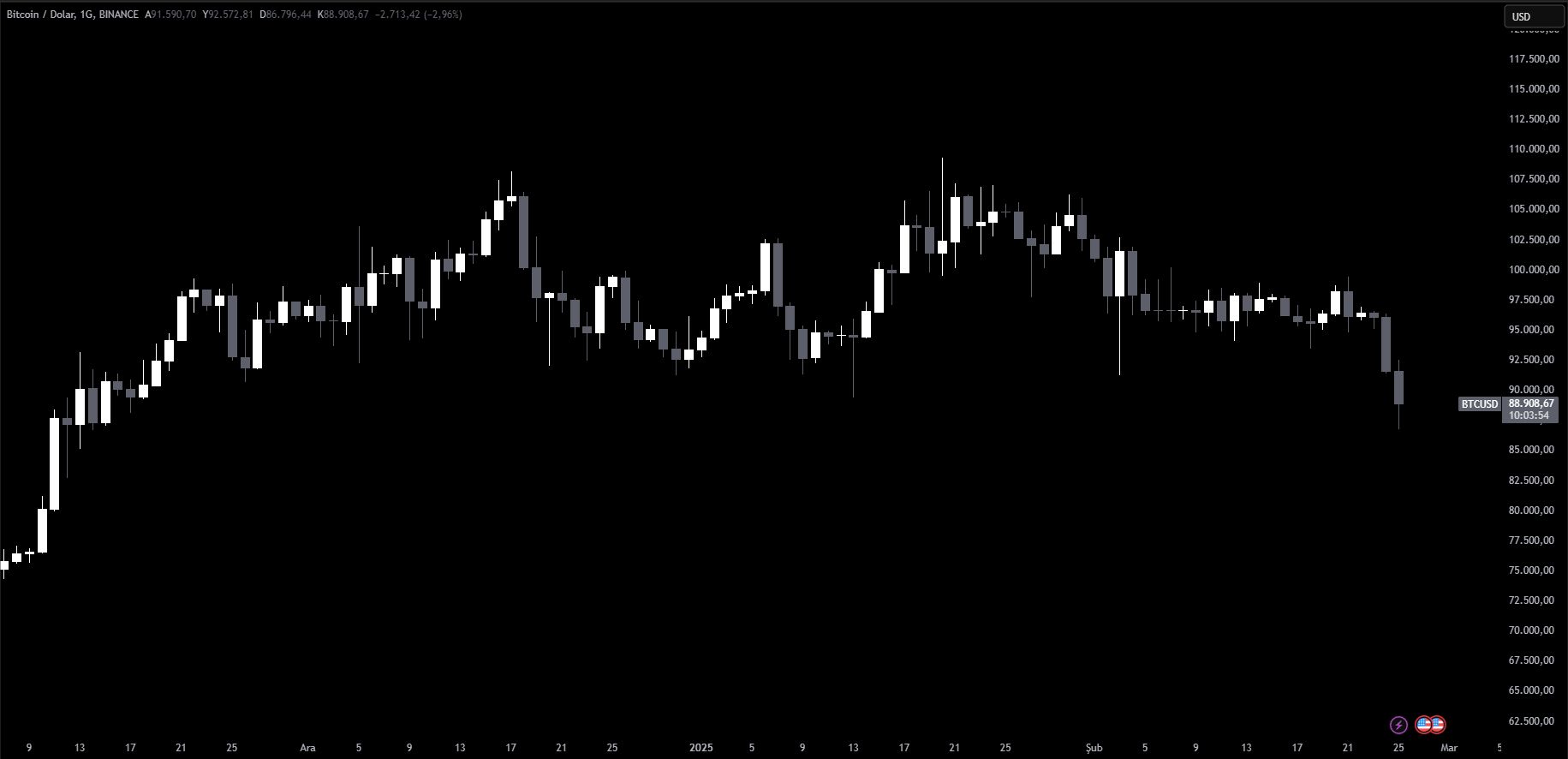

The world’s largest cryptocurrency, Bitcoin, fell 6% to $89,617, reaching its lowest level this year. Earlier in the day, Bitcoin dropped as low as $88,355. Major altcoins experienced steeper declines; Ethereum lost 10.45% to $2,410, XRP dropped 10.5% to $2.21, and Solana fell 12.6% to $138.6. The overall crypto market declined 6.8%, while the GMCI 30 Index, which tracks the performance of the top 30 cryptocurrencies, fell 8.96%.

Markets Face Widespread Uncertainty

Equity markets have also faced pressure after U.S. President Donald Trump announced tariffs on Canada and Mexico. The 30-day suspension on these tariffs is set to expire next week, raising concerns among investors.

Standard Chartered Global Head of Digital Assets Research Geoffrey Kendrick noted that the growing risk-off sentiment in traditional markets has negatively impacted crypto assets. This bearish outlook is also reflected in the Crypto Fear and Greed Index, which dropped to 25, its lowest level in five months.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Kendrick highlighted that Bitcoin is under pressure due to Solana-driven meme coin sell-offs and broader market corrections. He also pointed out that since the U.S. election, the average purchase price of Bitcoin spot ETFs has risen to $96,500, meaning many investors are now underwater at current price levels.

Signs of a Potential Recovery in the Medium Term

However, Kendrick sees a possible recovery for Bitcoin in the medium term. Declining U.S. Treasury yields could eventually support Bitcoin, but he warned that now is not the time to buy the dip, predicting that Bitcoin could fall further to the low $80,000s.

HashKey Global Managing Director Ben El-Baz pointed out that the crypto market’s strong correlation with U.S. equities has led investors to offload risk assets like Bitcoin. He emphasized that if critical support levels are not regained, a prolonged bear market could be in play.

Meanwhile, traders are closely watching Friday’s release of the U.S. Personal Consumption Expenditures (PCE) Price Index. This data is considered one of the Federal Reserve’s key inflation indicators. If inflation appears to be approaching the Fed’s 2% target, expectations for rate cuts could rise, potentially sparking Bitcoin‘s next bullish move.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.