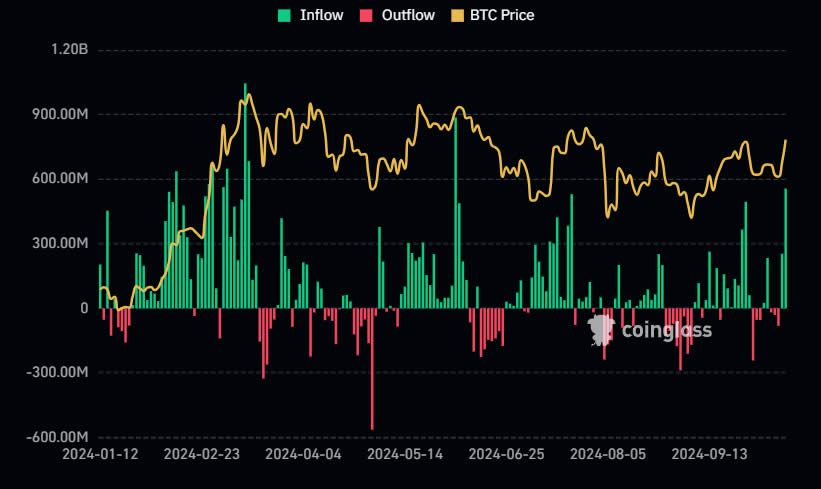

Spot Bitcoin ETFs have seen a massive surge in inflows, with $556 million pouring into these funds on October 14 alone, marking the highest single-day inflow in over 120 days. This inflow coincided with Bitcoin’s price surge to $67,800, the highest in more than three months. Institutional investors appear to be driving this demand, as Bitcoin ETFs are nearing $20 billion in net inflows over the past 10 months.

Nate Geraci, president of the ETF Store, highlighted that this inflow was primarily driven by advisors and institutional investors rather than retail traders, signaling growing adoption of Bitcoin in mainstream financial circles. Leading the inflow was the Fidelity Wise Origin Bitcoin Fund, which saw $239.3 million, followed by the Bitwise Bitcoin ETF with $100 million and BlackRock’s iShares Bitcoin Trust at $79.6 million.

Several factors are contributing to the surge in Bitcoin ETF inflows. The approaching U.S. presidential election is seen as a key driver, with both major political parties showing more favorable stances towards cryptocurrency regulation. Additionally, easing concerns about a potential recession, driven by positive U.S. economic data and gradual interest rate reductions by the Federal Reserve, have boosted investor confidence.

Might interest you: What is BabyDoge?

Institutional interest in digital assets has also grown, as hedge funds increase their exposure to crypto. Nearly half of traditional hedge funds now have some level of digital asset investments, a notable rise from previous years, and many plan to increase their exposure by the end of 2024. These factors have created what experts are calling a “perfect storm” for continued Bitcoin ETF inflows and broader crypto adoption.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.