The crypto market has witnessed a notable rebound in spot Bitcoin ETF inflows. Despite significant outflows earlier this week and Bitcoin (BTC) prices plummeting below $54,000 due to a sharp downturn, recent data indicates a strong comeback fueled by institutional investors buying the dip.

Institutional Investors Buying the Dip

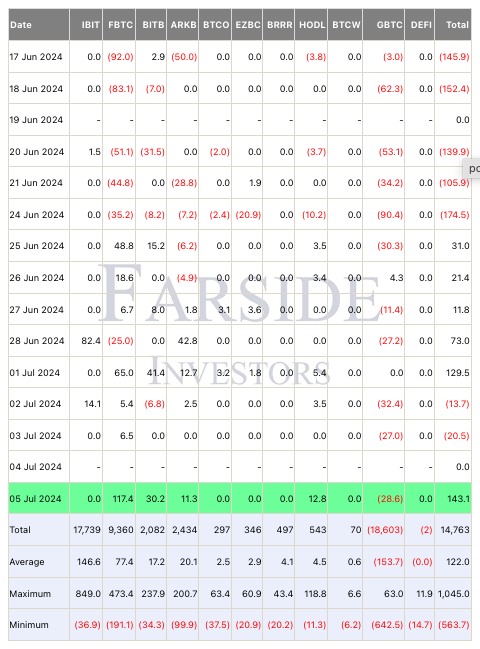

Recent inflows into spot Bitcoin ETFs suggest that major players are capitalizing on the market decline to accumulate BTC. While Grayscale’s spot Bitcoin ETF (GBTC) experienced a $28 million outflow, other ETFs saw significant inflows, reflecting institutional investor confidence.

According to recent data, Fidelity’s spot Bitcoin ETF (FBTC) led the way with $117 million in inflows on July 5th, followed by Bitwise’s spot Bitcoin ETF (BITB) with $30 million.

Bitwise Asset Management CEO Hunter Horsley revealed that his team managed to efficiently purchase BTC at a cost of less than half a basis point. Inflows into BITB surpassed $66 million in the first week of July, increasing total BTC holdings to over 38,000. Horsley emphasized Bitcoin’s strong outlook and viewed the current market dip as an excellent buying opportunity for both new and existing investors.

Analyst Perspectives on Market Dynamics

Despite the market turbulence, renowned Bitcoin skeptic Peter Schiff noted that spot Bitcoin ETF investors were not showing signs of panic. Schiff pointed out that trading activity indicated these investors were holding their positions firmly despite the ongoing volatility. Schiff believes a more substantial decline in the price of the largest cryptocurrency would be necessary for these investors to capitulate.

Schiff predicted that the capitulation of spot Bitcoin ETF holders could occur as early as next week, potentially this weekend if another significant sell-off materializes.

You can type your opinions as comments and follow us on Telegram, Twitter, and YouTube for the kind of news.